Page 2 of 29

February 2018

OFFICIAL

Contents

Key information ................................................................................................ 3

What is Help to Buy? ....................................................................................... 4

Help to Buy overview ....................................................................................... 5

How does it work? ............................................................................................ 6

Who can take part in the scheme?................................................................... 8

What does the Help to Buy Agent do? ............................................................. 9

How to buy a Help to Buy home?................................................................... 10

How long does the process take? .................................................................. 12

Leasehold reform and Help to Buy Equity Loan. What does this mean for

Help to Buy homebuyers? .............................................................................. 13

Your mortgage ............................................................................................... 14

What happens when I sell my Help to Buy home? ......................................... 15

What happens if property values fall? ............................................................ 17

Are there any restrictions on the mortgage provider? .................................... 19

Fees and costs............................................................................................... 20

Annual Percentage Rates (APR) for Help to Buy owners .............................. 23

Additional Help to Buy equity loan administration charges ............................ 24

Questions and answers ................................................................................. 25

Find your Local Help to Buy Agent................................................................. 29

Page 3 of 29

February 2018

OFFICIAL

Key information

Buyers using this scheme must provide security in the form of a second legal

charge over the home purchased with the Help to Buy equity loan.

Amount of loan

The maximum you can borrow from

Help to Buy in England is £120,000

and up to £240,000 for London.

There is no minimum amount.

Buyer deposit required

Buyers must provide a deposit of a

minimum of 5% of the full purchase

price of the home bought under this

scheme.

Frequency, number and

amount of repayments

After five years you will be required to

pay an interest fee of 1.75% of the

amount of your Help to Buy shared

equity loan at the time you purchased

your property, rising each year after

that by the increase (if any) in the

Retail Prices Index (RPI) plus 1%.

More details are on page 18.

The loan itself is repayable after 25

years or on the sale of the property if

earlier.

Other payments and charges

You must pay a monthly management

fee of £1 per month from the start of

the loan until it is repaid.

Total amount repayable

The total amount repayable by you

will be the proportion of the market

value of your home that was funded

by this loan, plus interest and

charges. The amount you will have to

repay under the loan agreement will

depend on the market value of your

home when you repay the Help to

Buy equity loan and the rate of

inflation in the meantime. An

example is shown on page 21

including the equivalent APR.

Page 4 of 29

February 2018

OFFICIAL

What is Help to Buy?

Help to Buy is equity loan assistance to home buyers from Homes England

1

.

Help to Buy makes new build homes available to all home buyers (not just first

time buyers) who wish to buy a new home, but may be constrained in doing

so – for example as a result of deposit requirements – but who could

otherwise be expected to sustain a mortgage.

Up to a maximum of 20% in England and up to 40% in London

2

, of the

purchase price is available to the buyer through an equity loan funded by the

Government through Homes England.

Help to Buy is available in England from house builders registered to offer the

scheme. Help to Buy has been available since 2013. In November 2015,

Government announced an extension of the initiative up to 2021 (it may close

earlier if all of the funding is taken up before 2021).

This guide provides an overview of the product. If you’d like to know more, or

if you want to apply, please contact your Help to Buy agent

www.helptobuy.gov.uk .

Your home may be repossessed if you do not keep up repayments on a

mortgage or any other debt secured on it.

Check that these mortgages will meet your needs if you want to move or

sell your home or you want your family to inherit it. If you are in any

doubt, seek independent advice.

APR 5.2% typical (see page 23 for more information).

1

Homes England was launched by the Secretary of State on 11 January 2018. Homes England is the

trading name of Homes and Communities Agency (the legal entity) and all Help to Buy mortgages have

Homes and Communities Agency as the lender.

2

As part of the Government’s Autumn Statement (November 2015) it was announced that London Help

to Buy will increase the equity loan available to a maximum of 40% of the purchase price from early

2016. This guide provides information and examples for both the London Help to Buy equity loan of

40% and the 20% equity loan that is available across the rest of England.

Page 5 of 29

February 2018

OFFICIAL

Help to Buy overview

With Help to Buy, the buyer (‘you’) buys a new home on a new build

development with assistance from Homes England in the form of an equity

loan.

For Help to Buy in England, not London, you must take out a first mortgage

(with a qualifying lending institution e.g. a bank or building society) for at least

25% of the value of the property you wish to purchase. This mortgage,

together with any cash contribution from you, must be a minimum of 80% of

the full purchase price. The maximum full purchase price is £600,000.

For London Help to Buy 40% equity loan assistance, your first mortgage must

be at least 25% of the value of the property you wish to purchase. The

mortgage, together with the cash contribution from you, must be a minimum of

60% of the purchase price. The maximum full purchase price is £600,000.

Your cash deposit contribution must always be a minimum of 5% of the full

purchase price.

Homes England will provide an equity loan to fund the balance needed to

make up the full purchase price of your home, up to a maximum of 20% (40%

maximum for London Help to Buy) of the full purchase price.

The equity loan must be repaid after 25 years, or earlier if you sell your home.

You must repay the same percentage of the proceeds of the sale to Homes

England as the initial equity loan (i.e. if you received an equity loan for 20% of

the purchase price of your home, you must repay 20% of the proceeds of the

future sale).

An initial monthly management fee of £1 is payable by direct debit from the

start of Homes England loan until it is repaid. After the first five years you will

pay an additional fee as interest of 1.75%, rising annually by the increase (if

any) in the Retail Price Index (RPI) plus 1%.

Local Help to Buy Agents will assess and approve your purchase for Help to

Buy, and you need their approval before you proceed with the buying process.

Further details on all these points and the buying process are set out within

this guide.

Page 6 of 29

February 2018

OFFICIAL

How does it work?

Help to Buy enables buyers to purchase a new property, funded by a

mortgage and with help from Homes England.

This enables you to take out a mortgage on which you make repayments in

the normal way. Your mortgage lender will require that you contribute a

deposit (minimum 5% of the full purchase price). Your mortgage and deposit

must cover a combined minimum of 80% of the total purchase price (or 60%

of total purchase price in London). The rest of the purchase price will be paid

for with an equity loan from Homes England.

As a result of providing this assistance, Homes England has an

entitlement to a share of the future sale proceeds equal to the

percentage contribution required to assist your purchase. Examples of

this are shown below.

For the first five years of Help to Buy home ownership you will pay an initial

monthly management fee of £1. This continues until the loan is repaid.

After five years, the equity loan will be subject to an additional interest fee

(collected from you on behalf of Homes England by Homes England’s

Mortgage Administrator) of 1.75% per annum on the outstanding amount of

the equity loan. From the fifth anniversary of the loan this fee will increase

each year by the increase (if any) in RPI plus 1%. This is illustrated on page

18.

The management fee and interest fees are not capital repayments to your

Homes England equity loan – they do not reduce the amount owing.

When you sell your Help to Buy home (unless you have chosen to repay

your equity loan earlier), you must repay the Help to Buy assistance

from a share of the sale proceeds. So, if Homes England assisted your

purchase with a 20% contribution, your repayment will be 20% of the

total market value when it is sold. Turn to page 17 to see what happens

if values have fallen.

Following the purchase you can choose at any time to make voluntary part

repayments (‘staircasing’ or a full repayment) of the Help to Buy assistance at

the prevailing market value. The minimum voluntary repayment is 10% of the

market value at the time of repayment.

Homes England’s entitlement to a share of the future sale proceeds is

secured through a second charge on your home. This is done in the same

way that your main mortgage lender will secure its lending through a first

charge on your home. Although, if you buy through Help to Buy, you will have

a mortgage for less than the full purchase price of the property, you will be the

legal owner with 100% title to your home. The tables below show how it

works.

