HOW TO SERIES

1

HOW TO SERIES

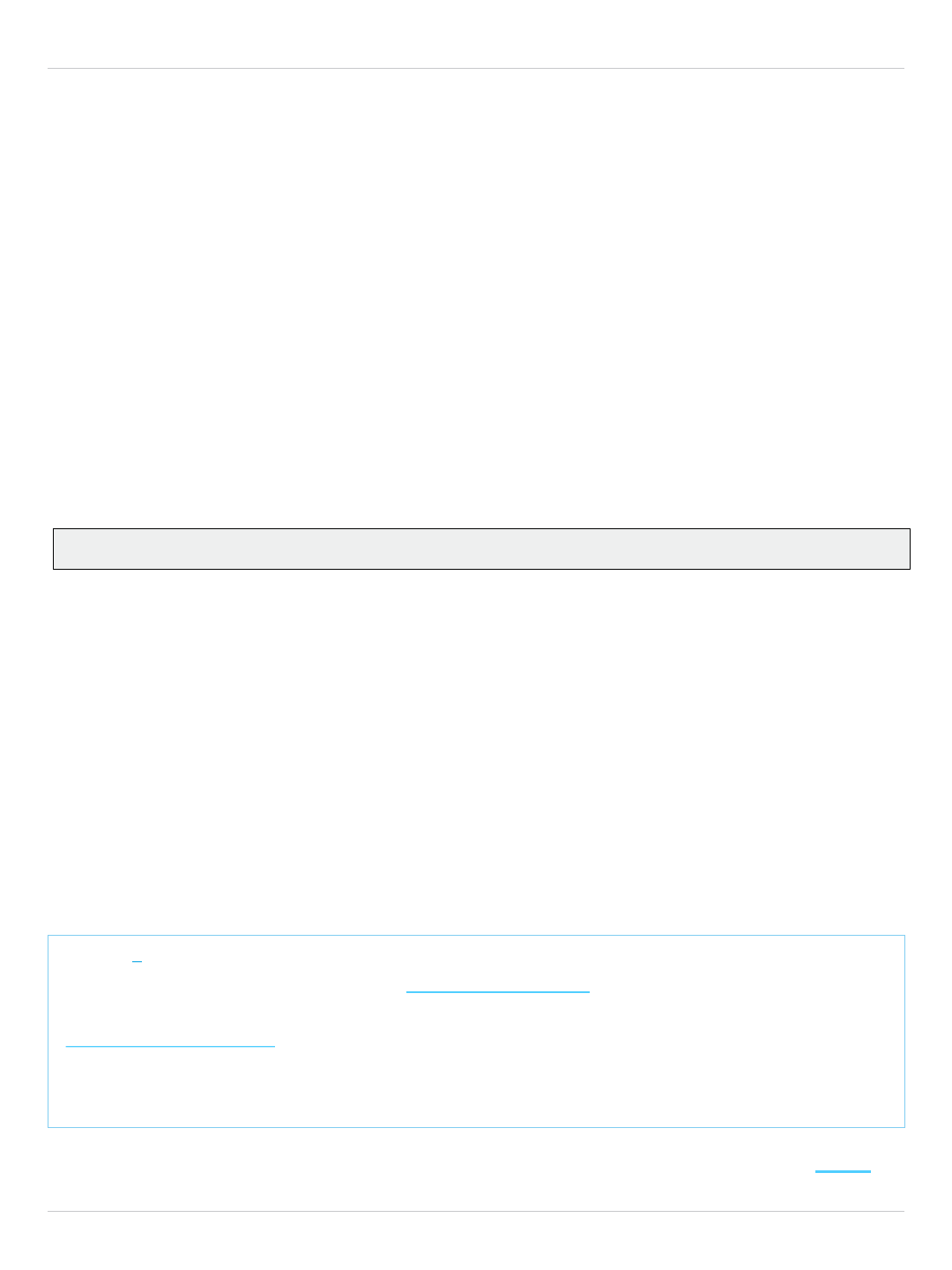

You may transfer or gift Amazon shares from your stock plan account to another account in your name, or to a

third party (individual, charity, trust, etc.). The process depends on the value of your share transfer, and the

location and type of the receiving account. For estate account questions, please contact the Morgan Stanley

Service center. See contact information on page 3

below.

Value

of transfer Transferring to Step

1 Step 2

Less than or

equal to

US$100,000*

An account in your name

or a third-

party’s name in

the U.S. or Canada

You may instruct the transfer by

phone. Go to page 3

below to

find the direct dial phone

numbers for your location.

Call the Morgan Stanley

Service Center agent to begin

the process. No paperwork is

required. Please be prepared to

provide the firm name, DTC

number, Account Number,

account title and contact

information if outside the U.S.

