Executive Summary 2Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

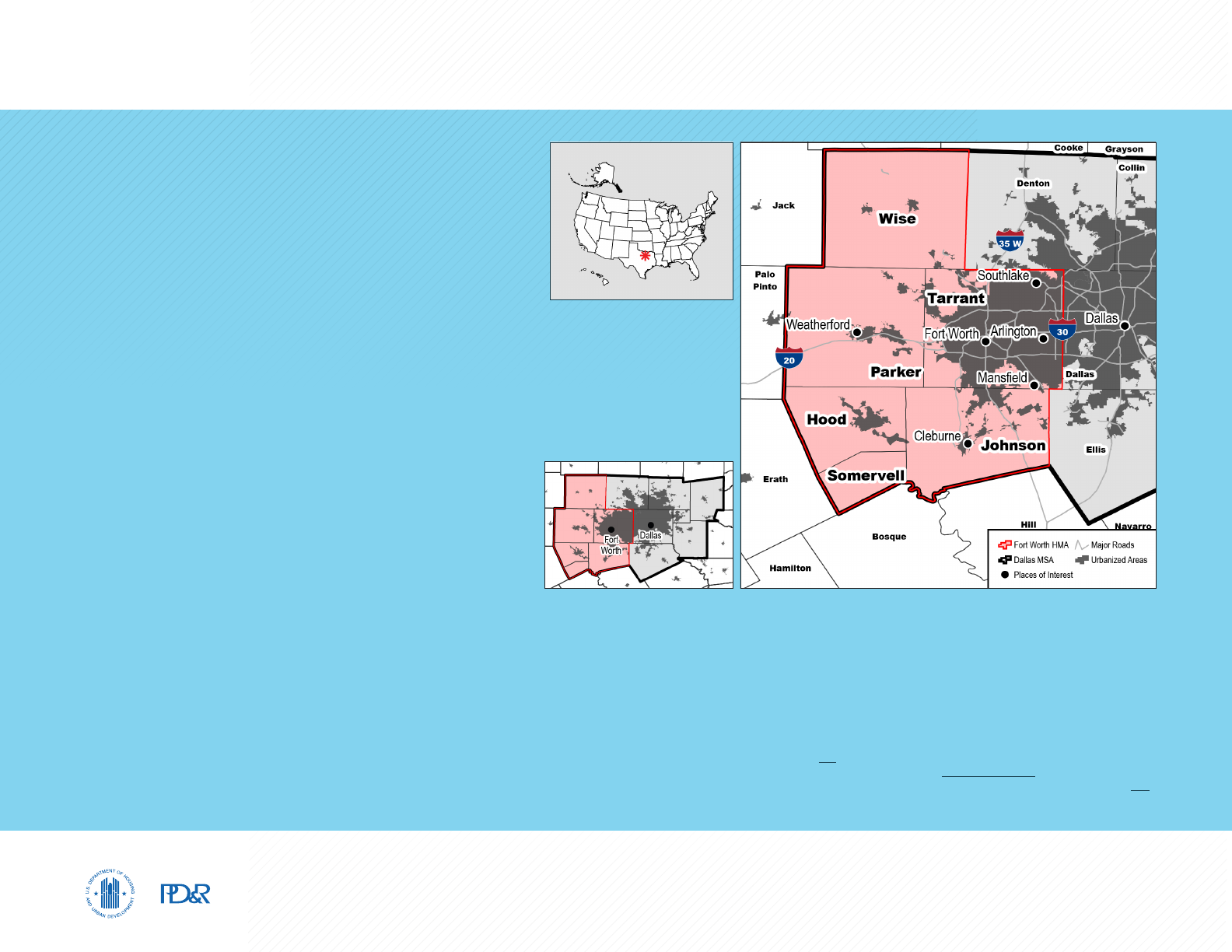

Housing Market Area Description

The Fort Worth-Arlington Housing Market Area

(hereafter, Fort Worth HMA) is coterminous with the

Fort Worth-Arlington, TX Metropolitan Division, which

makes up the western portion of the Dallas-Fort Worth-

Arlington, TX Metropolitan Statistical Area (MSA) in

north central Texas. The HMA has six counties: Hood,

Johnson, Parker, Somerville, Tarrant, and Wise. The

principal cities of Fort Worth and Arlington are located

in Tarrant County.

The current HMA population is estimated at 2,614,000.

Because of its cattle drive history and the construction

of the Texas and Pacific Railway in the late 1800s, the

principal city of Fort Worth became a livestock and

meatpacking center, earning the moniker of “Cowtown.”

The Dallas Fort Worth International Airport—primarily

in Tarrant County—serves as the main hub for the

American Airlines Group Inc. and in 2020 was the fourth

busiest airport in the world.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally,

at PD&R’s Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

The pace of job growth slowed during the first

quarter of 2021, partly due to a decline in nonfarm

payrolls in February, when a catastrophic ice storm

caused many businesses to temporarily close.

During the 3 months ending March 2021, nonfarm

payrolls in the HMA declined by 41,000 jobs, or

3.7 percent, to 1.06 million jobs; this decline followed

an increase of 25,300 jobs, or 2.4 percent, during

the same period a year earlier. During the 3-year

forecast period, nonfarm payrolls are expected to

increase at an average annual rate of 2.7 percent,

with notable growth expected in both goods-

producing and service-providing sectors.

The sales housing market in the HMA is currently

tight, with an estimated vacancy rate of 1.3 percent,

down from 2.1 percent in 2010. During the 12

months ending March 2021, the average existing

home sales price increased 8 percent to $283,600,

and the average new home sales price increased

2 percent to $322,800 (Zonda, with adjustments

by the analyst). During the next 3 years, demand is

estimated for 28,700 new homes. The 4,275 homes

under construction will satisfy some of the demand

in the first year of the forecast period.

Rental market conditions are balanced in the HMA

as of April 1, 2021, due to an increased propensity

to rent in the HMA since 2010. Apartment market

conditions are also balanced, with a vacancy

rate of 5.6 percent during the first quarter of

2021, nearly unchanged from a year ago. The

average apartment market rent during the first

quarter of 2021 increased 4 percent to $1,132

from a year earlier (RealPage, Inc.). During the

forecast period, demand is estimated for 18,000

new rental units; the 12,700 units currently under

construction will meet part of that demand.

Economy

Weak, but Improving: Although

69 percent of jobs lost due to the

effects of the COVID-19 pandemic

have been recovered, the pace of

job recovery has been uneven in

the Fort Worth HMA.

Rental Market

Balanced: The overall rental

vacancy rate is currently

estimated at 7.2 percent, down

from 11.7 percent in April 2010

when the market was soft.

Sales Market

Tight: The inventory of homes

available for sale in March 2021

fell by nearly 66 percent from a

year earlier.

