University of California

Business Travel Benefits

Summary

2024-2025

Policy

Number:

N04223810

June 1, 2024

1

Effective 6.1.2024

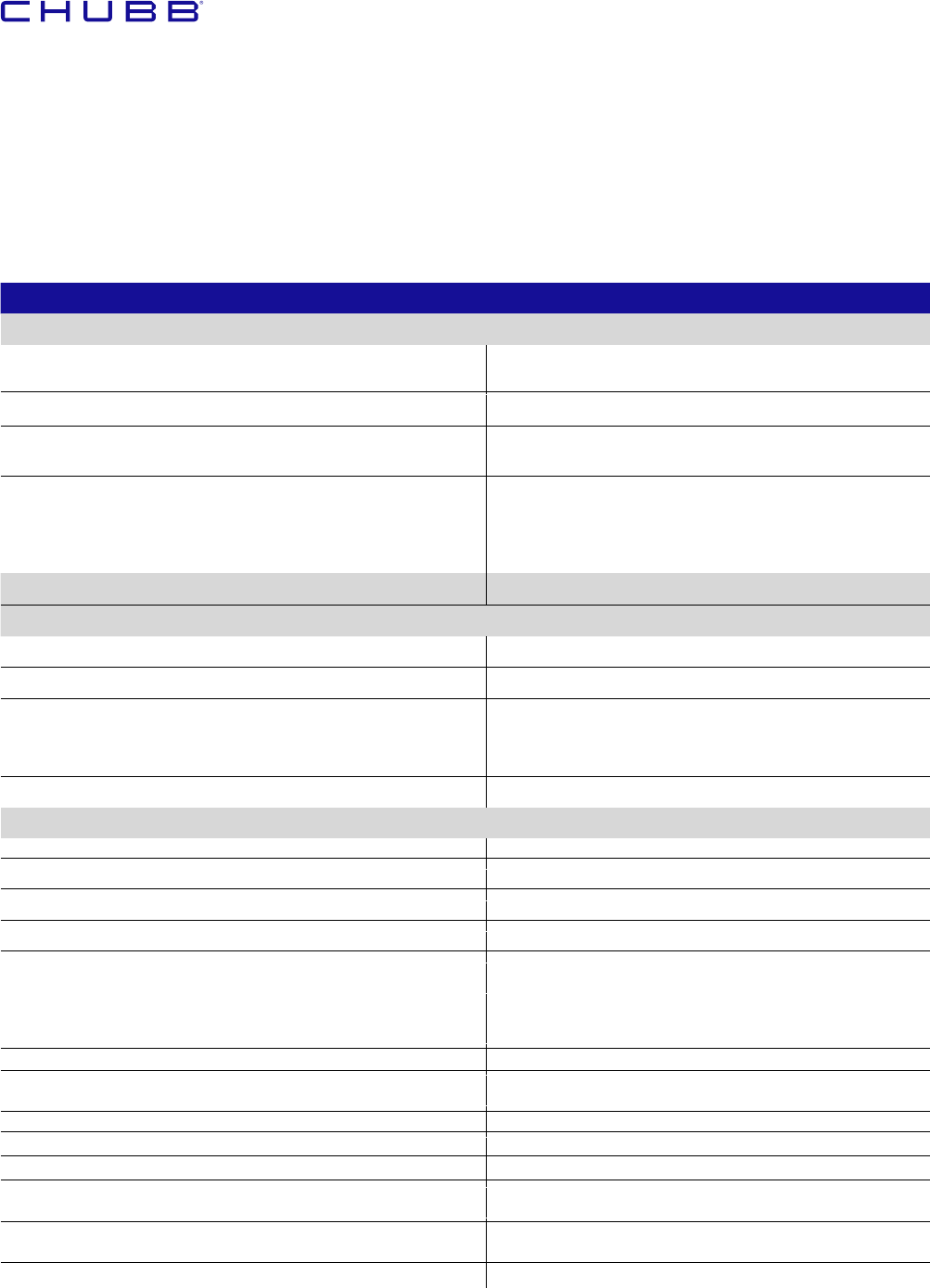

Benefit Description Benefit Amount

Accidental Death & Dismemberment

Regents/Regents Designates; Associ

ates of President/

Chancellor (UC Policy Guidelines) P

rofessors Emeritus

$250,000

Employees The lesser of ten (10) times basic annual salary or $500,000

Adul

t Traveling Companions* — includes spouses/domestic

partners

$100,000

Traveling Compani

ons* under the age of 26 (includes children)

* “Traveling Com

panion” means a person or persons with whom

the insured has coordinated travel arrangements and intends to

travel with during the business trip.

