University of California – Policy G-28

1 of 53

Travel Regulations

Contact:

John Barrett

Title:

Tax Manager

Email:

John.Barrett@ucop.edu

Phone:

(510) 987-0903

TABLE OF CONTENTS

I. POLICY SUMMARY ............................................................................................... 2

II. DEFINITIONS ......................................................................................................... 2

III. POLICY TEXT ......................................................................................................... 3

IV. COMPLIANCE/RESPONSIBILITIES ...................................................................... 6

V. PROCEDURES ....................................................................................................... 8

VI. RELATED INFORMATION ................................................................................... 42

VII. FREQUENTLY ASKED QUESTIONS .................................................................. 44

VIII. REVISION HISTORY ............................................................................................ 47

IX. APPENDIX ............................................................................................................ 48

Responsible Officer:

EVP - Chief Financial Officer

Responsible Office:

FA - Financial Accounting

Issuance Date:

7/15/2019

Effective Date:

7/1/2019

Last Review Date:

1/31/2019

Scope:

• Staff and academic employees of the University.

• Non-employees, including students, visiting scholars,

prospective employees and independent contractors.

• This policy does not apply to travel associated with

work done within the scope of the UC/DOE contract

for the management and operations of the Lawrence

Berkeley National Laboratory (LBNL). Travel not within

the scope of the LBNL contract is covered by the

provisions of G-28.

University of California – Policy G-28

Travel Regulations

2 of 53

I. POLICY SUMMARY

It is the policy of the University to comply with IRS regulations regarding the provision

and reimbursement of business-related travel, and to conform to the IRS “accountable

plan” rules.

II. DEFINITIONS

Business Purpose:

The business purpose of a University traveler may include activities

that contribute to any one of the University’s major functions of teaching, research,

patient care, or public service, or to any other substantial and bona fide University

business activity.

Campus:

The campus, Laboratory, UCOP, Agriculture and Natural Resources, or other

official University location under the jurisdiction of a Chancellor, as defined below.

Chancellor:

The chief executive officer of the campus. For purposes of this Bulletin, the

authorities and responsibilities assigned to the Chancellor are also assigned to the

Lawrence Berkeley National Laboratory (LBNL) Director, the Executive Vice President—

Chief Operating Officer, the Vice President--Agriculture and Natural Resources, and the

Principal Officers of The Regents, for employees under their respective jurisdictions.

Authority delegated to the Chancellor also may be delegated to other individuals.

Domestic Partner:

A domestic partner means the individual designated as an

employee's domestic partner under one of the following methods: (i) registration of the

partnership with the State of California; (ii) establishment of a same-sex legal union,

other than marriage, formed in another jurisdiction that is substantially equivalent to a

State of California-registered domestic partnership; or (iii) filing of a Declaration of

Domestic Partnership form with the University. See PPSM 2 for additional information.

Headquarters:

The place where the major portion of the traveler's working time is spent

or the place to which the employee returns during working hours upon completion of

special outside assignments.

Lodging:

Expenses for overnight sleeping facilities. This does not include

accommodations on airplanes, trains, buses, or ships, which are included in the cost of

transportation.

M&IE Reimbursement Cap:

The maximum amount authorized for daily meal and

incidental expenses established by the University for all travel of less than 30 days in the

continental United States (CONUS). Travelers may seek reimbursement only for their

actual expenses up to the cap amount (see Section V.E.2.a.i., Travel – Assignments of

Less than 30 Days). For purposes of the reimbursement cap, incidental expenses

include tips and fees for services, e.g., for waiters, baggage handlers, etc.

Per Diem:

The daily subsistence allowance authorized under the federal per diem rates

for a location of travel. The payment of a per diem does not require supporting receipts.

Per diems are authorized in these situations: for all foreign travel; travel within Alaska,

Hawaii, and United States possessions (OCONUS); domestic travel assignments of 30

days or more; and domestic travel assignments that exceed one year (see Appendix B).

University of California – Policy G-28

Travel Regulations

3 of 53

The incidental expenses portion of the federal per diem rate includes fees and tips given

to porters, baggage carriers, bellhops, hotel maids, stewards or stewardesses and others

on ships, and hotel servants in foreign countries; transportation between places of

lodging or business and places where meals are taken, if suitable meals cannot be

obtained at the temporary duty site; and mailing costs associated with filing travel

expense claims and payment of University-sponsored charge card billings. Federal per

diem rates do not include taxes on lodging, which may be reimbursed separately.

Refer to Section V.E., Subsistence Expenses, for more information on per diems.

Primary Agreement:

An agreement between the University of California and an

awarded supplier for a specific service or commodity that is the result of a University

competitive bid process. The primary agreement is established with the supplier

considered to have the best combination of value and service and who obtains the most

awarded quality points during the evaluation process. This supplier will be the

recommended University supplier for the specific service or commodity type (at

participating University locations) for the life of the agreement.

Reporting Period:

The forty-five day period within which a travel expense claim must

be submitted after the end of a trip. Refer to Section V.I.1., Reporting Period, for more

information.

Residence:

The primary residence where the traveler lives, regardless of other legal or

mailing addresses. However, when an employee is required to reside temporarily away

from his or her permanent residence because of official travel away from headquarters,

such residence may still be considered permanent if it is unreasonable to expect the

employee to move his or her permanent residence to the temporary job location.

Travel Expenses:

Expenses that are ordinary and necessary to accomplish the official

business purpose of a trip. Refer to the following sections for a description of travel

expenses eligible for reimbursement: Section V.D., Transportation Expenses; Section

V.E., Subsistence Expenses; and Section V.F., Miscellaneous Travel Expenses.

Travel Status:

The period during which a traveler is traveling on official University

business outside the vicinity of his or her headquarters or residence.

III. POLICY TEXT

A. Introduction

The policy and regulations contained in this Bulletin shall apply to all official

University travel, including travel funded under federal grants and contracts.

1

However, the policy does not apply to work done within the scope of the UC/DOE

contract for the management and operations of the Lawrence Berkeley National

1

Pursuant to Section 200.474 of the Office of Management and Budget’s 2 CFR Part 200, costs incurred

by employees and officers for travel must be considered reasonable and allowable only to the extent that

such costs do not exceed charges normally allowed by the institution in its regular operations as a result

of an institutional policy and the amounts claimed under sponsored agreements represent reasonable

and allocable costs.

University of California – Policy G-28

Travel Regulations

4 of 53

Laboratory. Travel not within the scope of the LBNL contract is covered by the

provisions of this policy.

This Bulletin includes special rules for non-employees, such as students, visiting

scholars, independent contractors, etc.

The terms set forth in an extramural funding agreement govern only when such terms

are more restrictive than University travel regulations. The campuses and LBNL may

adopt more restrictive procedures, if desired. In addition, the terms of a collective

bargaining agreement shall govern when such terms do not conform to the provisions

of this Bulletin.

B. Overview

University business travelers are strongly encouraged to purchase travel services,

when available, from Preferred Suppliers with whom the University has strategic and

collaborative sourcing primary agreements. Preferred Suppliers deliver competitive

value in the range of services required by University travelers. Such Suppliers include

airlines, car rental agencies, hotels, travel agencies, and online booking providers.

Although it might be possible to obtain a lower cost from nonparticipating suppliers,

use of Preferred Suppliers should, on average and over time, reduce the University's

overall travel costs and provide the best value to the traveler. For more information

about Connexxus and our preferred suppliers, including airlines, hotels, car rental

agencies, and travel agencies, see the Connexxus website.