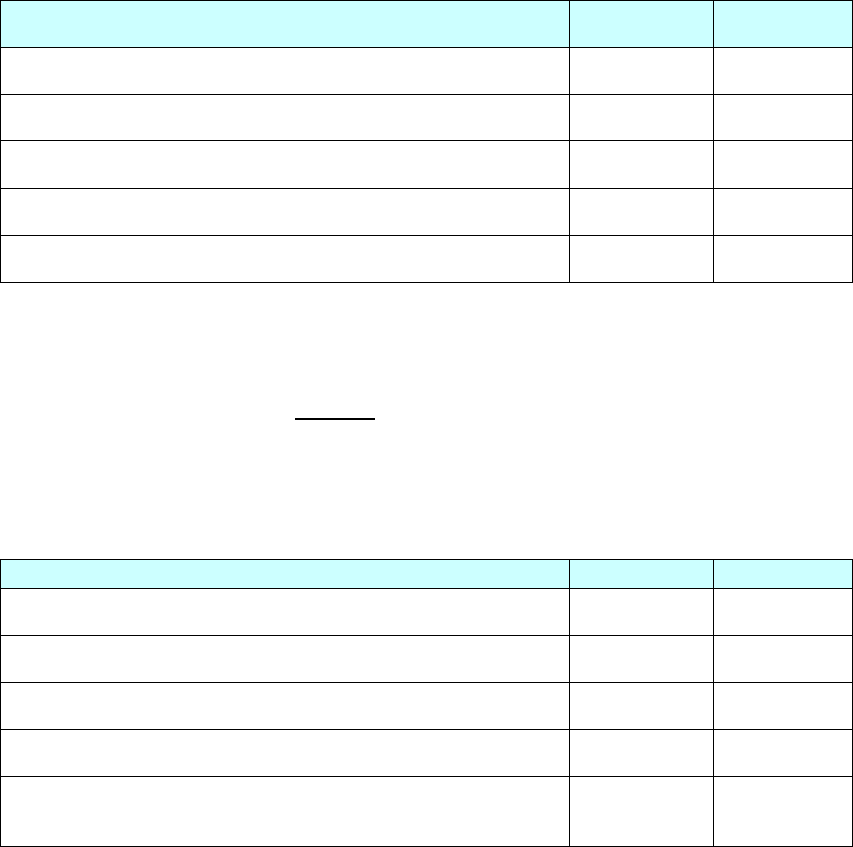

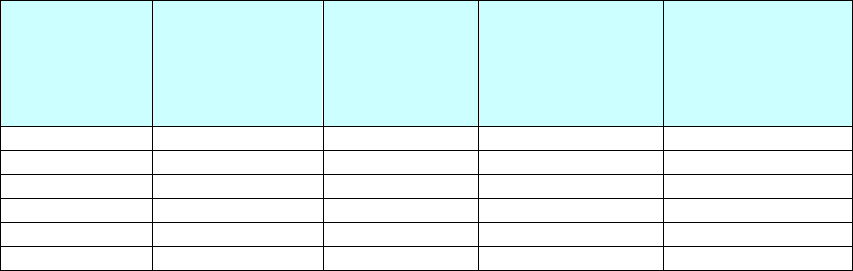

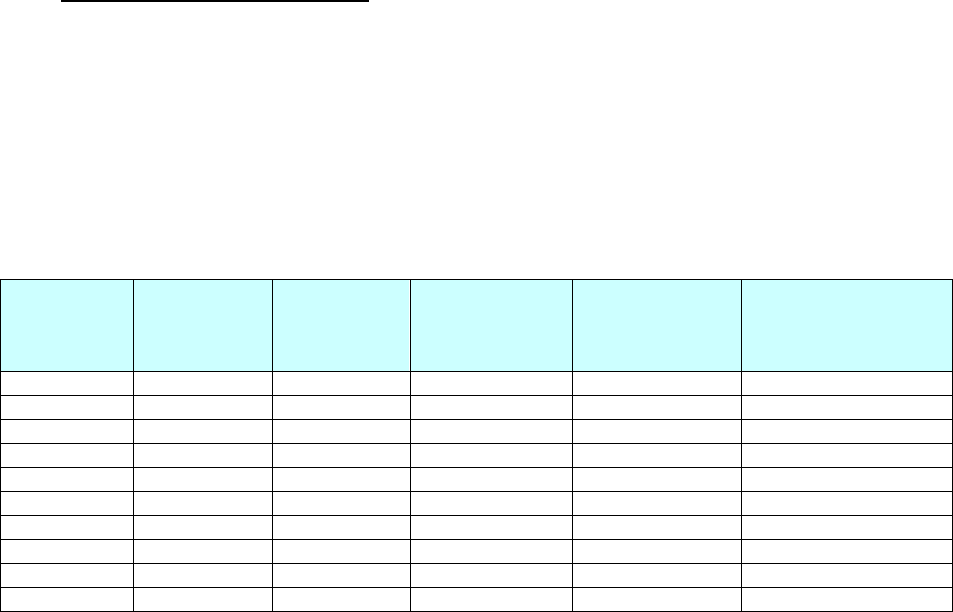

In this example below, the Help to Buy buyer has purchased a £200,000

home with a deposit of £10,000 and a mortgage of £150,000. Homes England

Page 7 of 29

February 2018

OFFICIAL

has contributed an equity loan totalling £40,000 or 20% of the total purchase

price.

In this example, when the home is sold, Homes England will be entitled to

20% of the total sale price.

Example of Help to Buy home ownership in England, not

London

£

%

Open market price of new home

£200,000

100

Help to Buy buyer mortgage @ 75%

£150,000

75

Help to Buy buyer pays minimum 5% deposit

£10,000

5

Help to Buy buyer total contribution

£160,000

80

Homes England Help to Buy assistance 20% equity loan

£40,000

20

Help to Buy always requires that the buyer has a main mortgage of at least

25% of the full purchase price.

In this example below, the London Help to Buy buyer has purchased a

£400,000 home with a deposit of £20,000 and a mortgage of £220,000.

Homes England has contributed an equity loan totalling £160,000 or 40% of

the total purchase price. In this example, when the home is sold, Homes

England will be entitled to 40% of the total sale price.

Example of London Help to Buy home ownership

£

%

Open market price of new home

£400,000

100

Help to Buy buyer mortgage @ 55%

£220,000

55

Help to Buy buyer pays minimum 5% deposit

£20,000

5

Help to Buy buyer total contribution

£240,000

60

Homes England London Help to Buy assistance 40%

equity loan

£160,000

40

Help to Buy always requires that the buyer has a main mortgage of at least

25% of the full purchase price.

Because Help to Buy assistance is through an equity loan, the amount

required to increase your equity share will be dependent on the total value of

the property at the time you want to redeem part of your equity loan

(sometimes known as ‘staircasing’) or repay in full.

The amount you need to do this will increase if your home increases in value

and decrease if its value falls (see examples later in this guide).

Page 8 of 29

February 2018

OFFICIAL

Who can take part in the scheme?

It is open to all buyers seeking a new build home.

Help to Buy buyers outside London must be able to fund up to 80% of their

selected property through a conventional mortgage and deposit. London Help

to Buy buyers must be able to fund 60% of the property through a

conventional mortgage and deposit.

Buyers must always provide a 5% cash deposit contribution (5% of the full

purchase price).

Buyers must take out a first charge mortgage with a qualifying lender.

The maximum purchase price is £600,000.

The Local Help to Buy Agent (see below) will carry out an assessment of an

application by a potential Help to Buy buyer to ensure that they are in a

position to afford a conventional mortgage for their proposed purchase. This

protects tax payers’ investment in the Help to Buy home. Buyers cannot use

the scheme if they require a main mortgage more than 4.5 times their

household income.

You must have access to a minimum 5% deposit of the full purchase price.

The property purchased must be your only residence. Help to Buy is

not available to assist buy-to-let investors or those who will own any

property other than their Help to Buy property after completing their

purchase.

You cannot rent out your existing home and buy a second home

through Help to Buy.

Applicants who make fraudulent claims for Help to Buy assistance may

be liable to criminal prosecution.

Fraudulent claims will always require immediate repayment of the Help

to Buy equity loan assistance.