$25,000

Aggregate Limit/per Aircraft Accident $5,000,000

Covered Losses (% of benefit amount)

Life, Two or More Members 100%

Quadriplegia 100%

One Member*, Paraplegia or Hemiplegia

* “Member” means loss of hand or foot, loss of sight of

one eye, loss of speec

h or loss of hearing.

50%

Thumb and Index Finger of the Same Hand, Uniplegia 25%

Other Provisions

Bereavement and Trauma Benefit $300 per session, maximum 10 sessions

Burial and Cremation Benefit $10,000

Carjacking Benefit 10% of the Prin

cipal Sum up to a maximum of $50,000

Coma Benefit 10% of the Principal Sum per month for 11 months

Home Alteration and Vehicle Modification Ben

efit 100% of Principal Sum up to a maximum of $25,000

Permanent Total Disability (PTD)

PT

D waiting period 365 days;

benefit amou

nt 100% of Principal sum; lump sum payment

Rehabilitation Benefit 10% of the Principal Sum up to a maximum of $25,000

Seat Belt (accidental death and dismemberment) 10% of benefit up to $

50,000

Air Bag (if seat belt worn) $10,000

Emergency Medical Evacuation

(When business traveler 100+ miles from home or office)

100% of usual and customary charges (Expenses incurred for

search and rescue missions are not covered.)

Repatriation of Remains

(When business traveler 100+ miles from home or office)