C. Travel Management Services

1. Travel Management Program

The systemwide Travel Management Program known as Connexxus is intended

to generate maximum benefit and value for University travelers and departments.

The program encompasses all aspects of University travel, including policy

development, processes, planning, data management, and Preferred Supplier

services and contracts. After appropriate training and communication, campuses

should mandate the use of Connexxus in order to realize the potential savings

achievable under the program (President’s June 21, 2009 letters to the

Chancellors).

2. UC Travel Council

The UC Travel Council, sponsored by the Executive Vice President—Chief

Financial Officer, provides general leadership, direction, and oversight in support

of the Connexxus program. At least one representative from each campus and the

LBNL shall have membership on the Travel Council. Campuses may appoint an

additional Medical Center representative for their location, if desired.

D. Reimbursement Standards

It is the policy of the University that all official travel shall be properly authorized,

reported, and reimbursed in accordance with this Bulletin. Under no circumstances

shall expenses for personal travel be charged to, or be temporarily funded by, the

University, unless otherwise noted in this Bulletin. All travel reimbursement requests

must be certified by the traveler, as indicated in section V.I.2.c.

University of California – Policy G-28

Travel Regulations

5 of 53

University employees traveling on official business shall observe normally accepted

standards of propriety in the type and manner of expenses they incur. In addition, it

is the traveler's responsibility to report his or her actual travel expenses in a

responsible and ethical manner, in accordance with the regulations set forth in

this Bulletin.

The University’s travel reimbursement procedures contained in this Bulletin are

designed to conform to the “accountable plan” rules published by the Internal

Revenue Service (IRS). Therefore, University reimbursement of an employee’s travel

expenses shall not result in additional taxable income to the employee. Travel

expenses considered by the IRS to be taxable income to the traveler are not

reimbursable except for the following:

• Expenses for travel in excess of one year,

• Imputed taxable income caused by substantiated expense reports submitted

after the time limit described in Section V.I.1., subject to campus discretion,

• Certain travel expenses related to moving a new appointee or a current

employee (refer to BFB G-13, Policy and Regulations Governing Moving and

Relocation, for more information), and

• Travel-related and childcare expenses for a spouse, domestic partner,

dependent-care provider, and dependents who accompany the employee

when pre-approved by the Chancellor or other senior University officer (see

Section V.H.2.f).

E. Travel Restrictions

California State Law ( Government Code Section 11139.8, enacted pursuant to AB

1887), effective January 1, 2017, prohibits state-funded travel to a state that has

passed a law after June 26, 2015 that (1) authorizes discrimination based on sexual

orientation, gender identity, or gender expression, or (2) voids or repeals existing

state or local protections against such discrimination. The law also prohibits state

agencies and UC from requiring employees to travel to such states. The State

Attorney General must develop, maintain, and has posted online the current list of

states where these travel restrictions apply. The Attorney General has also posted

online a set of Frequently Asked Questions that includes a list of exceptions provided

in Government Code Section 11139.8, which allow state-funded travel to states on

the Attorney General’s list under certain specified conditions.

University of California – Policy G-28

Travel Regulations

6 of 53

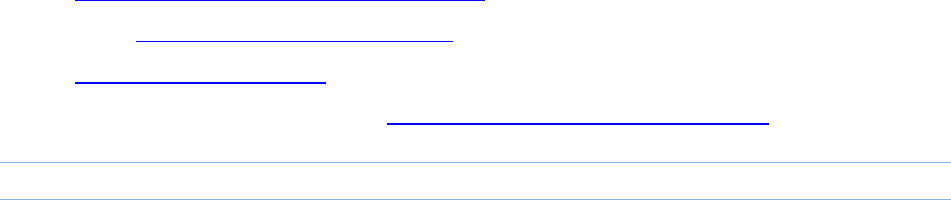

IV. COMPLIANCE/RESPONSIBILITIES

Function Responsibilities

Executive Vice President-Chief

Financial Officer

Establish and update the policies set forth in this Bulletin.

Department Heads (or person

delegated authority by the

Chancellor, or person officially

redelegated authority)

Approve payment for the travel expense claim or electronic equivalent

submitted by the traveler; ensure that appropriate documentation is provided

to substantiate the travel expense; ensure that the travel expenditures

comply with University policy and fund source restrictions.

Campus Controller’s Office or

Medical Center Controller, where

appropriate

Approve the travel expenses, including exceptions, for each campus

Chancellor, including a spouse or domestic partner, or an Associate of the

Chancellor. Initiate proceedings for the recovery of any outstanding cash

advances sixty days after a trip is completed.

Chancellors

• May establish more restrictive procedures for the travel policies authorized

under this Bulletin.

• Designate one or more approving Vice Chancellors to approve travel

expenses incurred by the Vice Chancellors, Deans, and Medical Center

Directors.

• Approve travel expenses incurred by the designated Vice Chancellors.

• May appoint a designee to approve travel expenses incurred by the

designated Vice Chancellors, provided that the designee does not report to

the designated Vice Chancellor.

• Provide written approval for use of private aircraft (including a rented

aircraft) for official travel after pilot registers the private aircraft with the

Chancellor and meets all the requirements under Section V.D.2.b.i.

• Delegate authority to pre-approve reimbursement of travel expenses of a

spouse, domestic partner, dependent-care provider, or dependents of an

accompanying parent (employee) or prospective employee.

Designated Vice Chancellors

2

• Review and approve travel expenses incurred by the Vice Chancellors,

Deans, and Medical Center Directors.

• In lieu of reviewing and approving each travel expense claim (or electronic

equivalent), the designated Vice Chancellor may:

o Appoint a high-level individual on his or her staff who is

knowledgeable about the travel regulations to review and approve

the travel expense claim for policy compliance, and

o Review and sign a periodic report (produced no less frequently than

monthly), which details the business purpose for each trip taken.

• May not redelegate this authority to another individual, except when the

designated Vice Chancellor is not available due to business travel,

vacation, illness, or other leave.

2

The term “designated Vice Chancellor” includes any other responsible administrator designated by the Chancellor.

University of California – Policy G-28

Travel Regulations

7 of 53

Function Responsibilities

• LBNL Director

• Executive Vice President-

Business Operations

• Vice President-Agriculture and

Natural Resources

• Principal Officers of The

Regents

Assigned the authorities and responsibilities that are assigned to the

Chancellor for purposes of this Bulletin.

President-Office of the President Establish procedures similar to the Chancellors for the approval of travel

expenses incurred by the President, the Executive Vice Presidents, the

Principal Officers of The Regents, and other Officers within the Office of the

President.

Travel Management Office Administer the University’s Travel Management Program under the general

direction of the UC Travel Council.

UC Travel Council Provide general leadership, direction, and oversight in support of the

Connexxus program.