An account in your name

or a third party’s name

outside the U.S. or

Canada

You may instruct the transfer by

phone. Go to page 3

below to

find the direct dial phone

numbers for your location.

A transfer agent Complete Morgan Stanley’s

Global Stock Plan Services

Letter of Authorization for Direct

Registration System (DRS)

Transfe

r.

Follow all submission

instructions on the form

and see page 2

below.

Please note, if the account is in

the name of a third party or in a

name that differs from your

Morgan Stanley account,

government issued ID will be

required. For joint accounts, ID

will be required for both

owners. See submission

instructions on the form or

page

2

below for more information.

Greater than

US$100,000

An account in your name

name or a third party’s

name in the U.S. or

Canada

Complete Morgan Stanley’s

Letter of Authorization for Stock

Transfer (US & Canada)

Follow all submission

instructions on the form and

see page 2

below.

Please note, if the account is in

the name of a third party or in a

name that differs from your

Morgan Stanley account,

government issued ID will be

required. For joint accounts, ID

will be required for both

owners. See submission

instructions on form or page 2

below for more information.

An account in your name

or a third-party’s name

outside the U.S. and

Canada

Complete Morgan Stanley’s

Letter of Authorization for Stock

Transfer for Non-U.S./Non-

Canadian Financial Institutions

A transfer agent Complete Morgan Stanley’s

Global Stock Plan Services

Letter of Authorization for Direct

Registration System (DRS)

Transfe

r.

How to Transfer Amazon Shares

Out of Your Morgan Stanley Stock

Plan Account

* Note: If your goal is to transfer out over

US$100,000 in stock value, you will not be able

to break up the transfers into multiple under

$100k requests and instead you must follow

instructions for Greater than US$100K.

2

HOW TO SERIES

HOW TO TRANSFER AMAZON SHARES OUT OF YOUR MORGAN STANLEY

AT WORK STOCK PLAN ACCOUNT

If you are required to submit a completed Letter of Authorization, you have two options:

Option 1 - Mail or fax the completed form to:

Morgan Stanley / Global Stock Plan Services

P.O. Box 182616

Columbus, OH 43218-2616

Fax: +1 614-467-4471

Once the form is received and reviewed, Morgan Stanley will call you to verbally verify your voice to

prevent fraud.

Option 2 - Call the Morgan Stanley Service Center to request the Letter of Authorization form be sent to you

via Secure Email. You will then return your completed form via Secure Email.

It is important to note that transfers of any value to a transfer agent as well as all third-party transfers over

$100,000 will require you to provide a clear copy of both sides of your government issued identification

document, including signature. It is recommended that you enlarge the copy to ensure readability.

Be aware that if the signature on your Letter of Authorization for Stock Transfer form does not match

your government issued identification, your request cannot be processed.

If you are concerned about your signature matching, consider one of the following options:

1. Provide alternate identification such as a government issued passport,

2. Have the Letter of Authorization notarized; or,

3. Request the receiving account broker dealer to provide a Medallion Signature Guarantee stamp on the

Letter of Authorization for Stock Transfer form.

Special considerations for third-party transfers:

Transfers or Gifting of Shares to a Third Party, Donor-Advised Fund, or Charity, are Subject to

Amazon’s Insider Trading Policy

Amazon’s plan rules require that you contact Amazon’s Legal Department at

stockpolicy@amazon.com

to make a gift of Amazon securities and are subject to the trading window

or preclearance. If you are subject to the trading window, you may only make gifts of Amazon

securities during the trading window unless you can make certain legal representations concerning

the gifted shares.

If you have questions, contact a Morgan Stanley Service Center agent at the phone numbers on page 3

of

this document.

PLEASE NOTE: Processing times on all transfer types can vary. For an estimated date of transfer, please

request this during your call or during call-back verification from Morgan Stanley Service Center if transfer

form was submitted to an agent and be sure to submit your request well in advance of the date you need

the transfer completed. For faster processing, please complete the forms electronically.

3

HOW TO SERIES

For assistance, please call the Morgan Stanley Service Center

Need Help?

For Canada, Mexico, United States:

(Toll-Free) +1-866-533-2575

Hours: 8 A.M. to 8:00 P.M. ET (Eastern Time)

All Other Countries (or if unable to connect):

Hours: 24 hours a day; Monday - Friday

Visit

AT&T Direct Toll-Free Access Codes website and dial

the appropriate Access Code for your country, then 833-500-0341.

Staffed languages:

French (during EMEA business hours), Cantonese, Japanese, Mandarin

(during Asia Pacific business hours) plus translation available in 200+

languages through Language Line Solutions.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley

Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients

should consult their tax advisor for matters involving taxation and tax planning and their

attorney for legal matters.

©2023 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC 5792478 (07/23)