100% of usual and customary charges

Travel Assistance Services

Services include pre-trip assistance, arrangements for

emergency medical care and emergency medical evacuation and

repatriation of remains

Emergency Reunion Benefit

$5,000 per person per trip (Maximum 2 people), if the covered

person is hospital confined for at least 24 consecutive hours due to

a covered Injury (for covered domestic trip)/covered Injury or

Sickness (for covered international trip) or is the victim of a

Felonious Assault

2

Effective 6.1.2022

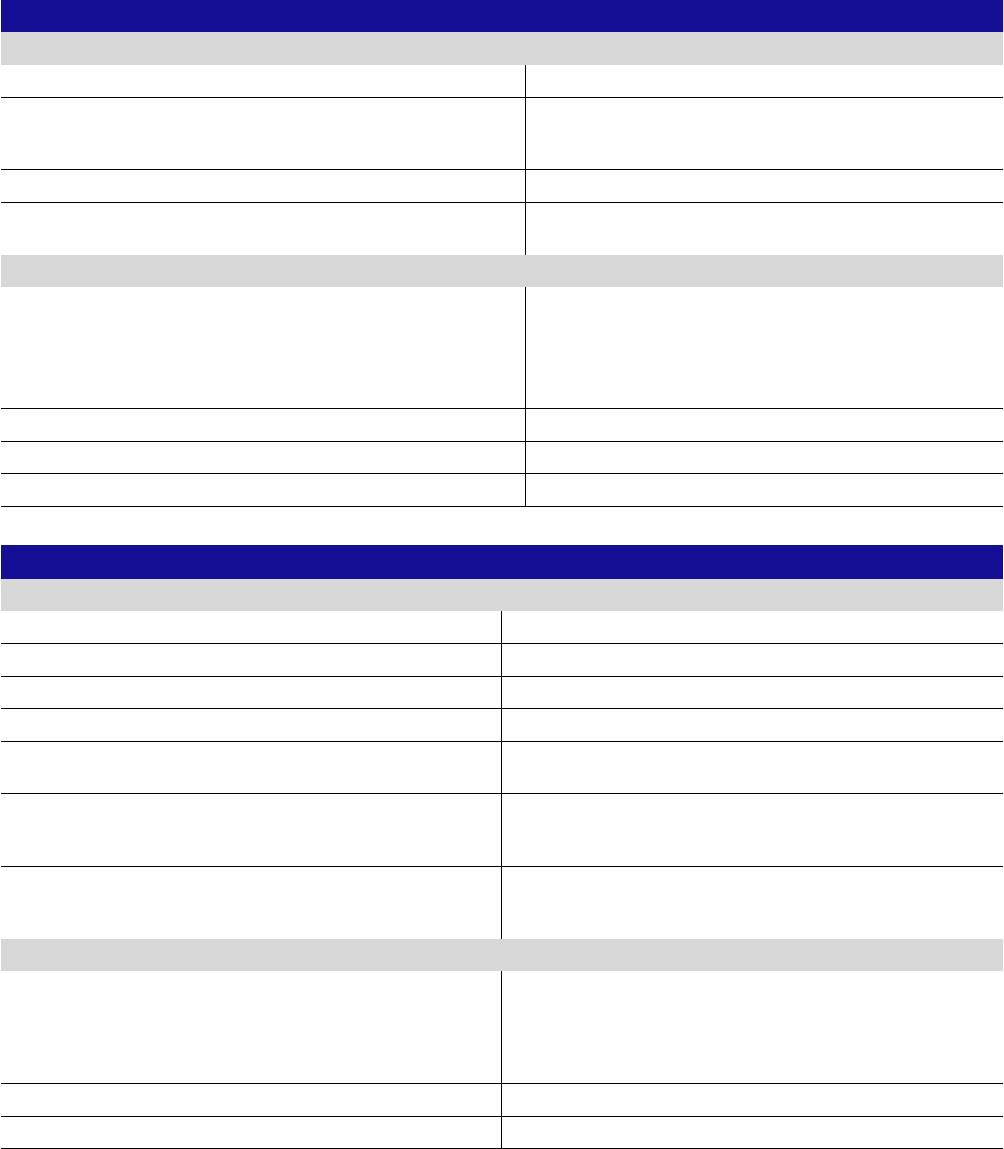

The Following Benefits are Only Applicable While Traveling Outside the U.S. or Your Home Country

Out of Country Medical Expense Benefit

Benefit Maximum $500,000

Deductible $0

Co-insurance 100% of usual and customary charges

Dental Treatment (Injury or Alleviatio

n of Pain) $1,000

Security Extraction (non-medical)

100% of covered expenses, $100,000 maximum

$2,000,000 aggregat

e limit

Return of Baggage and Personal Property (Applicable to a

covered Emerg

ency Medical Evacuation, Repatriation or

Security Evacuation.)

Up to $3,000 per Trip

Mental & Nervous Disorders: expenses for treatment of a

disorder, while hospital confined or on an outpatient basis,

limited to one treatment per day.

Inpatient: Treated as any other medical condition,

up to the medical maximum

Outpatient: 10 sessions maximum

Personal Property – Lost or stolen

Personal Property-which means personal goods belonging

to the Co

vered Person or for which the Covered Person is

responsible and are taken on a business Trip or acquired during

the Trip.

Up to $5,000 per trip ($2,500 maximum per item),

subject to a $25 deductible and depreciation

Depreciation is a reduction in the value of the item due to physical

deterioration/wear and tear, or due to the item being obsolete,

outdated in technology, etc.

Quarantine Benefit, if required by local government or doct

or Up to $2,000, for a period of no more than 14 days

Emergency Hotel Convalescence $100 per day subject to a maximum of $700

Benefit Description Benefit Amount

Travel Inconvenienc

e Benefits

Baggage Delay Benefit Maximum: $500 per Trip; Time Period: 6

hours

Lost Baggage

Deductible per Trip: $25; Benefit Maximum per Trip: $2,000;

Benefit Maximum per Item or Set of Items: $1,000 subject to

a Maximum of 2 bags

Trip Cancellation and Interruption

†

Benefit Maximum: $2,000

Trip Delay

‡

Benefit Maximum: $2,000; Time Period: 6 hours;

Daily Benefit Limit: $200; Maximum Benefit Period: 10 days

Covered Hazards

UC-Authorized Business Trip, less than 365 consecutive days

(Includes specified activities, such as hazardous spills clean up or

UC Police Department Bomb Unit)

Includes a total of up to 14 days Personal Deviation before

or after the Covered Trip

“Personal Deviation” means: 1) an activity that is not

reasonably related to the University of California’s activities;

and 2) not included in the purpose of the trip.

War Risk Covered

UC-qualified Pilo

ts, Crew or Passengers Covered

Commuting (Regents only) Included up to 2 hours

† Trip Cancellation or Interruption Covered Reasons:

a. Sickness, Injury, or death of a Covered Person or Family Member/or Traveling Companion. Injury or Sickness must be so disabling

as to reasonably cause a Trip to be delayed, canceled, or interrupted. If the Covered Person must cancel or interrupt the Trip due

to Injury or Sickness of a Family Member, it must be because their condition is life threatening, or because the Family Member

requires the Covered Person’s care. Cancellation due to the death of a Family Member or Traveling Companion is covered only

if the death occurs within 30 days of the Covered Person’s Scheduled Departure Date.

b. weather conditions or Natural Disasters causing delay, cancellation or interruption of travel.

c. the Covered Person’s Home/primary residence or Destination being made uninhabitable by fire, flood, vandalism, burglary or

Natural Disaster.