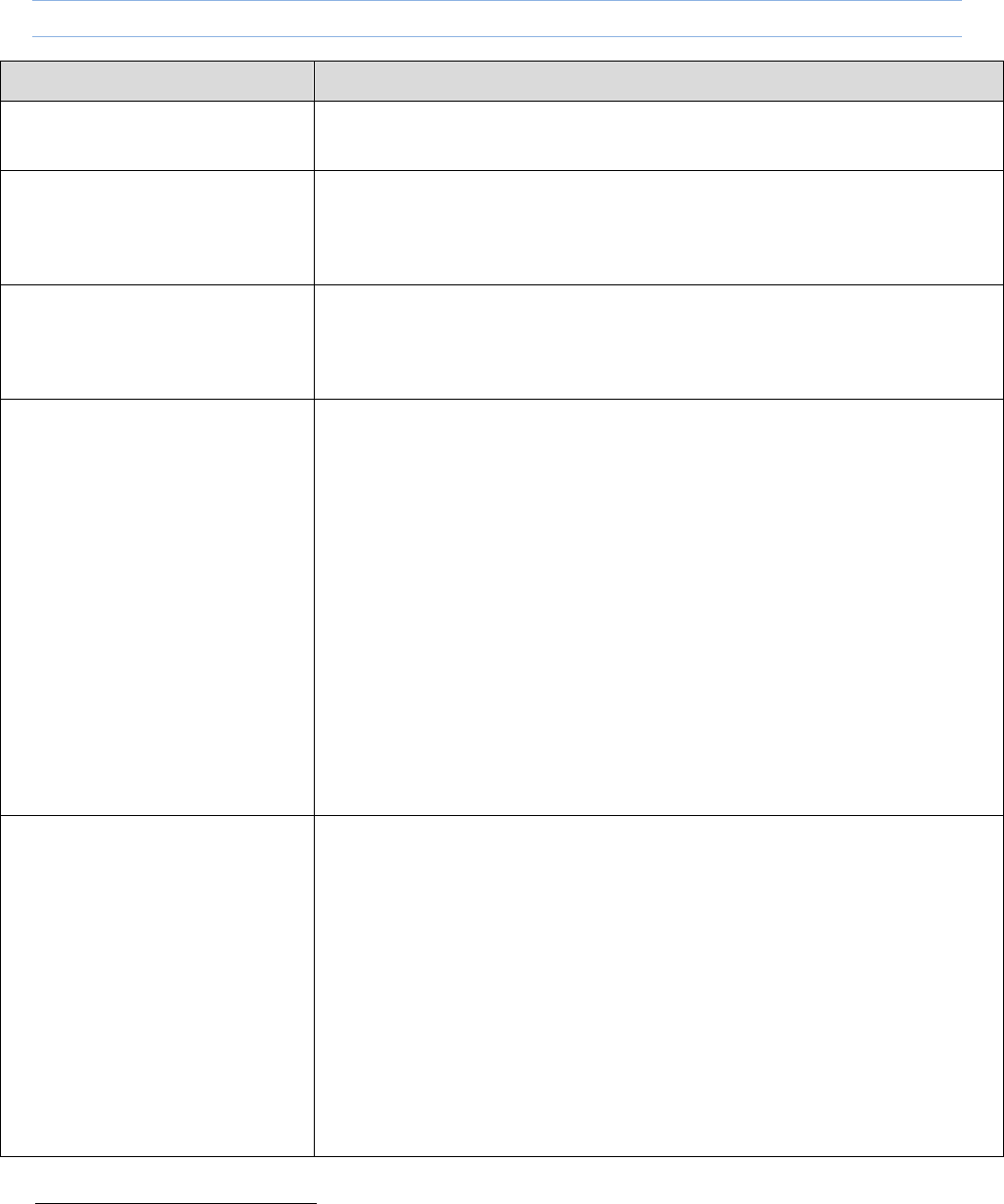

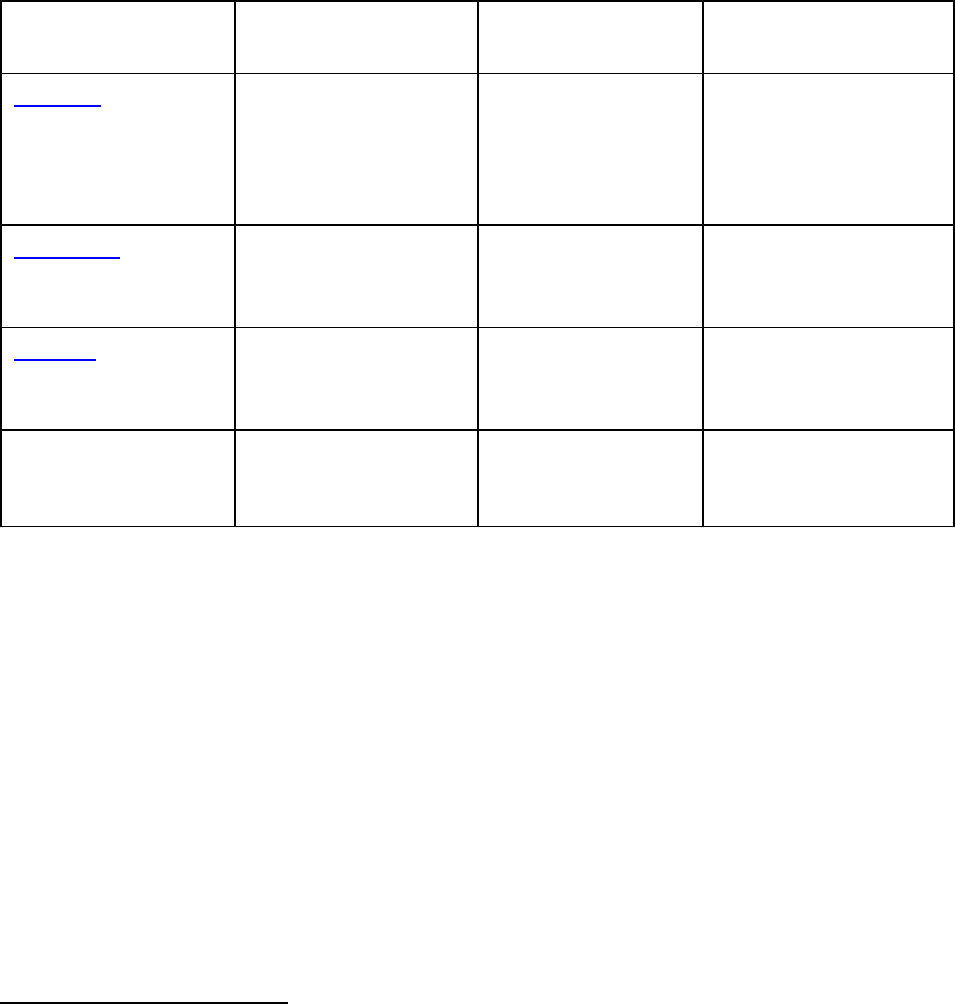

Payment Approval

Authority

Exceptions

Permitted

Exception Approval

Authority Comments

Chancellors (or

Chancellor’s designee if

any delegation of the

Chancellor’s authority is

made in writing)

Have the authority to

make exceptions to the

University’s Travel Policy,

as long as the exception

is in writing.

Yes Exceptions may be

granted by the Chancellor

or his or her designee

when one is required due

to extenuating

circumstances.

Any request for an

exception must document

the circumstances and

need for the exception.

When an exception has

been approved, expenses

will only be reimbursed to

the extent of actual costs

incurred, provided such

costs are deemed to be

ordinary and necessary

under the circumstances.

See Section V.I.,

Reporting Travel

Expenses, for more

information.

In general, exceptions should not be

made to the daily M&IE reimbursement

cap established for travel of less than

30 days within CONUS (see Appendix

B) unless necessitated by the business

requirements of the trip. For example,

an exception to the daily M&IE

reimbursement cap may be required

for athletic team training meals that

involve specific nutritional

requirements.

Transportation expenses shall be

reimbursed based on the most

economical mode of transportation and

the most commonly traveled route

consistent with the authorized purpose

of the trip. An exception to the

minimum miles per day requirement

may be approved, however, if a delay

is beyond the control of the individual,

e.g., weather, traffic, or physical

handicap of the traveler. Any exception

must be approved by the Chancellor.