Page 9 of 29

February 2018

OFFICIAL

What does the Help to Buy Agent do?

The Local Help to Buy Agents work on behalf of Homes England to signpost

potential buyers towards Help to Buy schemes in their area and will carry out

a sustainability check on applicants. Details of the policy the agents follow is

published here and is updated from time to time.

They will also guide you through the process of buying your Help to Buy home

and issue the approvals to your solicitor and the house builder to purchase

the home through the Help to Buy scheme.

The role of the Local Help to Buy Agent is to:

• hold information about Help to Buy schemes for prospective buyers,

• assess long term sustainability and eligibility, and

• give approval to a Help to Buy buyer’s solicitor/conveyancer to proceed

with a purchase.

Following the Help to Buy sale, your details will be transferred to Homes

England’s Mortgage Administrator.

The role of Homes England’s Mortgage Administrator is to provide a single

point of contact to:

• administer payment of fees and interest by buyers on their Help to Buy

equity loans,

• recover the equity loans repayments as owners sell and move on or

staircase, and

• provide advice and approval for exceptional cases relating to

subletting, remortgaging and requests for additional borrowing.

You can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Where are Help to Buy homes available?

Help to Buy homes are available from house builders registered to offer Help

to Buy homes in England. Registered builders will make it clear in their

advertising if Help to Buy homes are available on their development sites.

Page 10 of 29

February 2018

OFFICIAL

How to buy a Help to Buy home?

The four-stage Help to Buy buying process

Stage 1: Application

• Contact house builders, visit schemes of registered house builders and

identify your potential Help to Buy property.

• Its recommended that you see an Independent Financial Advisor (IFA)

to gain confirmation of your financial status. The Local Help to Buy

Agent and house builders will be able to suggest some IFAs for you to

try.

• You must ensure you have funds to pay:

o a reservation fee if required (maximum £500)

o a deposit on exchange of contracts of at least 5% of the full

purchase price (some main mortgage lenders may require

higher deposits)

o other fees on completion (e.g. stamp duty, legal fees, main

mortgage fees).

• You complete a Help to Buy “Property Information Form” (available

from the house builder). You must complete this with details of your

proposed purchase, your proposed main mortgage, deposit and

including your household income. The Property Information Form also

confirms your agreement to the funds due under the Help to Buy

mortgage being paid directly to the house builder.

• You must also reserve the home. You will usually be expected to pay

a reservation fee to the house builder.

• The signed Property Information Form and a copy of the builder’s

reservation form must be sent to the Local Help to Buy Agent.

Stage 2: Authority to Proceed

• Your Local Help to Buy Agent checks you can afford your main

mortgage and ensures you have signed the declaration that the Help to

Buy home will be your only residence. This is to protect tax payers’

investment in the Help to Buy equity loan.

• If affordable, you will receive an “Authority to Proceed” from your Local

Help to Buy Agent within four working days of the house builder

submitting your fully completed Property Information Form and

reservation form to the Local Help to Buy Agent. This process may be

delayed if you do not fully complete your Property Information Form.

• You instruct a solicitor to act for you and tell your IFA so that a full

mortgage application can be submitted.

• The ‘Authority to Proceed’ will be accompanied by instructions to you

and your solicitor/conveyancer. This pack will include legal documents

that will be explained to you by your solicitor/conveyancer.

• You should only submit your main mortgage application once you have

the “Authority to Proceed” from the Local Help to Buy Agent.

Page 11 of 29

February 2018

OFFICIAL

Stage 3: Mortgage offer and exchange of contracts

• Your solicitor/conveyancer will advise you and ensure you sign the sale

contract and the Help to Buy equity loan.

• Your solicitor/ conveyance will explain the legal implications of the

equity loan, that the Help to Buy home must be your only residence

and the consequences of a fraudulent application (see below).

• Your solicitor/conveyancer checks that your mortgage offer, property

price and available funds are consistent with the Authority to Proceed,

and requests permission to exchange contracts from the Local Help to

Buy Agent.

• Your Local Help to Buy Agent issues approval to your

solicitor/conveyancer and contracts are exchanged.

• You will have paid a deposit if required and are now legally contracted

to complete the purchase by an agreed date.

Stage 4: Completing the purchase

• At completion, your lender provides its funds and Homes England will

make its funds available to you via the house builder. Once completion

has taken place you own the property and can move in.

• Your solicitor returns confirmation of the sale to your Local Help to Buy

Agent who then registers your details with Homes England’s Mortgage

Administrator.

• A second charge is registered on your home by your solicitor in favour

of Homes England, entitling it to a share of the future sale proceeds.

The charge will be equivalent to the percentage contribution made

towards the purchase price. You must repay the percentage

contribution when you sell your home or after 25 years (whichever is

earlier).

The property purchased must be your only residence. Help to Buy is not

available to assist buy-to-let investors or those who will own any property in

the UK or abroad other than their Help to Buy property after completing their

purchase.

Y

ou cannot rent out your existing home and buy a second home through Help

to Buy.

Y

ou cannot purchase a Help to Buy property if you own land with resisidential

planning use.

You cannot purchase a Help to Buy home whilst your name is attached to the

deeds or if you will benefit financially from the future sale of a property even if

you do not live there.

M

arried couples own joint assets and therefore both parties are treated as joint

owners regardless of the mortgage/paperwork being in one or both names.

Applicants who make fraudulent claims for Help to Buy assistance will be

liable to criminal prosecution.

A

ll Fraudulent claims will always require immediate repayment of the equity

loan assistance.

Page 12 of 29

February 2018

OFFICIAL

How long does the process take?

Once you find a property you want to buy, you need to reserve it and submit a

duly completed ‘Property Information Form’ to your Local Help to Buy Agent.

Your Local Help to Buy Agent will seek to assess your affordability (from a

fully completed Property Information Form) within four working days and will

issue an Authority to Proceed.

Your Local Help to Buy Agent’s ‘Authority to Proceed’ is valid for three months

– the time limit for exchange of contracts. Typically, most house builders will

be seeking buyers to exchange contracts within one month of making a

reservation. You must legally complete on your purchase within six months of

exchanging contracts.

You are responsible for securing your mortgage and appointing your

solicitor/conveyancer, although your Local Help to Buy Agent and house

builders will be able to suggest some options.

Further information

Help to Buy homes are only available from Help to Buy registered house

builders who are in contract with Homes England to offer homes for sale

through the Help to Buy programme.

Registered builders will make it clear in their advertising whether Help to Buy

homes are available on their development sites.

Your Local Help to Buy Agent can also help you find out more about

availability of Help to Buy homes in your area.

Page 13 of 29

February 2018

OFFICIAL

Leasehold reform and Help to Buy Equity Loan. What does

this mean for Help to Buy homebuyers?

In December 2017, Government published the response to its consultation:

“Tackling unfair practices in the leasehold market”. The response can be

found in full here: https://www.gov.uk/government/consultations/tackling-

unfair-practices-in-the-leasehold-market

The Government believes that, other than in exceptional circumstances, there

are no good reasons for new build houses to be sold on a leasehold basis.

The Government has announced a package of measures to tackle abuses

and unfair practices in the leasehold market. These changes include bringing

forward legislation to stop the future development of new build leasehold

houses, other than in exceptional circumstances and to restrict ground rents

in newly established leases of houses and flats to a “peppercorn”. This will

apply to the whole new-build market, including the Help to Buy equity loan

programme.

All Help to Buy house builders are aware of this requirement but the longer

pipeline of development in place before the announcement means some

houses may still be offered for sale leasehold for a period of time before the

practice ceases.

The majority of Help to Buy new build house sales are already freehold and

Government intends that they should all be freehold in all but exceptional

circumstances. Leasehold can make sense for buildings with shared spaces

and infrastructure, such as blocks of flats. Almost all sales of Help to Buy flats

will continue as leasehold sales unchanged as is the usual practice for this

type of home.