d. the Covered Person or a Traveling Companion/Family Member being subpoenaed, required to serve on jury duty; being hijacked

or being required by a court order to appear as a witness in a legal action, provided the Covered Person, a Family Member

traveling with the Covered Person, or a Traveling Companion is not: 1) a party to the legal action, or 2) appearing as a law

enforcement officer.

e. being directly involved in or delayed due to a traffic accident en route to departure.

f. being called into active military service to provide aid or relief in the event of a Natural Disaster.

g. The Covered Person or a Traveling Companion being the victim of a Felonious Assault within 10 days prior to departure.

h. Strike resulting in the complete cessation of travel services.

i. a Terrorist Incident in a foreign City in which the Covered Person was scheduled to arrive within 45 days following the incident.

j. an employer-initiated transfer of employment within the same organization of 250 miles or more.

k. cancellation of scheduled public transportation as a result of: riot, civil commotion, Strikes, Natural Disasters, motor or railway

accidents that were unknown at the time of booking the reservation.

Covered Expenses for Trip Cancellation:

1. any cancellation charges imposed by a travel agency, tour operator, or other recognized travel supplier for the Covered Trip;

2. any prepaid, unused, non-refundable airfare and sea or land accommodations;

3. any other reasonable additional Trip expenses for travel, lodging, or scheduled events that are prepaid, unused,

and non- refundable.

“Terrorism”

means:

1. An act of violence directed against American interests and determined by United States officials to be a terrorist act. The terrorist

act must occur within any country of destination and after the Covered Person’s enrollment form and premium are received for

the Trip Cancellation coverage and within 45 days of the date the Covered Person is originally ticketed to travel; or

2. An act of violence directed at or occurring in an aircraft traveling or scheduled to travel where the Covered Person is ticketed to

travel, that is determined by United States officials to be a terrorist act. The terrorist act must occur after the enrollment form

and premium received for the Covered Person’s Trip Cancellation coverage and within 45 days of the date the Covered Person is

ticketed to travel; or Premium are received for the Covered Person’s Trip Cancellation coverage and within 45 days of the date the

Covered Person is ticketed to travel; or

3. The issuance of a Level 4 Travel Advisory (T) by the United States Department of State to avoid a country of Destination which the

Covered Person is ticketed to travel. As used by the State Department, “T” means Terrorism: terrorist attacks have occurred and/

or specified threats against civilians, groups, or other targets may exist. The Level 4 Travel Advisory (T) must be issued after the

enrollment form and premium are received for the Covered Person’s Trip Cancellation coverage and within 45 days of the date

the Covered Person is ticketed to travel.

This coverage do

es not cover loss caused by:

a. carrier caused delays, including an announced, organized, sanctioned union labor Strike that affects public transportation, unless

the Policy effective date is prior to when the Strike is foreseeable. A Strike is foreseeable on the date labor union members vote to

approve a Strike;

b. travel arrangements canceled or changed by an airline, cruise line, or Tour operator, unless the cancellation is the result of bad

weather or Financial Default, as defined;

c. changes in plans by the Covered Person, a Family Member, or Traveling Companion, for any reason;

d. financial circumstances of the Covered Person, a Family Member, or a Traveling Companion;

3

Effective 6.1.2022

e. any business or contractual obligations of the Covered Person, a Family Member, or a Traveling Companion, except for

termination or layoff of employment as defined above;

f. Default by the person, agency, or Tour operator from whom the Covered Person bought his or her coverage or purchased his or

her travel arrangements;

g. any government regulation or prohibition;

h. an event or circumstance which occurs prior to the effective date of coverage;

i. personal reasons;

j. weather. or,

k. Default caused by Financial Insolvency of the Travel Supplier, or Travel Arranger, from whom the Covered Person bought his or

her coverage or purchased his or her travel arrangements, unless due to Financial Insolvency.

‡ Trip Delay Cov

ered Reasons (in addition to the covered reasons listed under the Trip Cancellation):

a. Injury, Sickness or death to either the Covered Person, Family Member or traveling companion that occurs during the Trip;

b. carrier delay;

c. lost or stolen passport, travel documents or money;

d. Natural Disaster;

e. the Covered Person being delayed by a traffic accident while en route to a departure;

f. hijacking;

g. unpublished or unannounced strike;

h. civil disorder or commotion;

i. riot;

j. inclement weather which prohibits Common Carrier departure;

k. a Common Carrier strike or other job action;

l. equipment failure of a Common Carrier; or

m. the loss of the Covered Person’s and/or traveling companion’s travel documents, tickets or money due to theft.