University of California – Policy G-28

Travel Regulations

8 of 53

V. PROCEDURES

A. Approval of Travel Expense Claim

The authority to approve travel expense claims must be documented by a signature

authorization form on file with the Campus Controller’s Office (or the Medical Center

Controller, where appropriate) or by an electronic signature authorization. The travel

expense claim should not be approved by a person who reports directly or indirectly

to the traveler. Persons delegated the authority to approve travel shall not approve

their own travel. In addition, travelers may not approve the travel of a near relative,

e.g., spouse or domestic partner, child, parent, etc.

B. Payment of Travel

1.

Prepaid Expenses and Direct Charges

Individual travelers are prohibited from charging hotel and hotel-related expenses

directly to the University. However, campuses may enter into a direct billing

arrangement with a hotel for the payment of charges on behalf of travelers for

room and tax charges only. Campuses should ensure that travelers are aware of

such arrangements. Transportation tickets and conference fees may also be

charged directly to the University if the proper controls are in place, such as a

“ghost card” arrangement. Meals and miscellaneous expenses cannot be charged

or billed directly to the University as these expenses must be paid by the traveler

when they are incurred, and a claim for reimbursement submitted at the

conclusion of the trip.

Sections V.E.4., Payment of Group Subsistence Expenses, V.H.1.c., Students,

and V.H.2.b., Prospective Employees, provide additional information regarding

prepaid expenses and direct charges incurred by travelers.

2.

Corporate Travel Cards

Under guidelines established by campuses, corporate travel cards may be issued

to employees who travel on official University business.

3

Any traveler issued such

a card should use the card to pay for all expenses related to official University

business travel, including lodging and subsistence, except where the card is not

accepted. The cardholder will be billed directly for all expenses charged to the

corporate card. The cardholder is personally responsible for paying all charges on

the corporate card and for keeping the card current. The University will not

reimburse or pay late fee charges incurred in connection with the corporate

card. Corporate travel card payment delinquencies may result in the cancellation

of the traveler's card or other corrective action.

Travelers who have been issued a University corporate travel card are required to

use the card for cash advances, except under the circumstances listed below in

Section V.B.3.a., Eligibility.

3

Procurement Services, CFO Division, is responsible for negotiating contracts for campus corporate card programs

University of California – Policy G-28

Travel Regulations

9 of 53

The corporate travel card is valid only while an individual is employed by the

University, may be cancelled at the discretion of the University, and must be

relinquished to the employee’s department upon termination of employment.

3.

Cash/Non-Cash Advances

Travelers are required to use their corporate travel card to obtain cash advances

for expenses incurred in connection with official University business travel, if the

card provides this feature. Reasonable fees charged for obtaining a cash advance

using the corporate travel card are eligible for reimbursement.

a. Eligibility

Travelers who cannot obtain a cash advance through a corporate card may

request a cash advance from the University, in accordance with the procedures

established by the campus, under the following circumstances:

• The traveler is not eligible to participate in the corporate travel card

program or has not yet been issued a corporate travel card;

• The campus’s card program does not provide such a feature;

• The traveler has incurred corporate credit card expenses that must be

paid before a trip is completed;

• The travel requires special handling, such as foreign travel, group travel

for athletics, bowl games, student groups, etc.

b. Issuance of Cash Advances

Cash advances must be issued within 30 days of when an expense is to be paid

or incurred in order to satisfy IRS regulations and to meet the University's cash

management objectives. The amount requested on the Travel Advance Request

form shall not exceed a reasonable estimate of the out-of-pocket expenses

needed for the trip.

Cash advances should not be authorized under the following circumstances:

• The traveler is 30 days delinquent in submitting a travel expense claim

for a prior trip;

• The corporate travel card cannot be used due to the traveler’s failure to

meet the payment terms of the card; or

• The corporate travel card has been lost. (Lost cards should be reported

to the corporate credit card company immediately and arrangements

made for issuance of a replacement card.)

A traveler should have only have one outstanding cash advance per trip; each

advance should be accounted for before another advance is granted. The

traveler must submit a travel expense claim even if he or she is not owed

any additional reimbursement, in order to document the business purpose

for which the advance was issued.

University of California – Policy G-28

Travel Regulations

10 of 53

Section V.I., Reporting Travel Expenses, contains information on substantiation

of cash/non-cash advance expenses. Subsections 1.a, b, and d of Section V.G.,

Intercampus Travel Expenses, provide information on advances issued for

intercampus assignments. Section V.H.1.a., Visiting Academic Appointees,

details special requirements related to handling advances for such appointees.

c. Cancelled or Postponed Trips

A cash advance must be returned immediately if an authorized trip is cancelled

or indefinitely postponed.

A nonrefundable ticket associated with a cancelled trip must be used for the

employee's next business trip.

d. Unrecovered Advances

All cash advances must be accounted for within forty-five days after a trip is

completed. Unrecovered advances that are determined not to be business-

related travel expenses should be reported as income to the traveler, per section

V.B.3.d.ii. Accounting Manual chapter R-212-2, Receivables Management,

addresses the legal limitations with respect to the collection of delinquent

accounts or other indebtedness incurred by employees.

i. Recovery Procedures

An employee's written permission must be obtained before an outstanding

cash advance can be deducted from wages or from any other amounts due

the traveler. If the employee's consent cannot be obtained, the campus

may recover the debt through a collection agency.

ii. Tax Considerations

Cash Advances. If an employee fails to substantiate expenses and return

any unused cash advance amounts within 120 days of the end of a trip, the

University is obligated under IRS regulations to consider such amounts as

income to the employee. As a result, the amount of unsubstantiated

expenses and unrecovered advances will be reported through the payroll

system as additional wages to the employee no later than the first payroll

period following the end of the 120-day period. The income and applicable

employment taxes on the additional wages are to be withheld from the

employee’s regular earnings. No refund of such taxes or any

adjustment to gross income shall be made with respect to any

substantiation or reimbursement received from the employee after the

120-day period. (For more information on tax withholding, see Accounting

Manual chapter D-371-12.1, Disbursements: Accounting for and Tax

Reporting of Payments Made through the Vendor System.)

Non-Cash Advances. Travel payments, such as registration fees, airline

tickets, etc., made to a vendor on behalf of an employee should follow the

same reporting time frame for substantiation by the employee as outlined

as outlined in section V.I.1 of this bulletin.

University of California – Policy G-28

Travel Regulations

11 of 53

4.

Payment of Expenses on Behalf of Others

University travelers normally shall not be reimbursed for expenses paid on behalf

of other persons; however, limited exceptions are permitted (see Section V.H.2.f)

such as in the case of co-travelers who are sharing a room. Exceptions to this

rule, such as supervised group trips, must be approved in advance. (See Section

V.E.4., Payment of Group Subsistence Expenses, for more information.)

5.

Cancellation of Reservations

Travelers who are unable to honor a reservation shall be responsible for canceling

the reservation in compliance with the cancellation terms established by the hotel,

airline, etc. The traveler must return any refundable deposits to the University.

Charges or lost refunds resulting from failure to cancel reservations shall not be

reimbursed unless the traveler can show that such failure was the result of

circumstances beyond the traveler's control.

The traveler shall be responsible for promptly returning for a refund any unused or

partially used transportation tickets.

C. Insurance for Travelers

1.

University Travelers

All University travelers, including employees, medical residents, students, and

fellows, are covered worldwide, 24 hours a day, for a wide variety of accidents

and incidents while on official travel status. The coverage includes accidental

death, accidental dismemberment, paralysis, and permanent total disability. The

coverage also includes travel assistance services when the traveler is 100+ miles

from his or her home or headquarters, such as:

• Security extraction (security extraction is not subject to mileage limitation),

• Emergency medical evacuation and repatriation,

• Repatriation of remains,

• Out-of-country medical,

• Loss of personal effects (employees only), and

• Other travel assistance services.