If you intend to purchase a leasehold Help to Buy equity loan house you can

still proceed but, as with the purchase of any property, you are strongly

advised to take independent legal advice from your solicitor/conveyancer, and

pay particular attention to the terms of the lease before you contractually

commit to the purchase whether it is a house or flat/apartment. It is your

responsibility to do this. You can refer your solicitor/conveyancer to the link to

the Government’s response. You may also wish to get in touch with LEASE

via their website at https://www.lease-advice.org/

There is also further guidance in the QA section of this guide.

Page 14 of 29

February 2018

OFFICIAL

Your mortgage

What is the minimum contribution I must make to my Help to Buy home

purchase?

Outside of London your minimum contribution must be 80% of the full

purchase price which can be made up from your mortgage and your cash

deposit contribution and any other savings.

Buyers must have a first charge mortgage for a minimum of 25% of the full

market value and always provide a minimum 5% cash deposit contribution

(5% of the full purchase price).

London Help to Buy requires a minimum contribution of 60% of the full

purchase price. This can be made up from your mortgage and cash deposit

contribution.

Buyers accessing the London Help to Buy equity loan must have a first

charge mortgage for a minimum of 25% of the full market value and always

provide a minimum 5% cash deposit contribution (5% of the full purchase

price).

The long term sustainability of your mortgage contribution will be assessed by

the Local Help to Buy Agent.

Your mortgage will be based on a multiple up to a maximum 4.5 times your

household income. Higher multiples cannot be approved by the Local Help to

Buy Agent under any circumstances.

Your Local Help to Buy Agent will also work to a guideline to ensure that your

monthly costs (mortgage, service charges and fees) are no more than 45% of

your net disposable income. Higher percentages cannot be approved by the

Local Help to Buy Agent under any circumstances.

With limited resources available, Government is seeking to assist as many

buyers as possible to buy with a Help to Buy equity loan. Therefore, if it

looks like you can already secure a c90% main mortgage you should think

carefully whether a Help to Buy equity loan is right for you. There may be

better options for you to consider and you should seek independent financial

advice about this.

Page 15 of 29

February 2018

OFFICIAL

What is the legal mechanism that ensures Homes England receives their

correct share when the equity loan is repaid?

Homes England’s equity loan will be secured through a second charge

registered on your property title at Land Registry; this process will be

undertaken by your solicitor. This means your property cannot be sold in the

future unless Homes England’s equity loan percentage is repaid.

You must agree to the legal charge being secured on your home before your

purchase can be completed. Your Help to Buy equity loan also includes other

obligations such as the requirement for you to insure your property. Your

solicitor/conveyancer will advise you on the legal implications of your

obligations and these documents before they are signed.

What happens when I sell my Help to Buy home?

When you sell your Help to Buy home, (unless you have already chosen to

repay your Help to Buy equity loan) you will repay Homes England’s equity

loan simultaneously. So if you initially purchased with a 75% mortgage and a

5% cash deposit and have made no other staircasing repayments (see

Illustration 1 below), you will repay Homes England 20% of the value at the

time you sell.

The Mortgage Administrator will collect Homes England’s repayment.

You can sell your home at any time and an independent valuer must decide

what it is worth. Your property should be sold on the open market at the

prevailing market valuation. If you do sell your property for more than the

prevailing market value then the amount due to Homes England under the

equity loan will be their percentage value of the actual sale price. Homes

England will not agree to release its charge over the property for sales at less

than market value.

If there are any fees or interest outstanding, for example, interest arrears at

the time of selling, these must be paid before the sale is completed.

The Help to Buy equity loan must be repaid when you sell your home. You will

pay the costs of selling.

The illustrations below give examples of how the equity loan repayment is

calculated assuming a Help to Buy home starting value of £200,000 and a

buyer taking on a mortgage for 75% and paying a 5% deposit. Your

solicitor/conveyancer will be able to provide more illustrations when they

advise you on your purchase.

Page 16 of 29

February 2018

OFFICIAL

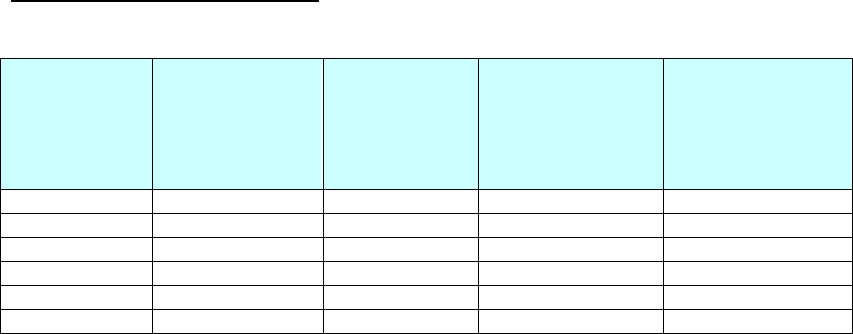

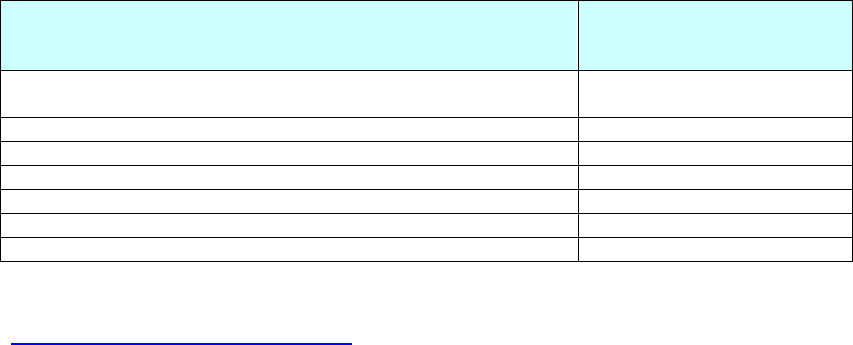

Illustration 1a

Start of year

Estimated

annual change

in property

price %

Total property

Value

Help to Buy

home owner

your

entitlement to

80% of

property value

Homes

England

entitlement to

20% of

property value

1

+2

£200,000

£160,000

£40,000

2

+2

£204,000

£163,200

£40,800

3

+2

£208,080

£166,464

£41,616

4

+2

£212,242

£169,794

£42,448

5

+2

£216,846

£173,477

£43,369

6

+2

£220,816

£176,653

£44,163

In the example in 1a, if the buyer chose to sell their Help to Buy home at the

start of year six (after owning the property for five years) and assuming

property values increased by 2% every year, the buyer would receive an

estimated £220,816 from the sale. The buyer would then use this to settle

any outstanding balance on their main mortgage and to repay the £44,163

Help to Buy equity loan.

London Help to Buy example

The illustrations below give examples of how the equity loan repayment is

calculated assuming a London Help to Buy home starting value of £400,000

and a buyer taking on a mortgage for 55% and paying a 5% deposit. Your

solicitor/conveyancer will be able to provide more illustrations when they

advise you on your purchase.

Illustration 1b

Start of year

Estimated

annual change

in property

price %

Total property

Value

London Help to

Buy home

owner your

entitlement to

60% of

property value

Homes

England

entitlement to

40% of

property value

1

+2

£400,000

£240,000

£160,000

2

+2

£408,000

£244,800

£163,200

3

+2

£416,160

£249,696

£166.464

4

+2

£424,483

£254,690

£169,793

5

+2

£432,973

£259,784

£173,189

6

+2

£441,632

£264,979

£176,653

In the example above, if the buyer chose to sell their London Help to Buy

home at the start of year six (after owning the property for five years) and

assuming property values increased by 2% every year, the buyer would

receive an estimated £441,632 from the sale. The buyer would then use this

to settle any outstanding balance on their main mortgage and to repay the

£176,653 Help to Buy equity loan.

Page 17 of 29

February 2018

OFFICIAL

What happens if property values fall?

Will I have to repay the full amount of Help to Buy assistance or just a

percentage of the total sale proceeds?