The Covered Person’s Duties in the Event of Loss: The Covered Person must provide Us with proof of the Travel Delay such as a

letter from the airline, cruise line, or Tour operator/ newspaper weather report/ police report or the like and proof of the expenses

claimed as a result of Delay.

No benefits will be paid for any loss or Injury that is caused by, or results from:

• intentionally self-inflicted injury; suicide or attempted suicide (applicable to Accidental Death and Dismemberment only).

• war or any act of war, whether declared or not. (This exclusion does not apply to UC Business Travel Policy, except within the

United States or the Covered Persons home country or country of permanent assignment, Afghanistan, Belarus, Gaza, Israel,

Lebanon, Russia, Ukraine, West Bank, and Yemen).

• a Covered Accident that occurs while on active duty service in the military, naval or air force of any country or international

organization. Upon Our receipt of proof of service, We will refund any premium paid for this time. Reserve or National Guard

active duty training is not excluded unless it extends beyond 31 days.

• sickness, disease, bodily or mental infirmity, bacterial or viral infection, or medical or surgical treatment thereof, except for

any bacterial infection resulting from an accidental external cut or wound or accidental ingestion of contaminated food

(applicable to accident benefits only).

• piloting or serving as a crewmember in any aircraft (except as provided by the policy).

• commission of, or attempt to commit, a felony.

In addition, no benefits will be paid for any loss, treatment, or services resulting from or contributed to by:

• Routine physicals.

• Routine dental care and treatment.

• Cosmetic surgery, except for reconstructive surgery needed as the result of an Injury.

• Mental and nervous disorders (except as provided by the policy).

• Pregnancy or childbirth. This does not apply if treatment is required as a result of a Medical Emergency.

• Routine nursery care.

What’s not covered?

4

Effective 6.1.2022

• Eye refractions or eye examinations for the purpose of prescribing corrective lenses or for the fitting thereof; eyeglasses,

contact lenses, and hearing aids.

• Services, supplies, or treatment including any period of Hospital confinement which is not recommended, approved, and certified

as medically necessary and reasonable by a Doctor, or expenses which are non-medical in nature.

• Treatment or service provided by a private duty nurse.

• Treatment by any Immediate Family Member or member of the Insured’s household.

Lost Baggage and Personal Property Benefits will not be paid for:

• more than $1,000 for Lost Baggage and $2,500 for Personal Property with respect to any one article or set of articles;

• vehicles (including aircraft and other conveyances) or their accessories or equipment, unless the equipment is directly

• related to the business of the Policyholder or the Covered Person’s study program;

• loss or damage due to:

– moth, vermin, insects or other animals;

– wear and tear; atmospheric or climatic conditions or gradual deterioration or defective materials or craftsmanship;

– mechanical or electrical failure;

– any process of cleaning, restoring, repairing or alteration;

• more than a reasonable proportion of the total value of the set where the loss or damaged article is part of a set or pair;

• devaluation of currency or shortages due to errors or omissions during monetary transactions;

• more than $500 with resp

ect to cash;

• any loss not reported to either the police or transport carrier within 24 hours of discovery;

• any loss due to confiscation or detention by customs or any other authority; or

• any loss or damage directly or indirectly caused by declared or undeclared war or any act thereof.

If we determine the benefits paid under the Benefit are eligible benefits under any other benefit plan, we may seek to recover any

expenses covered by another plan to the extent that the Insured is eligible for reimbursement.

We, Our, Us means ACE American Insurance Company that underwrites this insurance or it authorized agent.

The Benefits Summary Includes Certain Insurance Provisions; Insurance Contracts Govern.

Insured by ACE American Insurance Company.

Important Note

The policy provides travel insurance benefits for employees traveling outside of their Home Country. The policy does not constitute

comprehensive health insurance coverage (often referred to as “major medical coverage”) and does not satisfy a person’s individual obligation

to secure the requirement of minimum essential coverage under the Affordable Care Act (ACA). For more information about the ACA,

please refer to www.HealthCare.gov and Covered California www.coveredca.com.

This information is a brief description of the important features of the insurance plan underwritten by ACE American Insurance Company. It is not a contract of insurance

and may be subject to change based on the underwriting requirements of the company. Coverage may not be available in all states or certain terms may be different where

required by state law.

Chubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit our

website at www.chubb.com. Insurance provided by ACE American Insurance Company and its U.S.-based Chubb underwriting company affiliates. All products may not be

available in all states. This communication contains product summaries only. Coverage is subject to the language of the policies as actually issued. Chubb, 202 Hall’s Mill

Road, Whitehouse Station, NJ 08889-1600.

06/2024

5

Effective 6.1.2022