In addition, all University employees are provided with workers’ compensation

coverage for a work-related injury or illness that occurs during a University-

approved and funded business trip.

a. Registration for Travel Outside of California

Travelers must register all out-of-state and foreign country business trips to

ensure coverage. Booking travel through Connexxus’ preferred travel agencies

and supported online booking tools, with the exception of SWABIZ (Southwest)

automatically enrolls the traveler in the insurance program for travel outside of

California; otherwise the traveler must register on the Risk Services website and

complete the Traveler Insurance form before an out-of-state trip occurs.

University of California – Policy G-28

Travel Regulations

12 of 53

Registration is not required for travel within California as coverage is automatic.

2.

Vehicles

For information on insurance coverage requirements for employees who use their

private vehicles on University business, see Section V.D.3.a.iii., Insurance

Coverage. Sections V.D.3.b.ii., Insurance Coverage, V.D.3.b.iv., Damage to a

Rental Vehicle, and V.D.3.c.i., University Vehicles, contain information on

insurance coverage in connection with rental cars and University vehicles.

Refer to the Risk Services website for more information on automobile and liability

insurance coverage for individuals traveling on University business.

Questions should be directed to the local Risk Management office.

D. Transportation Expenses

Transportation expenses shall be reimbursed based on the most economical mode of

transportation and the most commonly traveled route consistent with the authorized

purpose of the trip. Any exception must be approved by the Chancellor.

Travel by a group of employees in the same aircraft, automobile, or other mode of

transportation is discouraged when the employees' responsibilities are such that an

accident could seriously affect the functioning of the University. Key employees, such

as the President, Chancellors, Vice Presidents, or a substantial number of employees

from the same organizational unit or program, should consider this risk when making

travel arrangements.

1.

General

a. Definition

Transportation expenses include the following: charges for commercial carrier

fares; travel agency service fees; car and aircraft rental charges; private car

mileage allowances; emergency repair to University cars; overnight and day auto

parking; bridge and road tolls; taxi and public transportation fares; and all other

charges for transportation services necessary to accomplish the official business

purpose of the trip.

b. Transportation Tickets

Transportation tickets should be procured in advance in order to obtain any

discounts offered by the carrier or negotiated by the University. Such tickets

should be purchased through Connexxus. Travelers will not be reimbursed for

non-cash certificates used for the purchase of transportation tickets, e.g.,

frequent flyer miles.

c. Lost Tickets

Service charges for tickets lost by travelers may be reimbursed, provided such

occurrences are infrequent. Charges for re-ticketing, schedule changes, etc. are

reimbursable if incurred for a valid business reason. The reason for the charge

must be specified on the travel expense claim.

University of California – Policy G-28

Travel Regulations

13 of 53

d. Allowable Mileage Expense

Mileage shall ordinarily be computed between the traveler's headquarters and

the common carrier or destination. Expenses for travel between the traveler's

residence and headquarters (commuting expense) shall not be allowed.

However, mileage expenses may be allowed between the traveler's residence

and the common carrier or destination if University business travel originates or

terminates during a regularly scheduled day off.

When a traveler is authorized to drive a private vehicle to or from a common

carrier terminal, mileage may be reimbursed as follows:

• One round trip, including parking for the duration of the trip; or

• Two round trips, including short-term parking expenses, when an

employee is driven to a common carrier.

Also, if an employee who is not on travel status has a temporary assignment

away from campus, reimbursement shall be made for mileage expenses incurred

between the campus and the assignment location, or home and the assignment

location, whichever is less.

e. Surface Transportation Used in Lieu of Air Travel

If advance approval has been obtained, a traveler may use surface

transportation for personal reasons even though air travel is the appropriate

mode of transportation. The cost of meals and lodging, parking, mileage, tolls,

taxis, and ferries incurred while in transit by surface transportation may be

reimbursed.

4

However, such costs shall not exceed the cost of airfare, based on

the lower of the regular coach fare available for the location of travel from a

standard commercial air carrier or the campus travel program fare, plus

transportation costs to and from the terminals.

f. Indirect or Interrupted Itineraries

Obtaining advance approval is suggested when a traveler takes an indirect route

or interrupts travel by a direct route, for other than University business. Any

resulting additional expenses shall be borne by the traveler. The reimbursement

of expenses shall be limited to the actual costs incurred or the charges that

would have been incurred via a usually traveled route, whichever is less. The

cost comparison should be based on what UC would have paid, which can be

obtained by a Connexxus-related travel agency prior to or at the time of booking

the trip. Any resulting excess travel time will not be considered work time, and

will be charged to the appropriate type of leave. The employee shall be

responsible for accurate reporting of such leave time.

g. Travel Extended to Save Costs

Additional expenses associated with travel extended to save costs, e.g., a

Saturday night stay for domestic travel, may be reimbursed when the cost of

4

The reimbursement of M&IE is subject to the 300 mile-per-day rule specified in Section V.D.3., Automobile.

University of California – Policy G-28

Travel Regulations

14 of 53

airfare would be less than the cost of airfare had the traveler not extended the

trip (provided the expenses were incurred in compliance with this Bulletin). Such

expenses, which include lodging, car rental, and M&IE (subject to the

reimbursement caps set forth in Appendix B) incurred within the vicinity of the

business destination, shall not exceed the amount the University would have

paid had the traveler not extended the trip.

2.

Air Travel

a. Commercial Airlines

Coach Class. Coach class or any discounted class shall be used in the interest

of economy. This policy applies to all travel (domestic or foreign, or any

combination thereof) regardless of the purpose or fund source.

Business or First Class. Use of business or first-class may be authorized under

the circumstances listed below. Documentation of such circumstances must be

provided on the travel expense claim.

• Business or first-class is the only service offered between two points;

• The use of coach class would be more expensive or time consuming,

e.g., when, because of scheduling difficulties, traveling by air coach

would require an unnecessary hotel expense, circuitous routing, or an

unduly long layover when making connections;

• An itinerary involves overnight travel without an opportunity for normal

rest before the commencement of working hours; or

• The use of business or first-class travel is necessary to reasonably

accommodate a disability or medical need of a traveler.

When a traveler prefers to use a higher class than the one authorized for

reimbursement, the traveler must pay the incremental cost of the airfare. In

cases other than those described above, a written authorization to use business

or first-class shall be obtained in advance from the Chancellor. The traveler shall

submit such authorization with the travel expense claim.

Other Ancillary Charges. Campus Chancellors can establish local policy for

reimbursement at their respective locations of ancillary charges such as checked

and carry-on baggage fees, early check-in or priority boarding and seat

selection. Likewise, reimbursement of higher cost airfare such as Economy Plus,

Extra Comfort, etc., within the economy class can be included in the local policy.

U.S. Flag Air Carriers. Under the Fly America Act published in Federal Travel

Regulation §301-10.13 by the General Services Administration (GSA), only U.S.

air carriers

5

shall be used for all travel reimbursed from federal grants and

5

Code-sharing agreements with foreign air carriers, whereby American carriers purchase or have the right to sell a

block of tickets on a foreign carrier, comply with the Fly America Act Regulations. The ticket, or documentation for an

electronic ticket, must identify the U.S. carrier's designator code and flight number.