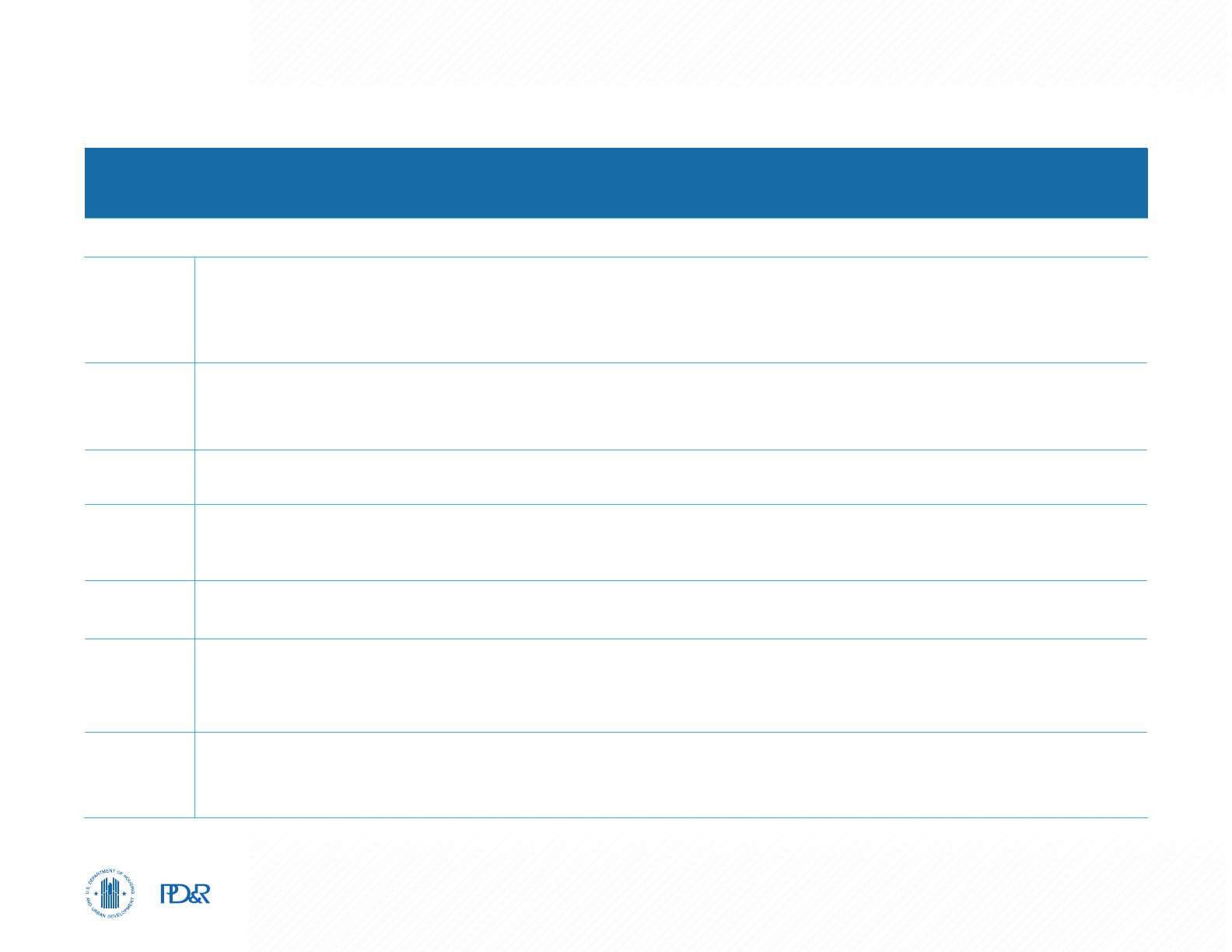

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 9

Home Sales Market 11

Rental Market 15

Terminology Definitions and Notes 18

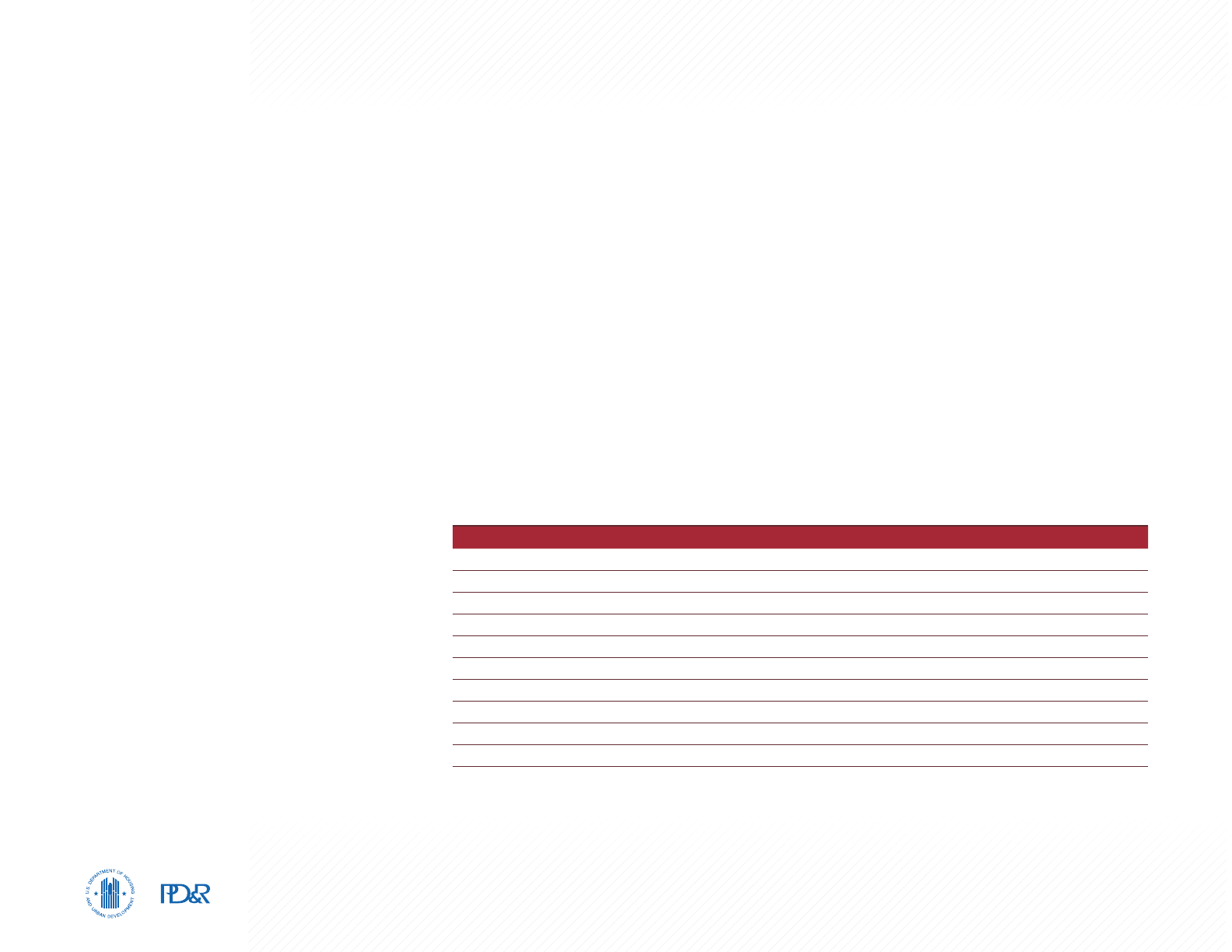

Notes: Total demand represents estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of April 1, 2021. The forecast period is April 1, 2021, to April 1, 2024.

Source: Estimates by the analyst

3-Year Housing Demand Forecast

Sales Units Rental Units

Fort Worth HMA

Total Demand 28,700 18,000

Under Construction 4,275 12,700

Economic Conditions 4Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

Largest Sector: Wholesale and Retail Trade

On a monthly basis, nonfarm payrolls

in the wholesale and retail trade sector

surpassed pre-pandemic (February 2020)

levels in October 2020 and continued to

increase through December but fell in

January and February 2021.

Primary Local Economic Factors

Originally an outpost to the western frontier of

Texas, Tarrant County evolved into a manufacturing

and transportation hub in the 1900s and a

burgeoning financial center for north Texas in the

2000s. Refineries moved to the HMA following

the discovery of oil in 1901, and the aviation

industry expanded around the Naval Air Station

Joint Reserve Base (formerly known as Carswell

Air Force Base) during World War II. Five of the

six counties in the HMA are part of the Barnett

Shale natural gas fields. Advances in natural gas

extraction used in the fields led to the Barnett

Shale becoming one of the most productive

natural gas fields in the United States during the

2000s and contributed to an increase in mining,

logging, and construction jobs in the HMA. Since

the early 2000s, Fidelity Investments and Deloitte

have opened large campuses in the Circle T Ranch

portion of the AllianceTexas development.

The manufacturing and the transportation and

utilities sectors have a significant impact on the

Name of Employer Nonfarm Payroll Sector Number of Employees

American Airlines Group Inc. Transportation & Utilities 25,000

Lockheed Martin Corporation Manufacturing 13,700

Texas Health Resources Education & Health Services 12,000

Naval Air Station Joint Reserve Base Fort Worth* Government 10,000

The University of Texas at Arlington Government 8,500

JPS Health Network Education & Health Services 6,500

City of Fort Worth Government 6,150

Cook Children’s Health Care System Education & Health Services 6,050

Tarrant County College Education & Health Services 6,000

Alcon Inc. Manufacturing 5,400

Table 1. Major Employers in the Fort Worth HMA

*Data include military personnel, who are generally not included in nonfarm payroll survey data.

Note: Excludes local school districts.

Source: Fort Worth Chamber of Commerce

local economy. With generally high-paying jobs, the manufacturing sector has been historically centered

around the aerospace and defense industry in the HMA. Companies such as Lockheed Martin Corporation,

which is the second largest employer in the HMA, and Bell Textron Inc. have manufacturing facilities in the

HMA (Table 1). In 2020, Bell Textron Inc. built a new manufacturing technology center in the city of Fort

Worth. The company is collaborating with Lockheed Martin Corporation to build the V-280 Valor, a tiltrotor

aircraft for the United States Army Future Vertical Lift program. Since 2015, the transportation and utilities

sector has grown the fastest of all the sectors, with an average growth rate of 4.4 percent, or 3,500

jobs, annually, because of the growing popularity of e-commerce. Some of this job growth has been at

companies located in AllianceTexas, a master-planned mixed-use community based around the Fort Worth

Alliance Airport in northern Fort Worth. The UPS Ground Hub, J.B. Hunt Transport Services, Inc., BNSF

Railway Company Alliance Intermodal Facility, and two The Kraft Heinz Company warehouses are some of

the facilities located in the development. Since 2015, the financial activities sector was the second fastest

growing sector in the HMA. The Charles Schwab Corporation opened a temporary office in AllianceTexas

in 2015, prior to moving their corporate offices to the northern part of the Circle T Ranch development. In

2018, TD Ameritrade, Inc., moved its two Fort Worth offices to a new, $123-million complex in the city of

Southlake to accommodate future expansion and expand their potential employee base to include people

from Dallas County.

Economic Conditions 5Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Current Conditions—

COVID-19 Related Restrictions

and Nonfarm Payrolls

In March 2020, executive orders intended to

mitigate the spread of COVID-19 were issued

by the governor of Texas. Since April 2020, the

governor issued a series of executive orders

aimed at achieving less restrictive COVID-19

countermeasures while continuing certain social-

distancing restrictions to safely reopen the Texas

economy. By October 2020, most establishments

were allowed to operate at 75 percent capacity,

and in March 2021, the governor allowed

establishments in the state to operate at

100 percent capacity, with a caveat allowing

county judges to use some COVID-19 mitigation

strategies restricting businesses to 50 percent

capacity under highly defined circumstances

of increased COVID-19 hospitalizations.

Although nonfarm payrolls are down considerably

year-over-year, 69 percent of the 126,200

jobs lost during March and April of 2020—as

a consequence of the efforts used to slow the

spread of COVID-19, including enforcing social

distancing and health safety standards—were

recovered by March 2021 (not seasonally

adjusted). Despite this partial recovery of jobs,

economic conditions remain weak. During the

3 months ending March 2021, payrolls declined

by 41,000 jobs, or 3.7 percent, compared with the

same 3-month period a year earlier. Those losses, however, were less than the job decline that occurred

during the 12 months ending March 2021, which captured all of the initial job losses due to the pandemic.

During the 12 months ending March 2021, payrolls totaled 1.04 million, reflecting a decrease of 56,100

jobs, or 5.1 percent (Table 2), compared with the same 12-month period a year ago. During the 12 months

ending March 2021, 10 of the 11 employment sectors lost jobs, with the majority of job losses in the

service-providing sectors. The leisure and hospitality sector, which fell by 24,200 jobs, or 19.2 percent, led

the decline and accounted for 43 percent of the total job losses in the HMA.

Approximately 79 percent of jobs lost in this sector were in the accommodation and food services industry,

which declined by 19,100 jobs, or 17.8 percent. The decline is due to limited travel to the HMA during this

period, as well as the countermeasures used to limit the contagion of COVID-19. The countermeasures

to limit COVID-19, however, resulted in a rise in the demand for e-commerce goods, which caused an

increase in warehouse construction and jobs in the transportation and utilities sector. The construction