When you sell your home, (unless you have repaid the Help to Buy equity

loan document previously) the Help to Buy equity loan document commits you

to repay a percentage of the market value equal to the percentage

contribution of assistance received.

This means if the market value of your property falls below the level at which it

was first purchased, you will repay less than the original amount Homes

England contributed to the original purchase.

You must always show that the proposed sale value is at the prevailing

market value before going ahead. Homes England’s Mortgage Administrator

must approve the sale before allowing the second charge to be released.

As long as you have complied with all your obligations in the Help to Buy

mortgage deed, you will not be required to provide for any shortfall in the

equity loan repayment if you sell when values have fallen.

If you do not comply with the terms of the Help to Buy mortgage deed, Homes

England will seek to recover all the money they are owed. Your solicitor will

explain the Help to Buy mortgage deed to you before the property is

purchased.

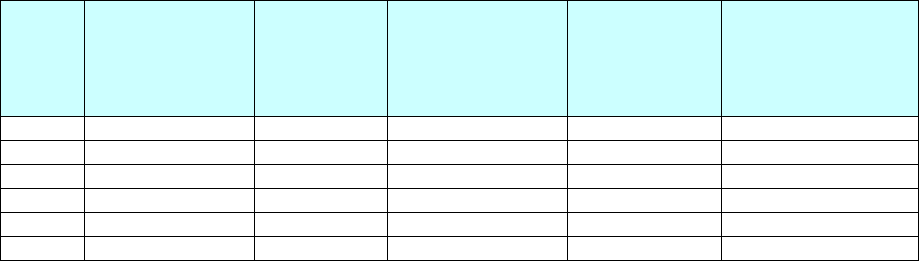

Illustration 2a

Start of year

Estimated

annual change

in property

price %

Total

property

Value

Help to Buy

home owner

your entitlement

to 80% of

property value

Homes England

Help to Buy

entitlement to

20% of property

value

1

-5

£200,000

£160,000

£40,000

2

-5

£190,000

£152,000

£38,000

3

-5

£180,500

£144,400

£36,100

4

+5

£171,475

£137,180

£34,295

5

+5

£180,049

£144,039

£36,010

6

+5

£189,051

£151,241

£37,810

In the above example, if no capital repayment has been made on the main

mortgage, repayment of the £150,000 mortgage from sales proceeds would

leave £39,051 to contribute to the repayment of the £37,810 equity loan.

Page 18 of 29

February 2018

OFFICIAL

London Help to Buy example

Illustration 2b

Start of year

Estimated

annual change

in property

price %

Total

property

Value

London Help to

Buy home owner

your entitlement

to 60% of

property value

Homes England

Help to Buy

entitlement to

40% of property

value

1

-5

£400,000

£240,000

£160,000

2

-5

£380,000

£228,000

£152,000

3

-5

£361,000

£216,600

£144,400

4

+5

£342,950

£205,770

£137,180

5

+5

£360,098

£216,059

£144,039

6

+5

£378,102

£226,861

£151,241

In the above London Help to Buy example, if no capital repayment has been

made on the main mortgage, repayment of the £220,000 mortgage from sales

proceeds would leave £158,102 to contribute to the repayment of the

£151,241 equity loan.

Can I redeem my equity loan in part, sometimes known as

“staircasing”?

The Help to Buy scheme allows you to repay all or part of your equity loan. A

partial repayment is often called “staircasing’.

Staircasing payments can be made at any time and must be a minimum of

10% of your home’s prevailing market value – whether that value is more or

less than when originally purchased. You may wish to check any additional

criteria with your current lender.

An independent valuer must provide a valuation of your property and you will

also be responsible for the associated administrative cost. Enquiries about

administrative costs should be made to Homes England’s Mortgage

Administrator.

If you decide to staircase after five years of ownership, the fees (see below)

you pay on your Help to Buy equity loan will reduce to reflect your smaller

outstanding loan percentage.

If you extend your mortgage to fund your partial repayment of Homes England

equity loan, your mortgage repayments will probably increase to reflect the

fact that you have repaid some of the equity loan. Homes England’s

Mortgage Administrator will need to approve any increase in your first charge

mortgage.

In the example below, the buyer chooses to staircase by 10% to reduce the

Homes England equity loan to 10% at the start of year six (after owning the

property for five years). Assuming property values increased by 5% every

year, the buyer would have to repay £25,526 to reduce the Homes England

equity loan to 10% based on the future property value.

Page 19 of 29

February 2018

OFFICIAL

If the buyer has any outstanding equity loan fees at the time of staircasing,

these arrears must also be paid at the same time as the staircasing payment

is made.

Your solicitor/conveyancer will be able to provide more illustrations when they

advise you on your purchase.

Illustration 3

Start

of

year

Estimated

annual change

in property

price %

Total

property

Value

Help to Buy

home owner

your entitlement

to 80% of

property value

Cost to Help

to Buy

Home owner

staircasing

by 10%

After staircasing

Help to Buy home

your entitlement

to 90% of

property value

1

+5

£200,000

£160,000

Not applicable

Not applicable

2

+5

£210,000

£168,000

£21,000

£189,000

3

+5

£220,500

£176,400

£22,050

£198,450

4

+5

£231,525

£185,220

£23,153

£208,373

5

+5

£243,101

£194,480

£24,310

£218,790

6

+5

£255,256

£204,204

£25,526

£229,730

Are there any restrictions on the mortgage provider?

Your first charge mortgage must be from a qualifying lending institution.

These include lenders who are authorised under the Financial Services and

Markets Act 2000, and who have permission to enter into regulated mortgage

contracts. This is likely to include most banks and building societies.

The Financial Conduct Authority keeps a register of authorised persons on its

website. The register can be found at http://www.fca.org.uk/register/

Your solicitor/conveyancer will check that the lender is compliant before a sale

can proceed.

Page 20 of 29

February 2018

OFFICIAL

Fees and costs

What are the monthly costs of Help to Buy?

Typically every month, you will need to make payments in addition to your

normal monthly outgoings, including:

• mortgage repayments to lenders

• Initial monthly management fee of £1 per month to be paid by direct

debit from the start of ownership until the loan is repaid

• after five years, interest fees on the Help to Buy equity loan (see

below)

• service charges, if you buy a house or flat with shared areas that

require maintenance

• council tax

• Life insurance

• buildings insurance

• utility bills and other costs of occupying the property.

How the interest fees are calculated on the Help to Buy equity loan?

If you have not repaid in full your Help to Buy equity loan after five years, you

will be required to pay an interest fee of 1.75% of the amount of your equity

loan at the time you purchased your property, rising annually from the fifth

anniversary of your equity loan by the increase (if any) in the Retail Price

Index (RPI) plus 1%. This fee is payable to Homes England’s Mortgage

Administrator.

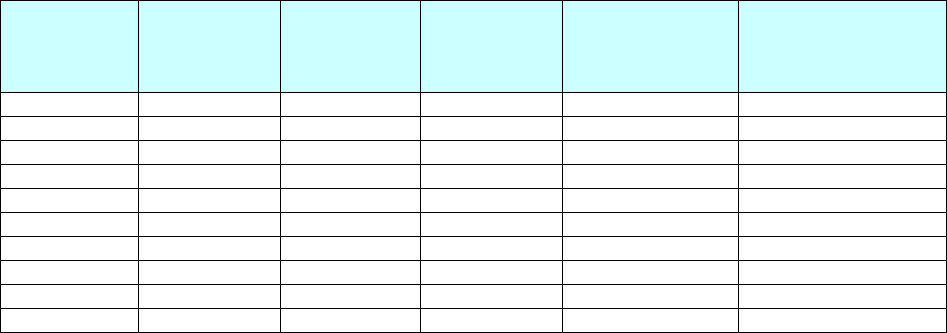

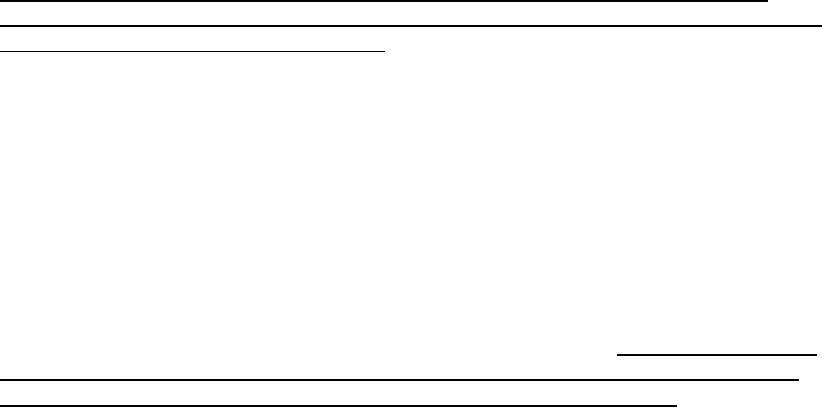

The example below shows how interest fees are calculated. A monthly

management fee of £1 is paid from when you first purchase. The interest fee

payment is not made for the first five years. After this date a monthly fee will

be payable and the table below illustrates how this would work on Help to Buy

equity loan totalling £40,000.