University of California – Policy G-28

Travel Regulations

15 of 53

contracts, including NIH grants

6

. However, there are exceptions to using only

U.S. air carrier services under the Fly America Act, depending on the scenarios

shown below:

• Generally, U.S. air carrier services that provide nonstop or direct

service from the origin to the destination must be used, unless such

use would extend travel time, including delay at origin, by 24 hours or

more;

• Generally, U.S. air carrier services that do not offer nonstop or direct

service between origin and destination must be used on every portion of

the route where it provides service, unless when compared to using a

foreign air carrier, such use would:

o Increase the number of aircraft changes outside the U.S. by two

or more; or

o Extend travel time by at least 6 hours or more; or

o Require a connecting time of 4 hours or more at an overseas

interchange point.

• When the costs of transportation are reimbursed in full by a third party,

such as a foreign government or an international agency, U.S. air

carriers do not have to be used.

• Open Skies Agreements. “Open Skies Agreements” are bilateral or

multilateral air transportation agreements to which the U.S. and the

government of a foreign country are parties. Under the Open Skies

Agreements, the U.S. government entered into several air transport

agreements that allow federally funded transportation services for travel

and cargo movements to use foreign air carriers under certain

circumstances. The Department of State’s website contains a list of

countries the U.S. government has Open Skies Agreements with,

including policy information contained in the various Open Skies

Agreements. Transportation is allowed between a point in the United

States and any point in a member state or between two points outside

the U.S. subject to certain restrictions.

Travelers funded by federal grants and contracts should review Federal

Travel Regulation §301-10.106 published by the GSA for any City-Pair

requirements, and §301-10.135 for any Open Skies requirements. The

GSA issued Guidance on October 6, 2010 for the Amendment of the

U.S.-EU Open Skies Agreement effective June 24, 2010. Federal

contractors and grantees who are not U.S. Government employees

should consult this guidance to determine if they need to be concerned

about City-Pair contract fares. Contractors and grantees should also

6

See section 7.9.1 “Travel/Employees”

University of California – Policy G-28

Travel Regulations

16 of 53

check with the airline to ensure that the airline is covered by the U.S.-

EU Open Skies agreement, which may change periodically.

Reimbursement of travel on a foreign air carrier may be denied in the

absence of such justification.

b. Private Aircraft

i. Approval

Before a private aircraft (including a rented aircraft) may be used for official

travel, the pilot must register with and obtain written approval from the

Chancellor. In addition, the following requirements must be met:

• The pilot must have a valid private license;

• The pilot must have logged at least 10 hours of flight time within the

preceding 90 days as a pilot in command of an aircraft of the same

make and model as the one to be used on the trip;

• To carry passengers, the pilot must either have logged a minimum

of 500 hours of flight time as a licensed private pilot in command of

an aircraft or possess a valid commercial (or higher type) pilot's

license issued by the Federal Aviation Administration.

• A current pilot history form and a certificate of insurance must be on

file with the campus risk management office; and

• Evidence must be provided of Aviation Liability Insurance coverage

with a minimum combined single limit of $1 million, with The

Regents named as additional insured.

Transportation expenses for a flight carrying passengers shall not be

reimbursed if the University pilot does not possess the above qualifications.

For purposes of the foregoing rule, anyone traveling in the aircraft other

than the pilot is considered to be a passenger.

ii. Reimbursement Options

When the pilot has obtained prior approval to use a private aircraft,

reimbursement shall be made based on the lesser cost of one of the

following two options:

• Private Aircraft Option. An amount for mileage using the private

reimbursement rate per mile shown in Appendix A, plus the cost of

meals and lodging while in transit. Mileage shall be computed on the

basis of the shortest air route from origin to destination. The travel

expense claim must show the aircraft registration number and shall

be clearly marked "Air Miles." Only the pilot will be reimbursed for

mileage expenses. Reimbursement shall be made for actual

landing and parking fees. Reimbursement is not allowed for storage

or parking fees at the location where the aircraft is normally stored.

University of California – Policy G-28

Travel Regulations

17 of 53

However, parking and transportation costs to and from the place of

storage may be reimbursed.

• Commercial Aircraft Option. The cost of the lowest regular coach

fare available for the location of travel from a standard commercial

air carrier, plus the cost of transportation to and from the terminals

and any meals and lodging that would have been allowed had the

traveler used a commercial airline. The cost of meals and lodging

while in transit also may be taken into account in determining the

appropriate reimbursement amount.

c. Chartered Aircraft

The actual expenses of chartering an aircraft are allowable; however, prior

approval must be obtained from the Chancellor.

3.

Automobile

Travelers may use their private vehicle for business purposes if it is less

expensive than renting a car, taking a taxi, or using alternative transportation, or if

it saves time.

When a person is authorized to travel by automobile (e.g., when an automobile is

the most economical and practical mode of transportation given the requirements

of the trip) actual M&IE incurred en route plus the cost of lodging, when

appropriate, may be reimbursed. However, a minimum of 300 miles a day must be

driven by the most direct route in order to obtain the M&IE and lodging

reimbursement. An exception to the minimum miles per day requirement may be

approved, however, if a delay is beyond the control of the individual, e.g.,

weather, traffic, or physical handicap of the traveler.

a. Private Vehicles

The following rules apply to all domestic travel.

i. Mileage Reimbursement Rates

When two or more persons on University business share a private vehicle,

only the driver may claim reimbursement for mileage.

• Standard Rate

The standard reimbursement rate per mile is set forth in Appendix A.

This rate takes into account all actual automobile expenses such as

fuel and lubrication, towing charges, repairs, replacements, tires,

depreciation, insurance, etc. Thus, under IRS regulations, travelers

who claim this rate are not required to substantiate the actual costs

of operating the vehicle.

• Rate for Travelers With Physical Disabilities

A traveler with a physical disability who must use a specially

equipped or modified automobile may claim reimbursement at the

standard rate per mile set forth in Appendix A. However, if the

University of California – Policy G-28

Travel Regulations

18 of 53

traveler incurred higher than standard operating costs, the traveler

may seek reimbursement by submitting a statement with the travel

expense claim certifying that he or she incurred higher operating

costs. The actual fixed and variable costs must be specified in the

statement.

The traveler should refer to IRS Form 2106, Employee Business

Expenses, to obtain additional information on the calculation of

actual vehicle operating costs. Form 2106 is available on the IRS

web site.

The departmental authority that approves the travel is responsible

for documenting the traveler's need to use such a vehicle.

ii. Private Vehicle Used in Lieu of Air Travel

When a traveler's private vehicle is used on University business in lieu of

available air travel, the traveler shall be reimbursed in accordance with the

procedures specified in Section V.D.1.e, Surface Transportation Used in

Lieu of Air Travel. Fuel, routine repairs and associated costs, tires,

gasoline, or other automobile expense items shall not be allowed when a

private vehicle is used. Such expenses are included in the mileage

reimbursement rates set forth in Appendix A.

iii. Insurance Coverage

When private vehicles are used on University business, the appropriate

campus officials are responsible for requiring that employees have

adequate liability insurance coverage. The minimum prescribed liability

insurance coverage is as follows: $50,000 for personal injury to, or death

of, one person; $100,000 for injury to, or death of, two or more persons in

one accident; and $50,000 for property damage. An employee who

regularly uses a private vehicle on University business is required to have

and provide upon request satisfactory evidence of liability insurance

coverage. Such evidence must be provided to the appropriate office before

the reimbursement of regular use mileage is allowed. Regular use is

defined as more than four trips per calendar month totaling at least 300

miles. When a private vehicle operated by an employee on official

University business is damaged by collision or sustains other accidental

damage, reimbursement for repairs borne by the employee may be

authorized up to $500 or the amount of the deductible (co-insurance),

whichever is less. Expenses that can be recouped from insurance are not

eligible for reimbursement. The amount reimbursed shall be based on

receipts submitted by the employee to the individual who authorized the

travel. The reimbursement may be charged to the department or to

another appropriate account as designated by the Chancellor.