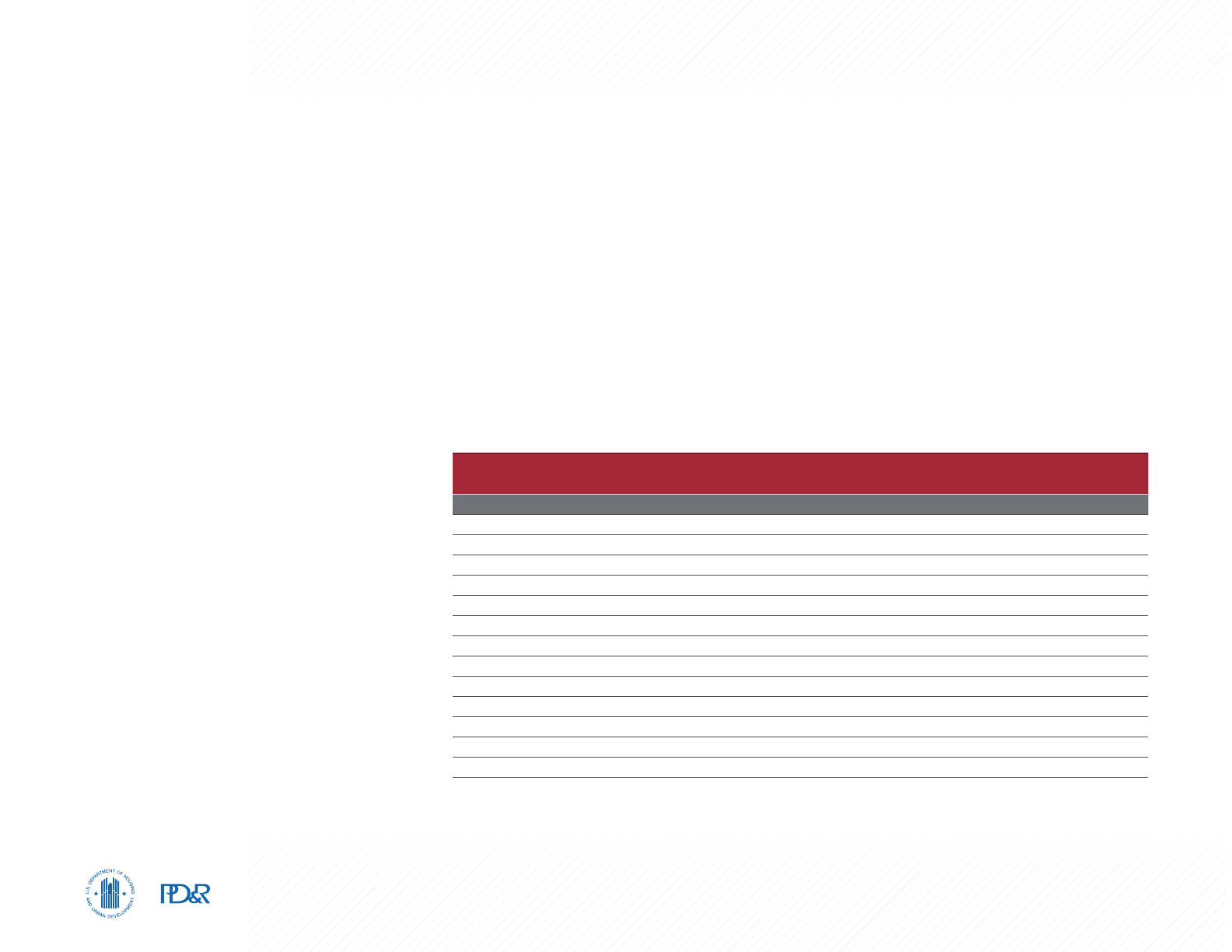

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s) in the Fort Worth HMA, by Sector

12 Months Ending

March 2020

12 Months Ending

March 2021

Absolute Change Percentage Change

Total Nonfarm Payroll Jobs 1,098.6 1,042.5 -56.1 -5.1

Goods-Producing Sectors 179.2 171.2 -8.0 -4.5

Mining, Logging, & Construction 76.5 72.6 -3.9 -5.1

Manufacturing 102.7 98.6 -4.1 -4.0

Service-Providing Sectors 919.3 871.3 -48.0 -5.2

Wholesale & Retail Trade 176.1 174.2 -1.9 -1.1

Transportation & Utilities 91.4 91.9 0.5 0.5

Information 10.8 9.4 -1.4 -13.0

Financial Activities 68.5 67.5 -1.0 -1.5

Professional & Business Services 123.6 118.7 -4.9 -4.0

Education & Health Services 142.1 135.4 -6.7 -4.7

Leisure & Hospitality 125.8 101.6 -24.2 -19.2

Other Services 42.3 36.6 -5.7 -13.5

Government 138.7 136.1 -2.6 -1.9

Notes: Based on 12-month averages through March 2020 and March 2021. Numbers may not add to totals due to rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 6Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

of industrial warehouses and facilities in the HMA increased during this time

and partly offset the decline of jobs in the mining, logging, and construction

sector, which were down by 3,900 jobs, or 5.1 percent, during the 12 months

ending March 2021. The transportation and utilities sector, which accounts

for 9 percent of the jobs in the HMA, was the only sector to expand (Figure 1).

Partly attributed to the growth of e-commerce, the transportation and utilities

sector increased by 500 jobs, or 0.5 percent, compared with 4,500 jobs, or

5.2 percent, added a year earlier.

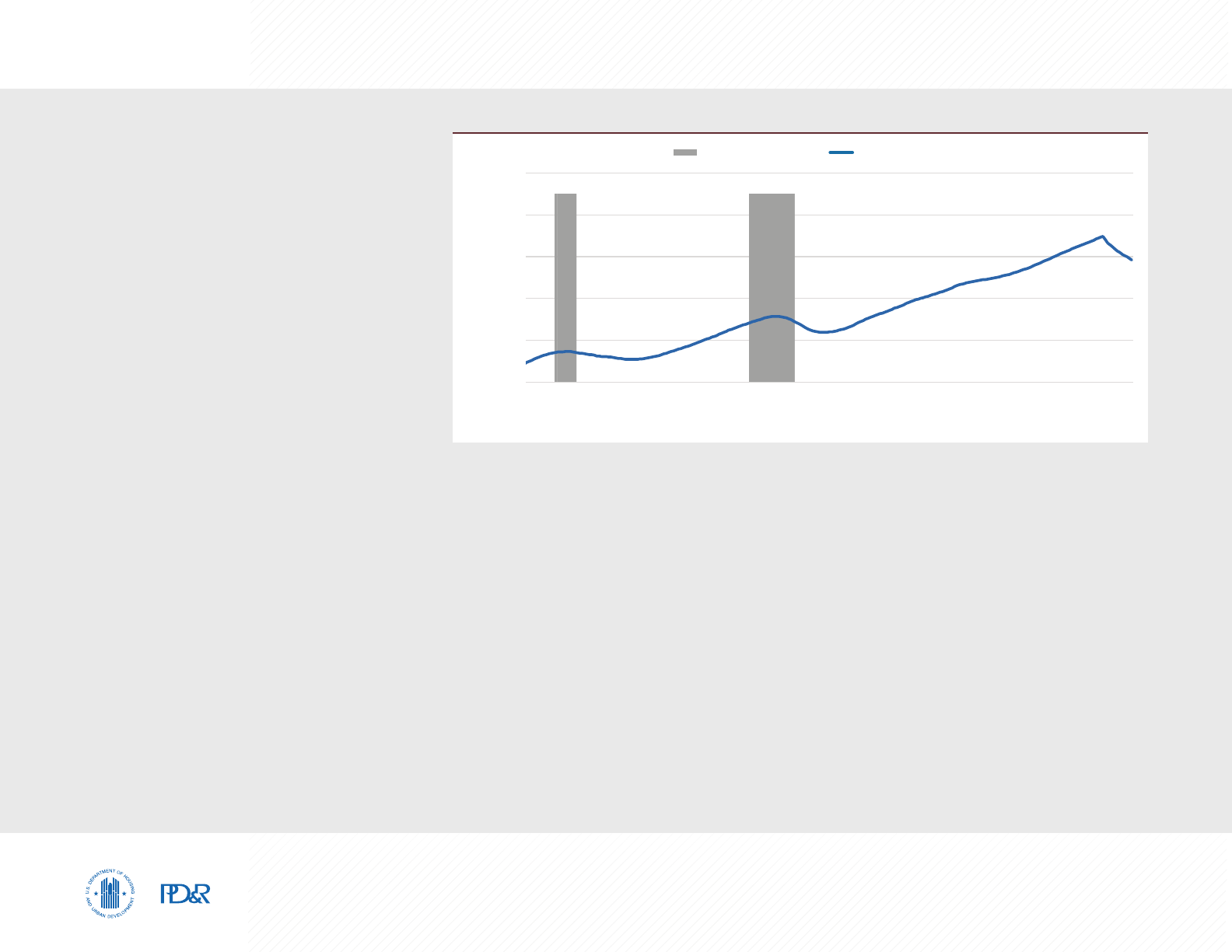

Current Conditions—Unemployment

Significant job losses occurred during the past year because of COVID-19

containment measures. The unemployment rate averaged 8.0 percent during

the 12 months ending March 2021, up from 3.3 percent during the previous

12 months but down from the recent 12-month peak of 8.4 percent during

May 2010 (Figure 2). By comparison, the unemployment rate in the nation

averaged 8.7 percent during the 12 months ending March 2021, up from

3.7 percent a year earlier.

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

Mar-00

Mar-01

Mar-02

Mar-03

Mar-04

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Unemployment Rate (%)

Fort Worth HMA Nation

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

Figure 2. 12-Month Average Unemployment Rate

in the Fort Worth HMA and the Nation

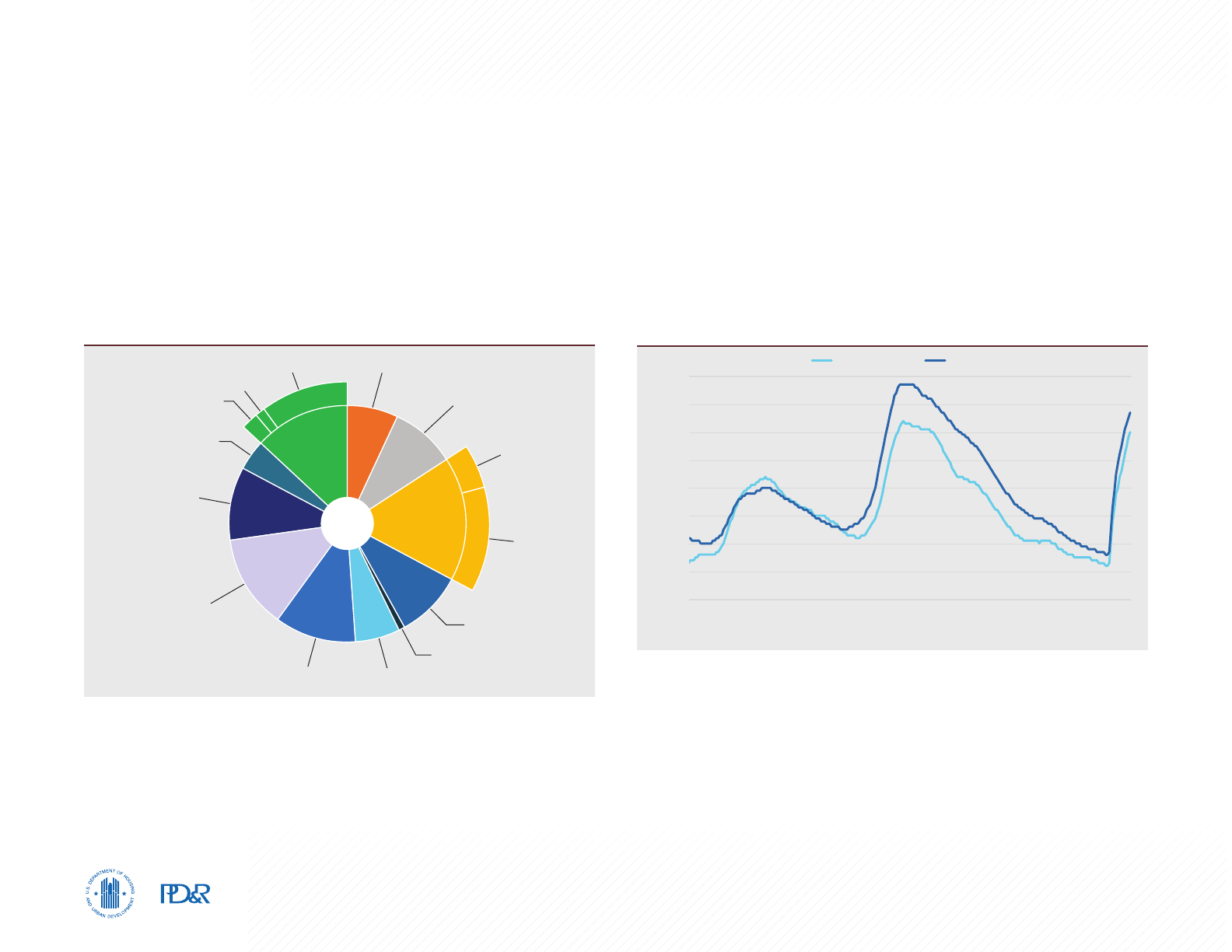

Education &

Health Services 13%

Mining, Logging, & Construction 7%

Manufacturing 9%

Transportation

& Utilities 9%

Information 1%

Financial Activities 6%

Professional & Business Services 11%

Leisure &

Hospitality 10%

Other Services 4%

Federal 2%

State 1%

Local 10%

Total

1,042.5

Government

13%

Wholesale

5%

Trade 17%

Retail

12%

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding.