Your solicitor/conveyancer will be able to provide more illustrations when they

advise you on your purchase.

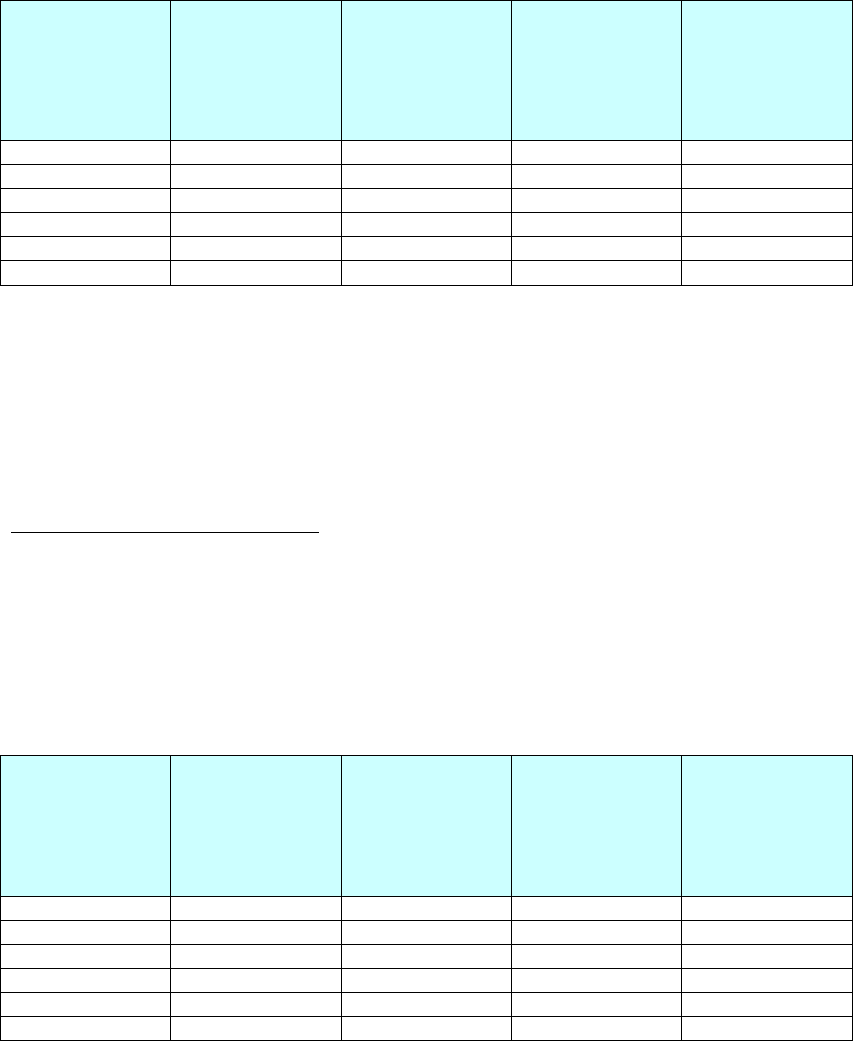

Illustration 4a

Start

of year

Help to Buy

equity loan

assistance

Estimated

RPI %+1

Interest Fee

percentage

Annual interest

fee and

management

fee due

Estimated monthly

payment (interest

fee and

management fee)

1

£40,000

6%

0%

£12

£1

2

£40,000

6%

0%

£12

£1

3

£40,000

6%

0%

£12

£1

4

£40,000

6%

0%

£12

£1

5

£40,000

6%

0%

£12

£1

6

£40,000

6%

1.75%

£712

£59

7

£40,000

6%

1.86%

£756

£63

8

£40,000

6%

1.97%

£800

£67

9

£40,000

6%

2.08%

£844

£70

10

£40,000

6%

2.21%

£896

£75

Page 21 of 29

February 2018

OFFICIAL

At the start of year six, after five years of ownership, the Help to Buy owner in

this example above has to pay a total monthly interest and management fee

of £59. At the start of year seven, after six years of ownership, the monthly

interest and management fee will have risen to £63.

London Help to Buy example

The example below shows how interest fees are calculated. A monthly

management fee of £1 is paid from when you first purchase. The interest fee

payment is not made for the first five years. After this date a monthly fee will

be payable and the table below illustrates how this would work on Help to Buy

equity loan totalling£160,000.

Your solicitor/conveyancer will be able to provide more illustrations when they

advise you on your purchase.

Illustration 4b

Start

of year

London

Help to Buy

equity loan

assistance

Estimated

RPI %+1

Interest Fee

percentage

Annual interest

fee and

management

fee due

Estimated monthly

payment (interest

fee and

management fee)

1

£160,000

6%

0%

£12

£1

2

£160,000

6%

0%

£12

£1

3

£160,000

6%

0%

£12

£1

4

£160,000

6%

0%

£12

£1

5

£160,000

6%

0%

£12

£1

6

£160,000

6%

1.75%

£2,812

£234

7

£160,000

6%

1.86%

£2,988

£249

8

£160,000

6%

1.97%

£3,164

£264

9

£160,000

6%

2.08%

£3,340

£278

10

£160,000

6%

2.21%

£3,548

£296

At the start of year six, after five years of ownership, the London Help to Buy

owner in this example has to pay a monthly fee of £234. At the start of year

seven, after six years of ownership, the monthly fee will have risen to £249.

The interest fee structure is intended to encourage you to staircase and move

to full ownership. The introduction of interest fees after five years also takes

into account that you benefit from living in your own home, made possible by

Homes England contributing part of the purchase price until your property is

sold.

The interest fee is not introduced until the start of year six, which means that

you have a five year period of low management fees (£1 per month) at a time

when many buyers are usually the most financially stretched.

The future rate of inflation cannot be predicted but you should assume your

interest fees will always rise. The examples shown above in illustrations 4a

and 4b assume annual inflation as measured by the RPI is 5% making the

annual fee increase by 6%, from 1.75% to 1.86%, in year seven.

In illustration 4a by the start of year ten, if the same rate of inflation is

maintained, the interest fee would be 2.21% equating to £75 per month based

Page 22 of 29

February 2018

OFFICIAL

on the original equity loan totalling £40,000. The London Help to Buy

example in illustration 4b shows at the start of year ten the interest fee would

equate to £296 per month based on the original equity loan of £160,000.

Your annual interest fee will always increase by a minimum of 1% (from the

fifth anniversary of your Homes England equity loan) even if there is no

increase or there is a decrease in RPI.

Your payment of management and interest fees does not contribute towards

repaying your Help to Buy equity loan. If you staircase or want to make full

repayment of the equity loan, any interest fee arrears must be repaid at the

same time.