University of California – Policy G-28

Travel Regulations

19 of 53

b. Rental Cars

i. Authorization to Rent

A vehicle may be rented when renting would be more advantageous to the

University than other means of commercial transportation, such as using a

taxi. Advance reservations should be made whenever possible and may

include up to an intermediate-size model, per the terms of UC-negotiated

rental agreements. Vehicles up to an intermediate-size model should be

used unless a no-cost upgrade is provided. When the University’s rental

contracts provide for refueling charges at a negotiated rate, this option may

be selected to purchase fuel in advance. Hand-held or uninstalled GPS

devices should not be rented unless the traveler is unfamiliar with the

location of travel. Use of other higher cost upgrades requires exceptional

approval.

The traveler is responsible for obtaining the best available rate

commensurate with the requirements of the trip. The discount negotiated

with car rental agencies by the University should be requested when

available. The University’s Connexxus website provides the rental

agency's University identification number, which should be given to the

agency at the time of rental in order to ensure that the vehicle is covered by

physical damage insurance.

ii. Insurance Coverage

Travelers are expected to use rental agencies with which the University

has systemwide contracts that include insurance coverage. The following

rules apply to insurance coverage for rental cars:

• The cost of full collision coverage for rental cars used in Alaska,

Hawaii, U.S. possessions (OCONUS), and foreign countries, is

allowable.

• On contract rental vehicles used in the continental United States

(CONUS), charges for additional insurance are not allowable,

including any charge for a collision damage waiver (CDW).

• Additional charges for insurance coverage will not be reimbursed if a

non-contract agency is used, unless no car rental company in the

area has such an agreement with the University.

• It is recommended that employees purchase supplemental

insurance when renting a vehicle outside the U.S.

• A vehicle rented from an agency with which the University has an

agreement is not covered by insurance when it is being used for a

personal day of travel.

Some rental car agreements contain special coverage provisions that differ

from the general coverage rules detailed above. For additional information

University of California – Policy G-28

Travel Regulations

20 of 53

on rental car insurance coverage, see UC Car Rental Insurance

Information.

The campus risk management office should be contacted for information

on campus-specific contracts or insurance coverage.

iii. Direct Billing

Vehicle rental charges billed directly to the University can be authorized

within parameters established by the Campus Controller’s office. Any direct

bill arrangement should only allow for the rental cost and associated tax for

rentals that are business related. Rental car charges that are not direct

billed should be paid with the traveler's corporate travel card (see Section

V.B.2, Corporate Travel Cards) or their personal credit card.

iv. Damage to a Rental Vehicle

A University traveler may be reimbursed for property damage to a rental

vehicle only if such expenses were incurred on days the vehicle was being

used for University business purposes. (See Section V.C.2., Vehicles, for

more information on insurance coverage). The amount reimbursed may be

charged to the traveler's department, the department sponsoring the

traveler, or to an account designated by the Chancellor, as appropriate.

The traveler shall submit with the travel expense claim a brief description of

the damage to the vehicle, including an explanation of the cause of such

damage, and either a police report or a report prepared by the rental

company.

c. Official Vehicles

i. University Vehicles

University vehicles shall be used in accordance with the guidelines

contained in BFB BUS-46, Use of University Vehicles. For information

regarding insurance coverage on University vehicles, refer to BFB BUS-81,

Insurance Programs.

d. Miscellaneous Automobile-Related Expenses

Charges for ferries, bridges, tunnels, or toll roads may be claimed by the vehicle

operator. Reasonable charges for parking while an employee is on travel status

or on University business away from regular duties also will be allowed for the

following:

• Day parking on trips away from an employee's headquarters;

• Day and overnight parking on overnight trips away from an employee's

headquarters or residence (a claim should not be made if free overnight

parking is available); and

• Parking charges incurred when an employee without a location parking

permit is occasionally required to drive to and from headquarters.

University of California – Policy G-28

Travel Regulations

21 of 53

Travelers should seek out the longer term parking accommodations at airports or

common carriers when travel is expected to exceed twenty four hours.

Valet parking charges in excess of normal parking charges shall be borne by the

traveler, unless the traveler obtains an exception.

4.

Rail or Bus

Rail or bus transportation may be used when required by the destination or by

business necessity. If a traveler's destination is served by a regularly scheduled

airline, however, the use of rail transportation shall be reimbursed in accordance

with the procedures specified in Section V.D.1.e., Surface Transportation Used in

Lieu of Air Travel. This rule does not apply to inter-city rail travel that is equivalent

to air transportation in total travel time. Reimbursement for the cost of Pullman

roomette accommodations is allowed. If more expensive accommodations are

used, the traveler must justify the expense in a written explanation submitted with

the travel expense claim.

If accommodations are included in the rail fare, e.g., Pullman roomette

accommodations, lodging expenses shall not be reimbursed for each night that

such accommodations are used.

5.

Ship

When travel by passenger ship is authorized, transportation at the lowest first-

class rate is allowed.

The reimbursement of subsistence expenses while on board a passenger ship

shall not be allowed if the cost of subsistence is included in the fare for passage

and stateroom. If the fare does not include subsistence, reimbursement shall be

based on the traveler's actual daily expenses, subject to the limits set forth in

Section V.E., Subsistence Expenses. A full explanation of the circumstances that

necessitated such expenses must be submitted with the travel expense claim.

6.

Other Forms of Transportation

a. Local Public Transportation, Shuttle Service, and Taxis

Local public transportation fares (e.g., buses, subway, streetcars) shall be

allowed. The cost of shuttle service (including airport limousine service, if

appropriate) to and from an airport or railroad station, plus reasonable tips, is

allowable to the extent such service is not included in air or rail fares. Taxi fares,

including tips, shall be allowed when the use of alternative transportation is

impractical or not available. The cost must be reasonable in relation to personal

car use costs, including parking, tolls, etc. When traveling to and from the airport

from the home location travelers should be good stewards of the University’s

resources and be mindful of the costs associated with the transport method

selected.

University of California – Policy G-28

Travel Regulations

22 of 53

b. Motorcycles

Motorcycles shall not be authorized for use on official University business, nor

shall any reimbursement be made for the use of such vehicles except for the

following situations:

• University police department employees on motorcycle assignment; and

• Motorcycles used when automobile transportation is not an available

option in the foreign location and used consistent with approved policies

for foreign locations.

c. Special Conveyances

Charges for using other types of conveyance (such as a helicopter or boat) shall

be allowed when the use is beneficial to the University and when the fare for the

conveyance is not included in the original cost of the common carrier fare. An

explanation justifying such use must accompany the travel expense claim,

unless the Chancellor has established a blanket authorization for the travel. A

copy of the authorization shall be attached to the travel expense claim (unless a

blanket authorization is published in the campus policy and procedures manual).

E. Subsistence Expenses

1.

General

a. Definition

Subsistence expenses incurred while on travel status consist of charges for

lodging and meals and incidental expenses (M&IE). For the definition of

incidental expenses, see Section II., Policy Definitions. Expenses reimbursed

must be ordinary and necessary to accomplish the official business purpose of

the trip. Subsistence expenses incurred within the vicinity of an employee’s

headquarters or residence shall not be reimbursed. To be eligible for

reimbursement, actual expenses must be documented in accordance with

Section V.I.2.b., Documentation Requirements. Regardless of the length of time

for business travel, the traveler must be at least forty miles from the headquarter

location or home, whichever is closer, to be reimbursed for an overnight stay.

b. Entertainment Meals

Expenses for meals incurred by employees who entertain while on travel status

are reimbursable in accordance with BFB BUS-79, Expenditures for Business

Meetings, Entertainment, and Other Occasions.