Based on 12-month averages through March 2021.

Source: U.S. Bureau of Labor Statistics

Figure 1. Share of Nonfarm Payroll Jobs in the Fort Worth HMA, by Sector

Economic Conditions 7Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

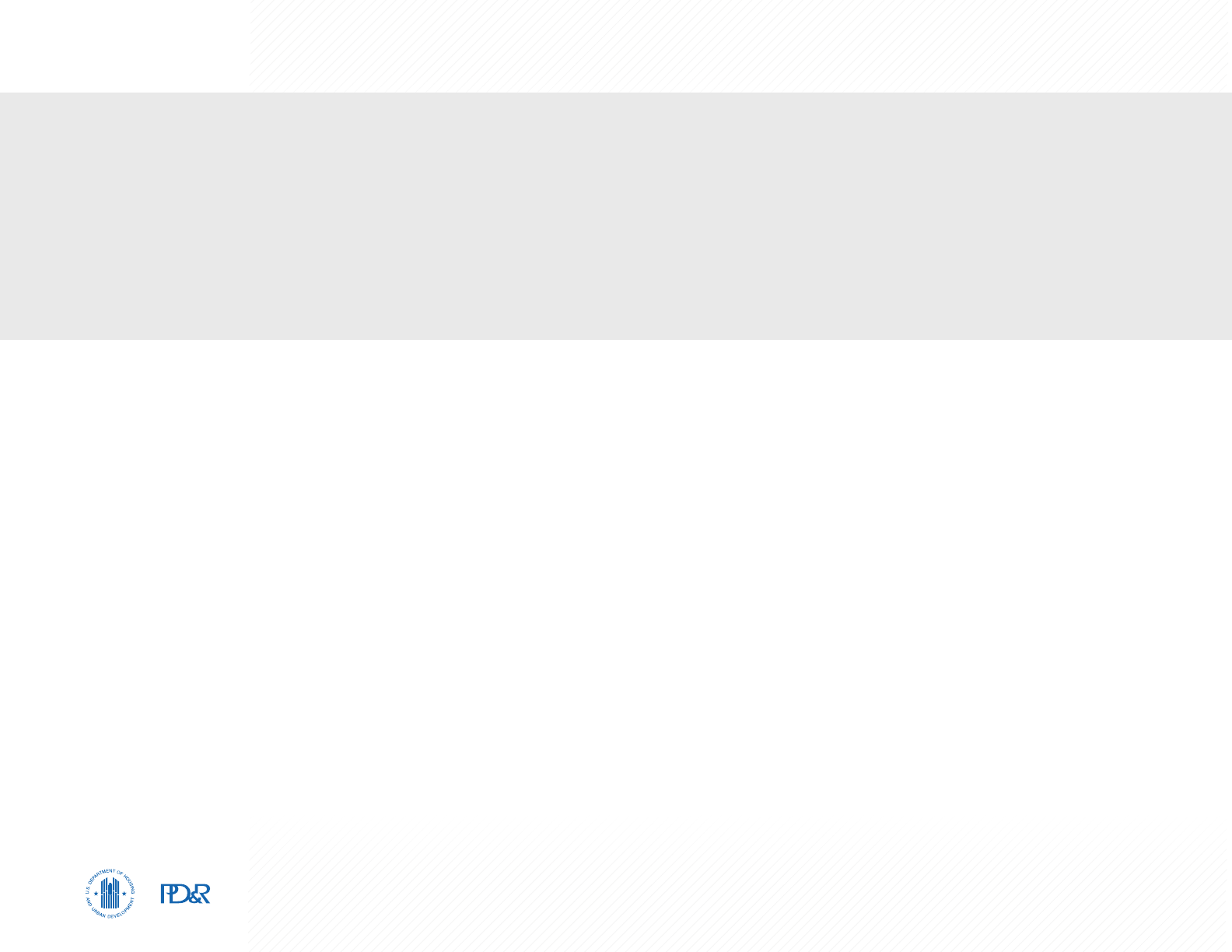

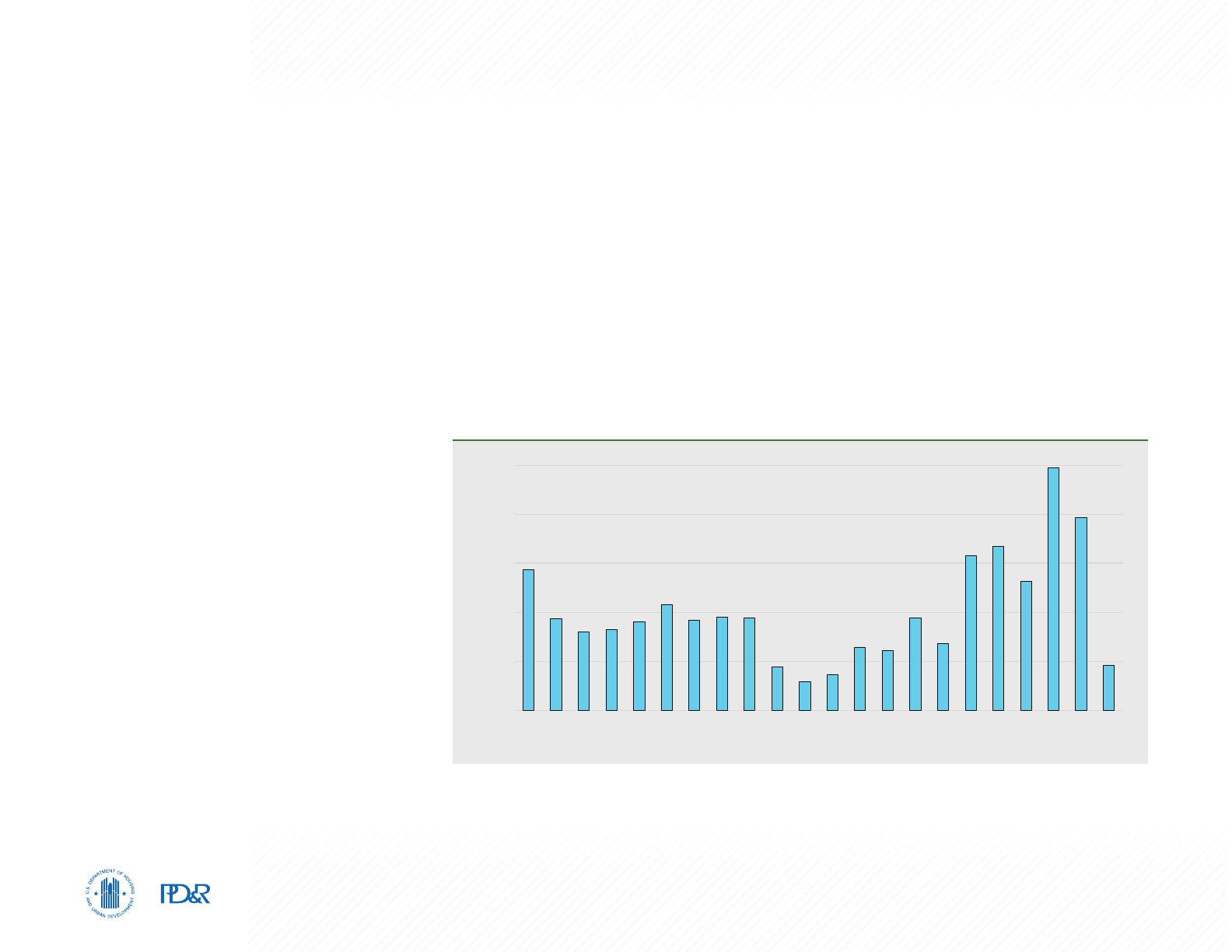

2001 Through 2008

Following an increase in nonfarm payrolls

in 2001, mainly due to a rise in the financial

activities sector of 3,000 jobs, or 6.9 percent,

total nonfarm payrolls declined from 2002

through 2003 by an average of 7,800 jobs, or

0.9 percent annually (Figure 3). From 2004

through 2008, strong economic growth coincided

with strong net in-migration, and payroll gains

occurred in 7 of the 11 nonfarm payroll sectors.

Payrolls increased by an average of 20,400

jobs, or 2.4 percent, annually, with the mining,

logging, and construction sector leading job

gains and accounting for 21 percent of the jobs

added as natural gas production from the Barnett

Shale natural gas fields increased. During this

time, the professional and business services

and the education and health services sectors

significantly contributed to the expansion and

increased by an average of 3,800 and 3,300

jobs, or 4.1 and 3.6 percent, annually.

2009 Through 2010

Economic conditions in the HMA weakened as a

result of the national recession that began in late

2007. From 2009 through 2010, nonfarm payrolls

fell by an average of 17,000 jobs, or 1.9 percent,

annually, to a low of 873,700 jobs in 2010. The

effects of the national recession were moderate

Economic Periods

of Significance

Note: Based on the 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

National Recession Nonfarm Payrolls

1,250

1,150

1,050

950

850

750

Mar-00

Mar-01

Mar-02

Mar-03

Mar-04

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Nonfarm Payrolls (in Thousands)

Figure 3. 12-Month Average Nonfarm Payrolls in the Fort Worth HMA

in the HMA compared with the nation, partly because of strong growth in the education and health

services and the government sectors, which increased annually by averages of 3,400 and 3,000 jobs,

or 3.3 percent and 2.4 percent, respectively. By contrast, job loss was greatest in the mining, logging,

and construction sector, which fell by an average of 7,900 jobs, or 11.7 percent, annually, accounting for

46 percent of all jobs lost during this period, as residential construction in the HMA declined.