Page 23 of 29

February 2018

OFFICIAL

Annual Percentage Rates (APR) for Help to Buy owners

Because you have to pay fees on your Help to Buy equity loan during your

ownership, and you may have to pay more than the original contribution back

to Homes England, the effect will be similar to a loan under which a buyer

pays credit charges at a rate dependent on the growth in house prices

combined with the percentage rates of fees payable.

The previous illustrations demonstrated separately the effects of house price

changes and fees on the costs a buyer would have to pay for 2 examples: A

Help to Buy purchase of a £200,000 market value home and mortgage and

contribution of 80%, and a London Help to Buy purchase of a £400,000

market value home and a mortgage and contribution of 60%.

The combined effect of fees and repayments affects the APR which is the

buyer’s cost of credit.

Using the previous illustrations of standard Help to Buy, after six years of

ownership, if the buyer decides to sell and house prices have grown for

example by 5% every year, the buyer will have to repay £53,604 on their

original equity loan of £40,000.

The owner will have also paid £700 in interest fees on the Help to Buy equity

loan. This means the total amount payable after five years on the Help to Buy

original assistance of £40,000 is £54,304.

Under the illustration of London Help to Buy, after six years of ownership, if

the buyer decides to sell and house prices have grown for example by 5%

every year, the buyer will have to repay £214,415 on their equity loan of

£160,000.

The owner will have also paid £2,800 in fees on the Help to Buy equity loan.

This means the total amount payable after five years on the Help to Buy

original assistance of £160,000 is £217,215.

For this example, this is equal to an APR 5.2% typical. The total amount

repaid is £54,304 or £217,215 under London Help to Buy. You should

remember this is an illustration. House price inflation, the Retail Price Index

and the fees and costs an owner pays could all vary substantially over time.

Your solicitor/conveyancer will be able to provide a further illustration of APR

when they advise you on your purchase.

As house values increase it may be in the Buyers interest to repay

Homes England as their financial position improves and makes this

possible.

Prospective buyers should always seek independent financial advice

before proceeding with their Help to Buy purchase.

Page 24 of 29

February 2018

OFFICIAL

Additional Help to Buy equity loan administration charges

In line with other main mortgage lenders, Homes England’s Mortgage

Administrator will charge Help to Buy owners for loan redemption and other

loan transactions. These charges are set out below. There are no application

or other administration charges when buyers first make their Help to Buy

equity loan purchase. Similarly, there are no early redemption penalties

payable by Help to Buy owners.

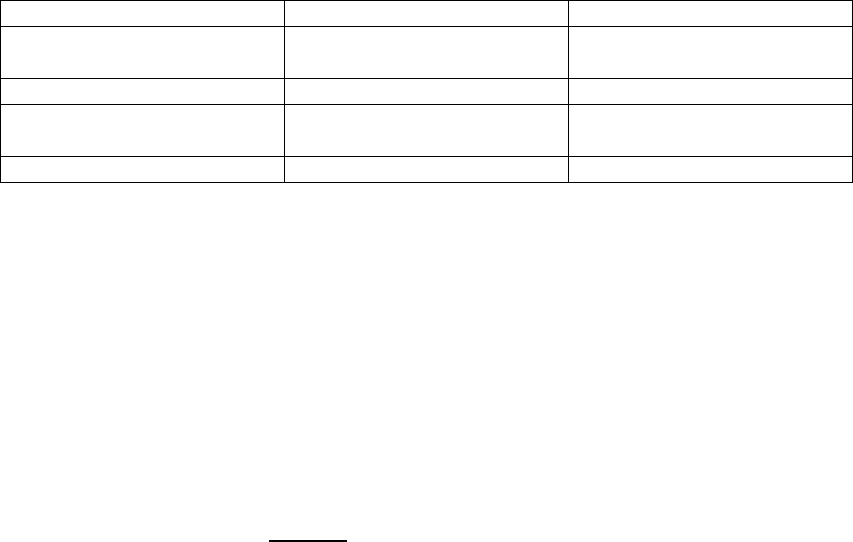

Transaction

Administration charge

payable by borrower

(includes VAT)

Full or partial repayment of the Help to Buy equity loan

(including staircasing)

£200

Remortgaging of the main mortgage

£115

Additional main mortgage borrowing

£115

Changes of names

£50

Subletting or home improvements

£50

Arrears debt recovery charge

£100

Referral of unrecovered arrears to debt recovery agency

Up to £600

You can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Page 25 of 29

February 2018

OFFICIAL

Questions and answers

Q Can I buy a home off plan?

Yes, you are able to reserve a new home off plan at any time. However, you cannot

exchange contracts before six months to legal completion of the sale. You also need

to ensure that your mortgage offer is valid through to legal completion.

Q Will I have to pay Stamp Duty?

The Government’s standard rules and procedures for Stamp Duty Land Tax (SDLT)

apply to all Help to Buy purchases.

SDLT is payable at the time of purchase, on the full purchase price of the home. That

is, the amount paid by you (the first mortgage and any cash contribution) plus the

value of the Help to Buy assistance.

Ther

e is no further SDLT to pay on any ‘staircasing’ repayments or repayment when

the home is sold.

You should budget for SDLT on the full open market price of the property when you

purchase a Help to Buy home.

Q

Can I use a builder’s part exchange scheme?

No, Help to Buy purchasers cannot be used in conjunction with any part exchange

schemes.

Q Who pays for repairs and on-going maintenance to my home?

It is your responsibility to repair and maintain your home. New homes often come

with a guarantee that will cover certain defects for up to 10 years after it was built.

This guarantee usually only covers defects in the house builder’s workmanship. Your

solicitor/conveyancer will be able to advise in more detail on this.

Q

Who provides the contribution for Help to Buy?

The equity loan is provided by Homes England and administrated by your local Help

to Buy agent. The contribution is secured by a second charge on your property title

registered at Land Registry.

Q

How long will it take before I can move in?

Because Help to Buy homes are generally on new developments (and may still be

under construction), in common with most new home sales, you will normally be

expected to arrange a mortgage and exchange contracts within one month of paying

your reservation fee.

Y

our moving in date may depend on the time required to complete construction work,

which will vary from scheme to scheme. Some Help to Buy applicants may need to

wait for a longer period of time for a home that matches very specific needs whereas

others may buy from a development that allows earlier occupation.

Q

What happens if the completion of my home is delayed?

Once you have committed to buy a home (at exchange of contracts) the house

builder will have agreed to build the home and keep you informed of progress.

If you are unhappy about any delays in construction you must speak to the house

builder. Your solicitor/conveyancer will be able to advise on the house builder’s

contractual responsibilities before you agree to the sale.

Page 26 of 29

February 2018

OFFICIAL

You should check with your house builder that the funding will be available on the

date you expect to complete your purchase

Q

Are there any restrictions on the properties that I can purchase?

All Help to Buy homes are on new build developments where Homes England has a

registration agreement with the house builder. You can only purchase from these

house builders. The maximum purchase price is £600,000.

Q I

would like to buy a Help to Buy house but the house builder tells me it is

only available on a leasehold basis. Should I stop my purchase?

It is your decision whether you are content to proceed with your purchase. A lease is

a private legal agreement between you and your landlord or freeholder and sets out

the rights and responsibilities of both parties. Homes England cannot provide legal

advice. We strongly recommend that you seek independent legal advice make

yourself aware of the terms of the lease and the associated costs. The Leasehold

Advisory Service have published guidance on what to look out for at

http://www.lease-advice.org/advice/leasehold-infosheets/

LEASE is a specialist advisory body funded by the Ministry of Housing, Communities

and Local Government to provide assistance to leaseholders. Alternatively, a

telephone appointment can be booked to speak to one of LEASE’s advisers on 020

7832 2500 (9.30am to 3.00pm Monday to Friday); or you can seek advice by e-mail:

info@lease-advice.org

A

s you may be aware, the Government has recently stated that other than in

exceptional circumstances, it cannot see the case for new build houses to be sold on

a leasehold basis and that it intends to bring forward legislation to prohibit the future

development of new build leasehold houses, other than in exceptional

circumstances.