2011 Through 2019

Economic conditions in the HMA began to improve in 2011, and by 2012 nonfarm payrolls had surpassed

the pre-recessionary high of 2008, reaching 927,300 jobs. From 2011 through 2014, job growth was

strong, increasing by an average of 25,600 jobs, or 2.8 percent, annually. Gains were strongest in the

mining, logging, and construction sector, which added an average of 4,100 jobs, or 6.6 percent, partly due

to relatively strong natural gas production in the HMA. Nonfarm payrolls moderated from 2015 through

2016, increasing by an average of 16,000 jobs, or 1.6 percent, annually, with all of the growth occurring in

the service-providing sectors. The transportation and utilities and the wholesale and retail trade sectors

Economic Conditions 8Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Commuting Patterns

With a robust highway system, including two interstate highways that traverse

the Dallas-Fort Worth-Arlington, TX MSA from east to west, many residents

of the HMA, particularly from Tarrant and Johnson Counties, commute to

Dallas County for work. The share of employed people commuting to Dallas

County has remained relatively constant since 2010. In 2018, 23 percent of

employed residents from Tarrant County commuted to Dallas County, which

was unchanged from 2010 (Census Bureau, OnTheMap, 2018 and 2010

data). Likewise, the percentage of employed residents commuting from

Johnson County to Dallas County during 2018 was 13 percent, which was

up 1 percentage point from 2010.

Employment Forecast

During the 3-year forecast period, nonfarm payrolls in the HMA are expected

to grow at an average of 2.7 percent annually. Job growth is expected to be

greatest during the first year of the forecast, with the recovery of all jobs

lost during the pandemic anticipated by the end of the first year. The goods-

producing and the service-providing sectors are both expected to contribute

to payroll growth during the next 3 years. Job gains are expected to be

strong in the transportation and utilities sector as demand for e-commerce

goods continues to expand. Hillwood Development Company, LLC, is planning

to begin construction on a 1.2 million square foot industrial building in the

AllianceTexas development, which is expected to be completed in 2022.

BNSF Railway Company announced an approximately $200 million expansion

to add a new double track from the Alliance Intermodal Facility in the city

of Fort Worth to the city of Cleburne in the southern portion of the HMA. As

the effects of the COVID-19 pandemic subside, the leisure and hospitality

sector is expected to grow. The $810 million second phase of the Texas Live!

development is expected to begin during the forecast period and create more

than 3,000 jobs. The second phase is expected to include 888 hotel rooms,

a new convention center, office space, a mixed-use residential building, and

additional dining, retail, and entertainment options.

led growth, both averaging 5,000 jobs annually, or 6.8 and 3.1 percent,

respectively. During this time, Amazon.com, Inc. built an e-fulfillment

center at AllianceTexas, which created 400 jobs. Close to the AllianceTexas

development, the Presidio Towne Crossing shopping center was built, with

a Target Corporation retail store as the anchor.

Nonfarm payroll growth accelerated from 2017 through 2019, averaging 28,100

jobs, or 2.7 percent, annually. During this time period, the service-providing

sectors accounted for 80 percent of job growth. The financial activities sector

grew the fastest during this time period, increasing 5.3 percent, or by an

average of 3,300 jobs, annually. The leisure and hospitality sector had the

largest job gains during the period, increasing by an average of 3,800 jobs,

or 3.2 percent. Texas Live!, an entertainment and hospitality district sited

between Globe Life Park, Globe Life Field, and AT&T Stadium in the city of

Arlington, opened in 2018, creating more than 1,000 permanent jobs. Other

sectors that grew substantially were the education and health services and

the professional and business services sectors, adding respective averages

of 3,600 and 3,500 jobs, or 2.7 and 3.0 percent, annually.

Population and Households 9Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Households

Current Population: 2.61 Million

Population growth has slowed since 2016

due to a slowdown in both net natural

change and net in-migration.

Population and

Migration Trends

As of April 1, 2021, the estimated population of

the Fort Worth HMA is approximately 2.61 million,

representing an average increase of 38,050, or

1.6 percent, annually since April 2010 (Table 3).

From 2000 to 2005, the population grew by an

average of 39,250, or 2.1 percent, annually, as net

in-migration slowed nearly every year (Figure 4)

in response to the economic downturn during the

early 2000s. The population increased by 53,100,

or 2.6 percent, annually, from 2005 to 2008 as

the economy in the HMA expanded. During this

time period, net in-migration grew to its highest

levels during the past two decades, averaging

32,250 people annually and accounting for

61 percent of the population growth. From

2008 to 2013, population growth slowed to

37,350 people, or 1.7 percent, annually, due to

the economic downturn in the HMA stemming

from the effects of the national recession of the

late 2000s. During that period, net in-migration

slowed to 18,450 people, whereas natural change

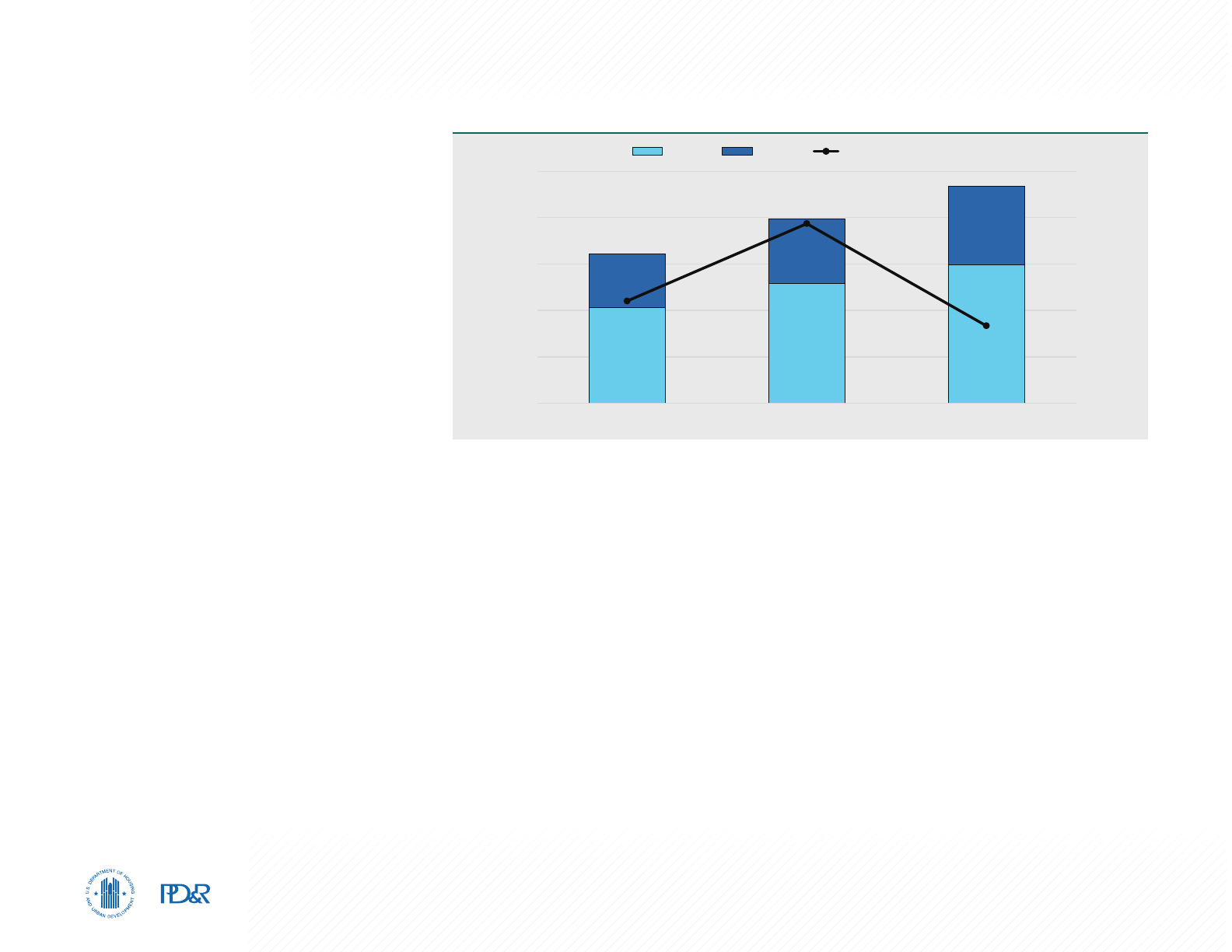

Notes: Data displayed are average annual totals. The forecast period is from the current date (April 1, 2021) to April 1, 2024.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

60,000

50,000

40,000

30,000

20,000

10,000

0

2000-2001

2001-2002

2002-2003

2003-2004

2004-2005

2005-2006

2006-2007

2007-2008

2008-2009

2009-2010

2010-2011

2011-2012

2012-2013

2013-2014

2014-2015

2015-2016

2016-2017

2017-2018

2018-2019

2019-Current

Current-Forecast

Population Change

Net Natural Change Net Migration Population Growth

Figure 4. Components of Population Change in the Fort Worth HMA, 2000 Through the Forecast

Population

Quick Facts

2010 Current Forecast

Population 2,195,694 2,614,000 2,720,000

Average Annual Change 43,750 38,050 35,050

Percentage Change 2.2 1.6 1.3

Household

Quick Facts

2010 Current Forecast

Households 796,284 936,900 976,200

Average Annual Change 15,200 12,800 13,100

Percentage Change 2.1 1.5 1.4

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to current, and current to forecast.

The forecast period is from the current date (April 1, 2021) to April 1, 2024.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Table 3. Fort Worth HMA Population and Household Quick Facts

averaged 18,900 people and accounted for 51 percent of the population change. Due to the economic

expansion in the HMA that began in 2011, the population grew steadily from 2013 to 2016, averaging

45,050 people or 1.9 percent annually, with net in-migration accounting for 61 percent of the growth,

averaging 27,550 people a year. Although the economy strengthened from 2016 to 2019, population

Population and Households 10Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

growth slowed to an average of 38,600 people

annually, or 1.6 percent; both net in-migration and

net natural change slowed during this period—

averaging 23,350 and 15,250 people a year,

respectively. From 2019 to current, the pandemic

caused population growth to slow further to

30,400 people, or 1.2 percent, with a net in-

migration of 18,350 people.

Household Trends

Household growth in the HMA has generally

reflected population growth trends since 2000.

The current number of households in the HMA

is estimated at 936,900, representing an average

annual increase of 12,800 households, or

1.5 percent, since April 2010—a pace slightly

slower than the 1.6-percent population growth

rate in the HMA during the same period. The

number of households increased an average of

2.1 percent annually during the 2000s, slightly

slower than the 2.2-percent population growth

during the same period. Since 2010, there has

been an increase in the propensity to rent, with

renter households accounting for 36.2 percent of

all households in the HMA, up from 35.1 percent

during the 2000s (Figure 5).

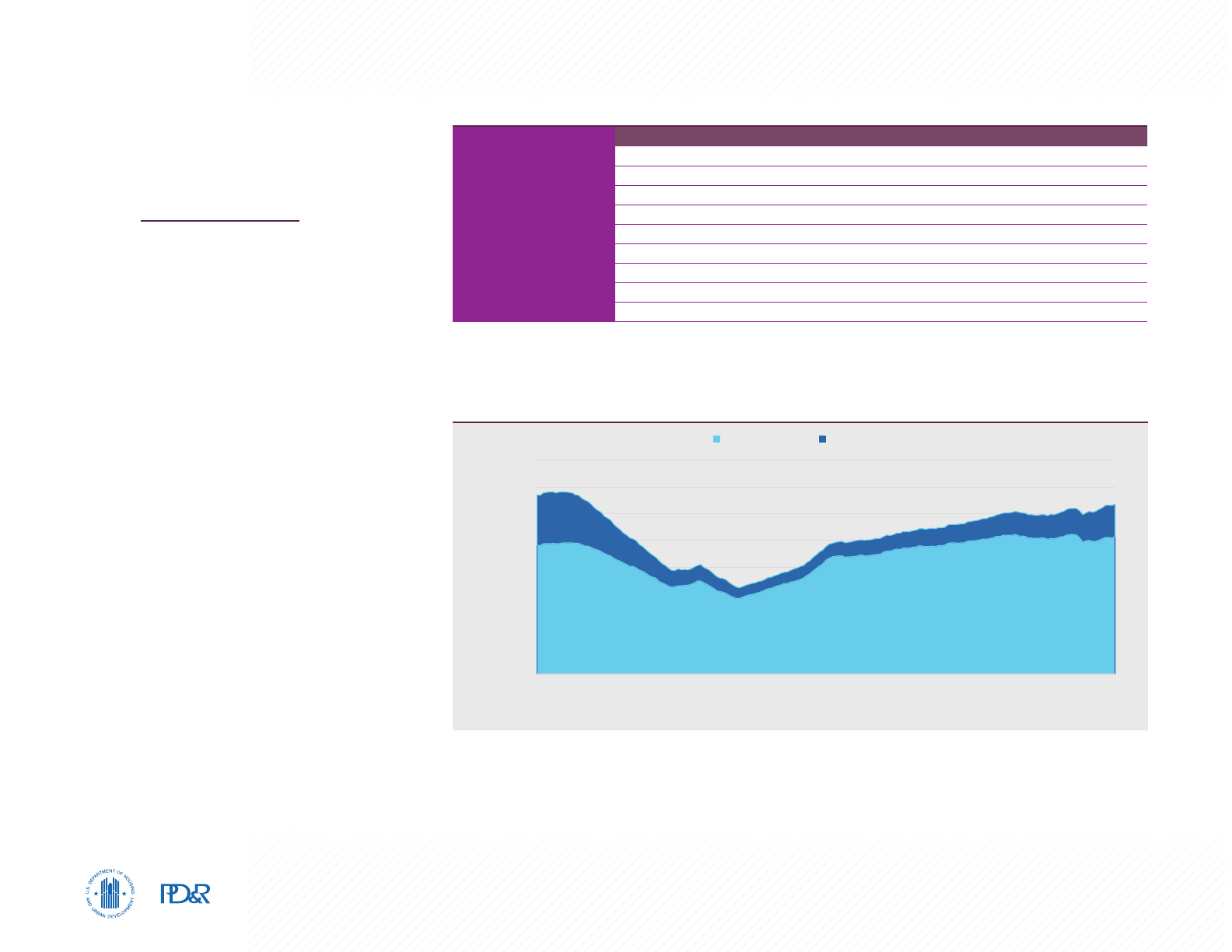

Note: The current date is April 1, 2021.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

65.5

65.0

64.5

64.0

63.5

63.0

1,000,000

800,000

600,000

400,000

200,000

0

2000 2010 Current

Homeownership Rate (%)

Households

RenterOwner Homeownership Rate

64.1

64.9

63.8

Figure 5. Households by Tenure and Homeownership Rate in the Fort Worth HMA

Forecast

Population growth in the Fort Worth HMA is expected to continue during the 3-year forecast period, with

the population reaching 2.72 million by April 1, 2024, reflecting average annual growth of 35,050 people,

or 1.3 percent; that rate of growth is lower than the period since 2010 because net natural increase is

expected to continue slowing. As jobs lost from the pandemic are recovered and moderate economic

growth ensues, approximately 66 percent of the growth will come from net in-migration. Household

growth is expected to average 13,100, or 1.4 percent, annually, with the number of households in the HMA

reaching 976,200 by the end of the forecast period—a pace that is slightly faster than population growth.

Home Sales Market 11Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Tight

During the 12 months ending March 2021,

total home sales and prices in the Fort

Worth HMA increased 3 and 7 percent,

respectively (Zonda).

Current Conditions

The sales housing market in the Fort Worth

HMA is currently tight, with an estimated sales

vacancy rate of 1.3 percent (Table 4), down from

2.1 percent in April 2010. The supply of homes in

the HMA fell from a 2.3-month supply in March

2020 to a 0.8-month supply in March 2021

(CoreLogic, Inc.). New and existing home sales in

the HMA increased to 63,650 homes sold during

the 12 months ending March 2021, up 3 percent

compared with the previous 12 months (Zonda)

but slower than the increase of 5 percent a year

earlier—partly because the number of existing

homes for sale declined as many people did not

want to show their homes to prospective buyers

during the pandemic. During the same period,

the average new and existing home sales price

increased 7 percent to $291,200.

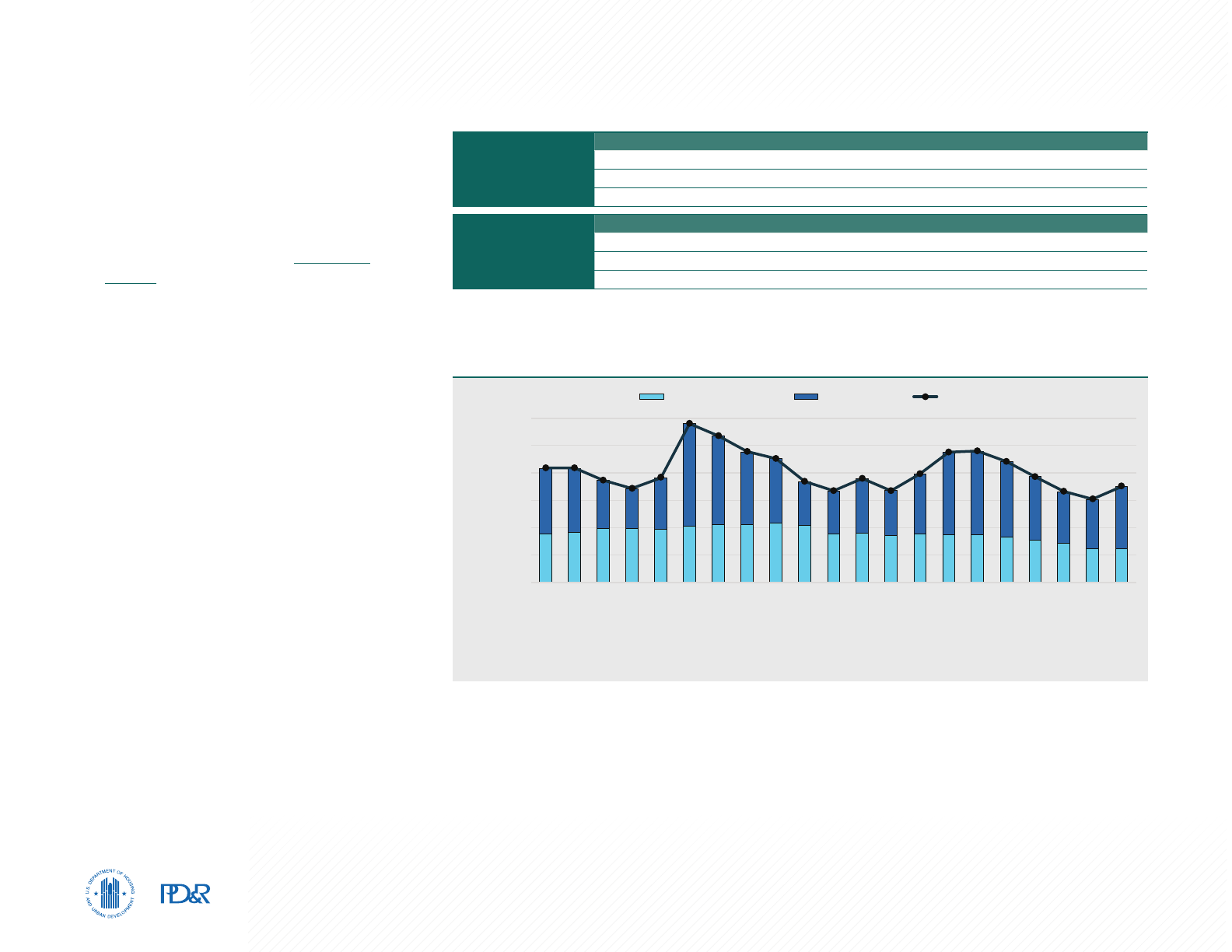

New Home Sales and Prices

New home sales in the HMA peaked at 19,000

homes sold in 2006 (Figure 6) when job and

population growth combined with relaxed lending

standards contributed to strong home sales.

The number of new home sales subsequently

Home Sales

Quick Facts

Fort Worth HMA Nation

Vacancy Rate

1.3% NA

Months of Inventory

0.8 1.3

Total Home Sales

63,650 6,927,000

1-Year Change

3% 16%

New Home Sales Price

$322,800 $392,100

1-Year Change

2% 3%

Existing Home Sales Price

$283,600 $353,100

1-Year Change

8% 12%

Mortgage Delinquency Rate

4.1% 3.7%

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending March 2021; and months of inventory and

mortgage delinquency data are as of March 2021. The current date is April 1, 2021.