M

ore FAQ on leasehold and Help to Buy is also available here:

https://www.gov.uk/government/publications/leasehold-reform-and-help-to-buy-

equity-loan

Q

Can I sublet my Help to Buy home?

No. Help to Buy is designed to assist you to move on to or up the housing ladder. If

you wish to sublet, you will first have to repay the Help to Buy equity loan assistance.

In exceptional circumstances (e.g. a serving member of the Armed Forces staff

whose tour of duty requires them to serve away from the area in which they live for a

fixed period, then sub-letting is allowed. In these circumstances you would also

require approval from your mortgage lender and Homes England’s Mortgage

Administrator). You can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Q

Can I own other homes and buy a Help to Buy home?

No. Help to Buy is designed to assist you to move up the housing ladder and must

be your only residence. This means you will be expected to sell your current home

(in the UK or abroad) if moving up the ladder. The disposal of your current home will

be verified by your solicitor/conveyancer before you can proceed to exchange

contracts on the Help to Buy Home.

In addition you cannot be linked to another property financially. For the avoidance of

doubt, married couples own assets jointly and therefore if one owns a property the

other is directly linked to the asset and treated as a home owner also.

Page 27 of 29

February 2018

OFFICIAL

Q Can I own a Help to Buy home and buy a second home?

No. Help to Buy is designed to assist you to move up the housing ladder. If you can

afford to purchase another home you will have to repay the Help to Buy equity loan.

Married couples also standardly by law own each other’s assets; therefore all assets

in a single name are treated as jointly owned in this scenario.

Q W

hat are the key differences between the Help to Buy equity loan offered

across England and the one offered in London?

The Autumn Statement in November 2015 announced an increase in the London

Help to Buy equity loan from 20% to 40%. The eligibility and requirements for the

programme otherwise have remained the same. The table below details the extent of

the changes.

Feature

Help to Buy

London Help to Buy

Maximum equity loan

available

20% of purchase price

40% of purchase price

Buyers cash deposit

5% of purchase price

5% of purchase price

Minimum mortgage

required

25% of purchase price

25% of purchase price

Maximum purchase price

£600,000

£600,000

The property purchased must be your only residence. Help to Buy is

not available to assist buy-to-let investors or those who will own any

property other than their Help to Buy property after completing their

purchase.

You cannot rent out your existing home and buy a second home

through Help to Buy.

Applicants who make fraudulent claims for Help to Buy assistance may

be liable to criminal prosecution.

Fraudulent claims will always require immediate repayment of the equity

loan assistance.

Q

Can I use cash from my council, Housing Association or other public sector

body to buy with the addition of help through Help to Buy?

Provided that your local council is satisfied that this represents value-for-money and

the other funding is compatible with Help to Buy. Funding provided which must be

secured against your home would not be compatible with the Help to Buy scheme.

Assistance from Local Authority Clearance Payments are not permitted through Help

to Buy.

Q

After purchasing my home, can I increase my mortgage or take out another

loan?

Not without permission from Homes England’s Mortgage Administrator. Further

advances must be approved by Homes England’s Mortgage Administrator.

A

dvances to be used for staircasing or repaying the equity loans will usually be

welcomed and approved. Advances for other purposes will be considered by Homes

England’s Mortgage Administrator on a case by case basis (see question below

regarding extending or altering the property).

Page 28 of 29

February 2018

OFFICIAL

You can transfer your mortgage to another qualifying lending institution (see page

19), following prior permission from Homes England’s Mortgage Administrator.

However, you must ensure your new lender is informed that your home is a Help to

Buy property with a second charge entitling Homes England to a share of the future

sale proceeds.

H

omes England’s Mortgage Administrator may decline permission for further

advances or transfer to another lender if after assessment they consider you may be

putting yourself in an unsustainable financial position.

Y

ou can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Q

Can I extend or alter the property?

Not without permission. Because Help to Buy is designed to help people move up

the housing ladder, you should consider repaying part or all of Homes England’s

contribution before making plans for improvements or alterations. This is because

Homes England is seeking to help future aspiring buyers and may use the proceeds

of these repayments to make more assistance available. Therefore, consent will not

usually be granted for significant home improvements. Homes England’s Mortgage

Administrator will act reasonably in considering any application and will review cases

of hardship if, for example, property modifications are required for a disability.

When your property is sold in the future, if improvements have been made with the

approval of Homes England’s Mortgage Administrator, these will be ignored when

your property is valued to work out how much should be repaid to Homes England.

Y

ou can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Q

After five years of ownership how is the fee collected?

Fees can be paid in a single yearly payment or in monthly instalments. The monthly

management fee (£1) is always paid monthly by direct debit.

H

omes England’s Mortgage Administrator will collect your fees and interest by direct

debit. They will contact you at least a month before your fees are due, to set up (if

not already done so) your repayment arrangement.

Y

ou will also receive a statement each year confirming when your fees are payable.

The annual statement will also show any payments you have made once you start

paying the fee.

Y

ou can find out more about the Mortgage Administrator here:

https://www.myfirsthome.org.uk/

Q

What if I die after purchasing a Help to Buy home?

This depends on whether you bought your home alone or with others.

If you bought the house/flat on your own and you die, the home will be passed on in

the normal way under the terms of your will and the payments explained in this guide

will be made by your estate in accordance with the scheme. If you have not made a

will it will pass under the laws of intestacy.

I

t is recommended that a sole buyer seeks independent legal advice about this.

If you bought your home with others and one of them dies, their interest in the

property will either be transferred to the surviving co-owner (s) or will pass under the

terms of their will, or (if there is no will) the laws of intestacy.

It is recommended where there are two or more owners, that they seek independent

legal advice about this.

Q Can owner names be added or changed on the Help to Buy property?

The policy for post sales transactions can be found on the mortgage administrators

website after the point of sale. Policy can change due to regulatory decsions linked

to second charge loans. It is crucial tht you check with the mortgage administrator

regarding any post completion requirments prior to starting any processes. Currently

at the time of publication owners can be removed from equity mortgage but new

names xannot be added this is due to this being classed as a new lending decision.

Q Can I get help with benefits to pay the Help to Buy fees and interest if, for

example, I lose my job?

Because Help to Buy fees and interest are not classified as rent, they do not qualify

for Housing Benefit. You should make sure you have made arrangements to ensure

you can continue to make you Help to Buy payments if your income falls. You should

seek independent financial advice about this before purchasing a Help to Buy home.

Q What happens if my partner moves out and no longer wants to be party to

the equity loan agreement?

Homes England’s Mortgage Administrator will be able to arrange for a ‘Deed of

Release’ which will release your partner from the obligation of having to repay the

equity loan. Assuming that your first charge mortgage lender is content for this to

take place and that you are able to provide evidence that you can meet your housing

costs and still have a reasonable standard of living, permission should be a formality.

As previously stated this is the policy at the time of publication, regulations can

change and it is important to check with the mortgage administrator regarding any

post completion requirements.

Q Who is the Mortgage Administrator?

The Mortgage Administrator is the agent appointed by Homes England to provide

post-sales services in relation to your Help to Buy equity loan (such as collection of

fees, processing of requests for redemptions, etc.) after you have purchased your

home. The Mortgage Administrator is also referred to as the ‘Post Sales Agent’.

Contact details for the Mortgage Administrator and a summary of its services will be

provided to you after completion. You can find out more about the Mortgage

Administrator here:

https://www.myfirsthome.org.uk/

For all enquires relating to the reservation and purchase of a property with Help to

Buy equity loan up to the point of sale completion, you should contact your Local

Help to Buy Agent.

Find your Local Help to Buy Agent

To find out the nearest location of Help to Buy homes in your area, you should

contact your Local Help to Buy Agent.

Go to http://www.helptobuy.gov.uk/equity-loan/find-helptobuy-agent to locate

them on the map. All contact details can be found on the website.

Page 29 of 29

February 2018

OFFICIAL