Sources: National Association of Realtors; Census Bureau /HUD; CoreLogic, Inc.; HMA Sales and Prices—Zonda, with adjustments by the analyst

Table 4. Home Sales Quick Facts in the Fort Worth HMA

Source: Zonda, with adjustments by the analyst

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Sales Totals

Existing Sales New Sales

Figure 6. 12-Month Sales Totals by Type in the Fort Worth HMA

declined, however, each of the next 5 years to a low of 4,000 homes sold in 2011, as demand for homes

fell due to the national housing crisis and economic downturn in the HMA. As economic conditions

improved, new home sales increased every year in the HMA. From 2012 through 2014, new home sales

Home Sales Market 12Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

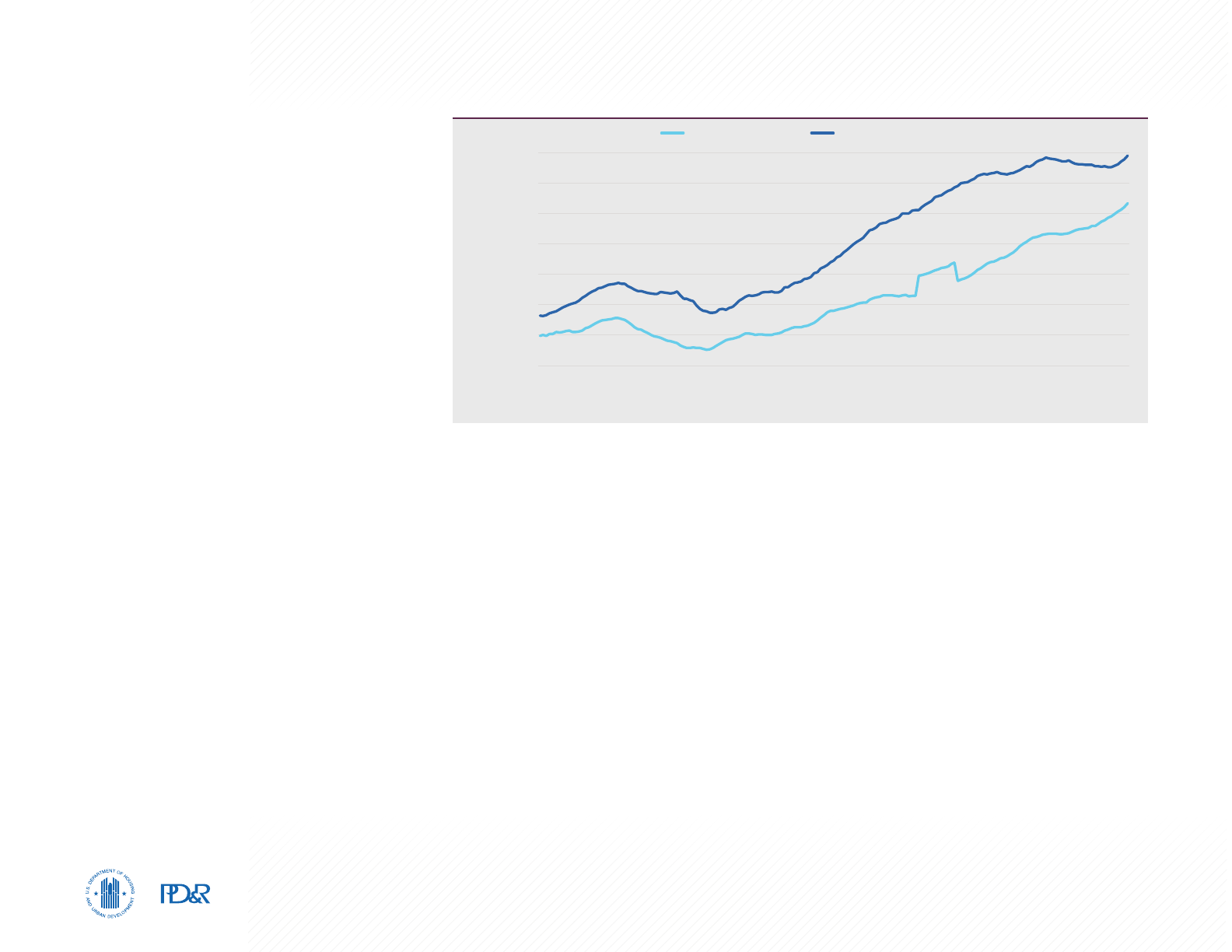

Note: From the 12 months ending November 2015 through October 2016, the average existing home sales price appears to break with the trendline

because sales of higher priced existing homes were relatively higher in November 2015.

Source: Zonda, with adjustments by the analyst

325,000

300,000

275,000

250,000

225,000

200,000

175,000

150,000

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Average Sales Price ($)

Existing Sales Price New Sales Price

Figure 7. 12-Month Average Sales Price by Type of Sale in the Fort Worth HMA

increased by an average of 650 homes, or

14 percent, annually, to 5,925 homes sold as

job opportunities increased. As job growth in

the HMA moderated in 2015 and 2016, new

home sales increased by an average of 480, or

8 percent, annually. From 2017 through 2019, as

the economy in the HMA expanded more rapidly

with job growth occurring in many of the higher

paying sectors, new home sales increased by an

average of 880 homes, or 11 percent, annually,

to 9,550 homes sold in 2019. Due to a lack of

supply of existing homes available for sale and

rising demand during the pandemic, new home

sales during the 12 months ending March 2021

increased to 12,300, up 23 percent from a

year earlier.

The average new home sales price rose from

2006 through 2007 by an average of $13,700, or

7 percent, annually, to $216,500, as demand for

homes increased (Figure 7). After reaching a peak

of $218,200 in early 2008, the average new home

price in the HMA trended downward to $195,900

in 2010 because of the economic downturn

during that time. As economic conditions in the

HMA improved, new home sales prices increased

each year from 2011 through 2018, averaging a

gain of $15,400, or 6 percent, annually to reach

$319,000 before falling 1 percent in 2019. During

the 12 months ending March 2021, the average

new home sales price increased to a peak of

$322,800, up by $7,700, or 2 percent, from a

year earlier.

Existing Home Sales and Prices

Existing home sales, which includes regular resale and real estate owned (REO) home sales, averaged

48,150 homes annually from 2005 through 2006 when in-migration to the HMA peaked. Due to the

housing crisis and subsequent economic downturn in the HMA, existing home sales fell by an average of

3,700 homes, or 9 percent, annually from 2007 through 2011. From 2012 through 2019, as the economy in

the HMA expanded, existing homes sales increased by an average of 2,675 homes, or 7 percent, annually.

During the 12 months ending March 2021, existing home sales declined 1 percent from a year earlier to

51,350. By comparison, the 52,100 existing homes sold during the 12 months ending March 2020 was

a 3-percent increase from a year prior. The recent decline in existing home sales has coincided with a

decline in home sales inventory.

The average existing home sales price increased from 2006 through 2007 by an average of $8,850, or

5 percent, annually to $188,000, before falling 6 percent to a low of $164,600 in 2009 as mortgage

lending standards tightened and as the economy in the HMA began to contract. Beginning in mid-2010,

existing home prices began to rise and increased to $175,000 in 2011. Existing home prices increased

by an average of $10,850, or 6 percent, annually from 2012 through 2014 as the economy in the HMA

Home Sales Market 13Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

expanded. A relatively large number of existing

homes sold in November 2015 were priced over

$2 million, which contributed to an increase in

the average existing home sales price in 2015

by $16,950, or 8 percent, to $224,500, before

adjusting to $220,800 in 2016. As job growth

began to accelerate, prices increased by an

average of $13,750, or 6 percent, annually from

2017 through 2019, reaching $276,600 in 2020.

During the 12 months ending March 2021, the

average sales price for existing homes rose to

$283,600, up 8 percent from a year ago.

Delinquent Mortgages

and REO Properties

In March 2021, 4.1 percent of home loans in the

Fort Worth HMA were seriously delinquent or had

transitioned into REO (real estate owned) status,

up from 1.1 percent a year earlier but less than the

peak of 6.3 percent in January 2010 caused by the

recession and foreclosure crisis (CoreLogic, Inc.).

By comparison, the national percentage of

seriously delinquent mortgages and REO

properties was 3.7 percent in March 2021, up

from 1.3 percent a year earlier but significantly

below the peak rate of 8.6 percent in January

2010. The rate of seriously delinquent mortgages

and REO properties in the Fort Worth HMA and

the nation have increased during the past year,

primarily because homeowners had greater

difficulty paying their mortgages due to job losses

during the COVID-19 pandemic.

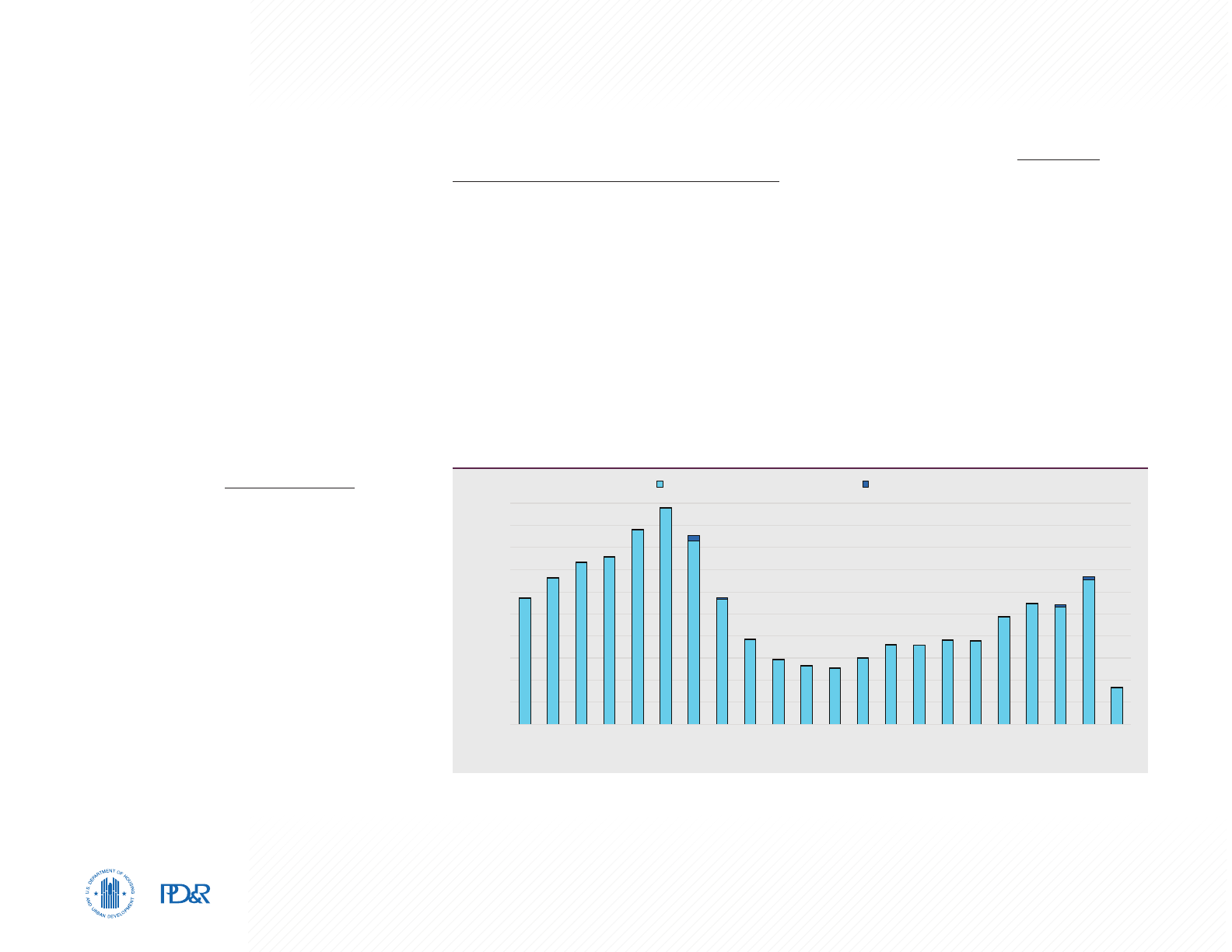

Sales Construction Activity

New home construction activity in the Fort Worth HMA, as measured by the number of single-family

homes, townhomes, and condominiums permitted, was higher during the 2000s, averaging 12,400 units

permitted annually, compared with the 2010s when an average of 7,650 units were permitted annually

(Figure 8). The number of homes permitted was high from 2000 through 2006, when an average of

14,400 homes were permitted annually because of relaxed mortgage lending standards combined with job

and population growth during the period. As lending standards became more stringent due to the housing

crisis, and economic conditions weakened as a result of the national recession, new home construction

activity in the HMA fell by 25 percent annually, from 2007 through 2010, to a low of 4,675 homes by 2011.

Sales construction activity increased to an average of 6,575 homes permitted annually from 2012 through

2016 as the economy in the HMA continued to recover following the recession of the late 2000s and in-

migration increased, which contributed to more homebuyers in the HMA. Although migration to the HMA

slowed beginning in 2017, a stronger pace of job growth contributed to greater demand for new homes in

the HMA, and sales construction activity rose to an average of 9,750 homes permitted annually from 2017

18,500

16,650

14,800

12,950

11,100

9,250

7,400

5,550

3,700

1,850

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Single-Family Homes/Townhomes Condominiums

Notes: Includes single-family homes, townhomes, and condominiums. Data for 2021 are through March 2021.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2019—final data and estimates by the analyst; 2020 and 2021—preliminary

data and estimates by the analyst

Figure 8. Average Annual Sales Permitting Activity in the Fort Worth HMA

Home Sales Market 14Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

through 2019. During the 12-months ending

March 2021, the number of homes permitted

averaged 12,350, or a 16-percent increase from

the same period a year earlier (preliminary data,

with adjustments by the analyst).

New Home Developments

Although new homes are being built throughout

the Fort Worth HMA, new home construction

has been more prevalent in north Fort Worth

as well as Wise and Parker Counties, which

allow for

easy access to the north Fort Worth/

AllianceTexas area of the HMA. Portions of

Johnson County and

southern Tarrant County,

which allow for easy access to north Fort Worth

and Dallas County (located to the east of the

HMA), have also had increased home construction.

New developments in Parker County include the

Silverstone Pearson Ranch development built by

Table 5. Demand for New Sales Units in the Fort Worth HMA During the Forecast Period

Sales Units

Demand 28,700 Units

Under Construction 4,275 Units

Note: The forecast period is from April 1, 2021, to April 1, 2024.

Source: Estimates by the analyst

Riverside Homebuilders in the city of Weatherford, which has 70 homes planned at buildout; currently,

67 homes have been sold. Homes at the development are currently priced between $309,900 and

$394,900. In Tarrant County, the Silver Oak subdivision in the city of Mansfield, built by D.R. Horton, Inc.,

has 110 homes planned at buildout; currently, 100 homes have been sold, and the remaining 10 homes

under construction are available for sale. Homes at the Silver Oak development are currently priced

between $382,500 and $437,000.

Forecast

During the next 3 years, demand is expected for an estimated 28,700 homes in the Fort Worth HMA

(Table 5). The 4,275 single-family homes currently under construction will satisfy a portion of the estimated

demand during the forecast period. Demand is expected to be highest during the first year of the

forecast period.

Rental Market 15Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Balanced

Apartment vacancy rates have remained

generally stable since 2019, and rents

continue to increase due to a high number

of newly completed market-rate apartment

units being added to the rental stock.

Current Conditions

and Recent Trends

Overall rental housing market conditions (which

includes single-family homes, townhomes, and

mobile homes for rent) in the Fort Worth HMA

are currently balanced, with an estimated rental

vacancy rate of 7.2 percent, down from 11.7 percent

in 2010 when the market was soft (Table 6). During

2015 through 2019, 48 percent of the occupied

rental units in the HMA were in structures with five

or more units, typically apartments (2015–2019

American Community Survey, 5-year data). The

apartment market is also balanced. During the

first quarter of 2021, the HMA had a vacancy rate

of 5.6 percent, up from 5.5 percent during the

same period a year earlier (RealPage, Inc.). The

apartment vacancy rate ranged from 9.7 percent

during the first quarter of 2005 to 7.7 percent

during the first quarter of 2008 (Figure 9). From

the first quarter of 2009 through the first quarter

of 2010, the average apartment vacancy rate

increased by 0.9 of a percentage point to

9.4 percent as the rental market softened. As

Rental and

Apartment

Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate

11.7 7.2

2006–2010 (%) 2015–2019 (%)

Occupied Rental Units by Structure

Single-Family Attached & Detached

32.1 35.6

Multifamily (2–4 Units)

14.7 12.5

Multifamily (5+ Units)

48.8 47.9

Other (Including Mobile Homes)

4.4 4.0

1Q 2021 YoY Change

Apartment Vacancy Rate

5.6 0.1

Average Rent

$1,132 4%

1Q = first quarter. YoY= year-over-year.

Notes: The current date is April 1, 2021. Percentages may not add to 100 due to rounding.

Sources: 2010 vacancy rate—2010 Census; 2006–2010 and 2015–2019 American Community Survey, 5-year data; RealPage, Inc.

Table 6. Rental and Apartment Market Quick Facts in the Fort Worth HMA

1Q = first quarter.

Source: RealPage, Inc.

Vacancy Rate (%)

Average Monthly Rent ($)

Average Monthly Rent ($) Vacancy Rate (%)

10.0

8.0

6.0

4.0

2.0

0.0

1,150

1,050

950

850

750

650

1Q05

1Q06

1Q07

1Q08

1Q09

1Q10

1Q11

1Q12

1Q13

1Q14

1Q15

1Q16

1Q17

1Q18

1Q19

1Q20

1Q21

Figure 9. Apartment Rents and Vacancy Rates in the Fort Worth HMA

Rental Market 16Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Notes: Includes apartments and units intended for rental occupancy. Data for 2021 are through March 2021.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2019 final data and analyst estimates; 2020 and 2021–preliminary data and

estimates by the analyst

0

2,500

5,000

7,5 00

10,000

12,500

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Figure 10. Average Annual Rental Permitting Activity in the Fort Worth HMA

many owner households shifted to renter status

during the early 2010s, and as migration to the

HMA increased, rental market conditions began to

tighten. The average apartment vacancy rate fell

from 8.0 percent during the first quarter of 2011,

when the market was balanced, to 5.0 percent

during the first quarters of 2016 and 2017, when

the market was tight. A rise in new apartment units

entering the market during the first quarter of 2019

increased the average vacancy rate to 5.6 percent.

The average apartment rent in the HMA increased

nearly each year during the past 17 years, with the

rent falling only in 2010. The average apartment

rent increased an average of 2 percent annually

from the first quarter of 2005 through the first

quarter of 2009 before falling 1 percent during the

first quarter of 2010, as the rental market softened.

The average apartment rent increased an average

of 3 percent annually from the first quarter of 2011

through the first quarter of 2014, before increasing

by an average of 5 percent annually through

the first quarter of 2020 as new apartment units

offered at higher rents entered the market in the

HMA. During the first quarter of 2021, the average

rent was $1,132, an increase of 4 percent from the

same period a year earlier.

Market Conditions

by Geography

During the first quarter of 2021, the South

Arlington/Mansfield market area had the lowest

average vacancy rate among the 14 RealPage, Inc.-defined market areas (hereafter, market areas) in the

Fort Worth HMA at 3.9 percent, with an average rent of $1,232, in part due to the proximity of employment

centers within the HMA and Dallas County. By contrast, the highest vacancy rate, at 6.8 percent, was in

the East Fort Worth market area, the second most affordable area of the HMA, where the average age of

apartment units is the oldest, with an average asking rent of $947 during the first quarter of 2021.

Rental Construction Activity

Rental construction activity in the Fort Worth HMA, as measured by the number of rental units permitted,

has recently been at or above annual rental construction activity levels from the 2000s through mid-2010s,

peaking in 2019 (Figure 10). During the 2010s, apartment construction notably increased in the north and

central areas of the city of Fort Worth. During the 12 months ending March 2021, 9,650 units were permitted,

down 18 percent compared with a year earlier (preliminary data, with adjustments by the analyst). From

2000 through 2008, rental construction activity averaged 4,875 units permitted annually. By comparison,

from 2009 through 2011, rental construction activity averaged 1,825 units annually, as builders responded to

Rental Market 17Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

increasing vacancy rates from 2009 through 2010.

Rental demand increased as the economy in the

HMA expanded, and rental construction activity

averaged 5,100 units annually from 2012 through

2017. Rental construction activity slowed in 2018 as

builders responded to the influx of new apartment

supply from relatively high levels of construction

during 2016 and 2017. As the pace of economic

expansion in the HMA increased, construction

activity increased by 88 percent in 2019 before

beginning to slow in 2020.

New Apartment Developments

Among several recently completed apartment

developments is the 250-unit Alleia at Presidio, a

market-rate property that opened in late 2020 on

the north side of Fort Worth, with rents starting at $1,213, $1,849, and $2,299 for one-, two-, and three-

bedroom units, respectively. The 408-unit Presidium Revelstoke, a market-rate apartment development

in Fort Worth, near the AllianceTexas area, was also built in 2020, with rents for one-, two-, and three-

bedroom units starting at $1,275, $1,760, and $2,455, respectively.

Forecast

During the forecast period, demand is estimated for 18,000 new rental units in the Fort Worth HMA

(Table 7). Demand is expected to increase in the second and third years of the forecast period because

of increasing net in-migration and improving economic conditions. The 12,700 units currently under

construction are expected to satisfy demand through the second year of the forecast period.

Note: The forecast period is April 1, 2021, to April 1, 2024.

Source: Estimates by the analyst

Rental Units

Demand 18,000 Units

Under Construction 12,700 Units

Table 7. Demand for New Rental Units in the Fort Worth HMA During the Forecast Period

Terminology Definitions and Notes 18Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in an HMA. Some units are constructed or created without a building

permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected in the residential building

permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some of these estimates are included in

the discussions of single-family and multifamily building permits.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve a

balanced market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies. The

estimates do not account for units currently under construction or units in the development pipeline.

Forecast Period 4/1/2021–4/1/2024—Estimates by the analyst.

Home Sales/

Home Sales

Prices

Includes single-family, townhome, and condominium sales.

Net Natural

Change

Resident births minus resident deaths.

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units such as single-family, multifamily, and mobile homes.

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

Terminology Definitions and Notes 19Fort Worth-Arlington, Texas Comprehensive Housing Market Analysis as of April 1, 2021

Comprehensive Housing Market Analysis Fort Worth-Arlington, Texas

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

B. Notes on Geography

1.

The metropolitan division definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB) in the OMB

Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

C. Additional Notes

1.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may also be

useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to make determinations

regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

2.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD. The analysis

and findings are as thorough and current as possible based on information available on the as-of date from local and national sources. As such, findings or

conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state and local government officials

who provided data and information on local economic and housing market conditions.

D. Photo/Map Credits

Cover Photo iStock

Contact Information

Nancy Smith, Economist

Fort Worth HUD Regional Office

817–978–9415

nancy.[email protected]