2.

Travel in Excess of 24 Hours

a. Domestic Travel - Travel within the United States and Its Possessions

For purposes of determining the applicability of Sections i, ii, and iii below, an

official University business trip begins when the traveler leaves his or her

residence or headquarters, whichever occurs last, and ends when the traveler

returns to his or her residence or headquarters, whichever occurs first.

University of California – Policy G-28

Travel Regulations

23 of 53

i. Travel - Assignments of Less than 30 Days

CONUS Travel. For travel assignments of less than 30 days within the

continental United States (CONUS), the reimbursement of daily

subsistence expenses shall be based on the actual amounts incurred for

lodging and meals and incidental expenses, subject to the maximum per

day reimbursement cap described below. The M&IE cap for CONUS

travel under 30 days shall not be treated as a per diem. M&IE

reimbursement shall be limited to the actual reasonable costs incurred;

subject to the daily maximum reimbursement cap set forth in Appendix B.

Departments should remind their travelers that only expenses actually

incurred are reimbursable. Travelers should be required to submit meal

receipts if it appears that they are treating the cap as a per diem by

routinely claiming the full M&IE amount. Lodging expense reimbursements

are actual up to $275 per night before taxes and mandatory hotel fees and

must be supported by original itemized receipts, regardless of the amounts

incurred, and must be reasonable for the locality of travel. When the

traveler is unable to secure lodging at $275 per night or less, the traveler

must submit additional documentation such as price comparisons within

the proximity of the meeting location that supports the higher lodging rate

incurred. The price comparisons should be performed at the time of

booking.

A traveler who is required to attend a conference where the prearranged

conference lodging rate exceeds the $275 per night cap may stay at the

conference hotel without exceptional approval.

OCONUS Travel. Travel within Alaska, Hawaii and U.S. possessions

(OCONUS) shall be reimbursed in accordance with the non-foreign locality

per diem rates published by the Department of Defense (see Appendix B).

ii. Long-Term Travel - Assignments of 30 Days or More

The long-term daily expense rate shall be authorized when a traveler can

reasonably be expected to incur expenses in one location comparable to

those arising from the use of establishments catering to long-term visitors,

and when the traveler is expected to be in one location for 30 or more

consecutive days but not in excess of one year.

CONUS Travel. For domestic travel assignments of 30 days or more within

the continental United States, the per diem allowance authorized for

subsistence expenses is based on an estimate of actual daily expenses

(see below for information on estimating and computing a daily expense

rate). Reimbursement of such expenses shall be limited to a daily amount

of up to 100% of the applicable federal per diem rate (published by the

General Services Administration) established for travel within CONUS (see

Appendix B). Actual costs paid for lodging taxes, which are not

included in CONUS per diem rates, may be reimbursed as a

miscellaneous expense.

University of California – Policy G-28

Travel Regulations

24 of 53

OCONUS Travel. For travel within Alaska, Hawaii and U. S. possessions

the actual lodging and subsistence expense incurred shall be reimbursed,

limited to 100% of the non-foreign locality per diem rates (see Appendix B).

Daily Expense Rate. The daily expense rate is computed by dividing the

monthly lodging costs (determined by estimating actual expenses) plus an

appropriate amount for M&IE (not to exceed the amounts specified in

Appendix B), by the number of days of occupancy in the rental period. The

following recurring expenses may be considered part of the lodging cost

when a traveler rents a room, apartment, house, or other lodging on a long-

term basis:

• Rental cost of a furnished dwelling;

• Utilities;

• Monthly base telephone charges.

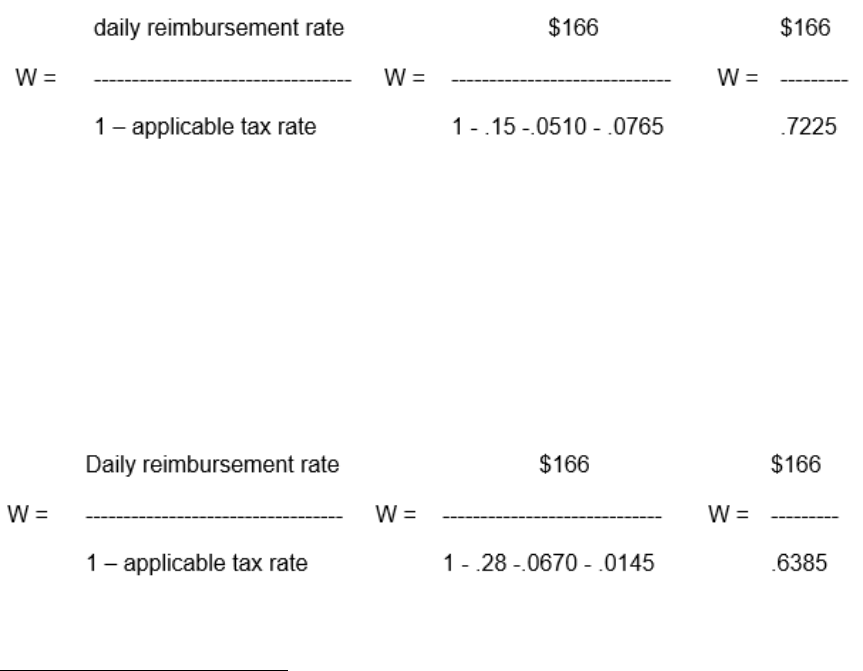

iii. Indefinite Travel - Assignments that Exceed One Year

Under the IRS one-year rule, travel away from home that lasts more than

one year in a single work location is considered indefinite. Any travel

expenses reimbursed during that period must be treated as taxable income

subject to withholding for income and employment taxes (i.e., social

security and Medicare).

Accordingly, for an employee whose indefinite assignment requires a

change of residence in order to undertake an assignment, who plans to

return at the end of the assignment, and who expects to remain in a single

location for more than one year, subsistence expense reimbursement shall

be treated as follows:

• The entire reimbursement, effective as of the first day of the

traveler's assignment, shall be included in the employee's gross

income subject to withholding for income and applicable

employment taxes;

• The subsistence reimbursement must be paid through the payroll

system as additional income subject to withholding;

• The reimbursement for such assignments shall be limited to 2 years.

An exception may be granted by the Chancellor to extend the

reimbursement for a longer period of time; and

• The cost of moving the employee to and from the location of the

indefinite assignment shall be reimbursed in accordance with

University moving policies (refer to BFB G-13, Policy and

Regulations Governing Moving and Relocation).

To compensate for additional federal and state income taxes and

employment taxes owed by the employee, the reimbursement rate for

actual subsistence expenses may be increased up to 150% of the per diem

University of California – Policy G-28

Travel Regulations

25 of 53

rates authorized for domestic travel of 30 days or more (see Section a.ii.

above).

A separate calculation of the amount of the increase must be made for

each employee, taking into account each employee's additional federal and

state income tax liability and liability for employment taxes. The formula

provided by the IRS for grossing up payments to cover an employee's tax

liability should be used to calculate the increase (see Appendix C for

examples based on the IRS Tax Gross Up Formula).

Under IRS regulations, the following situations also are considered

indefinite assignments:

• Indefinite Assignment Ends Prematurely

An indefinite assignment that is realistically expected to last more

than one year shall be considered indefinite regardless of whether it

actually exceeds one year. Thus, any amounts withheld in

connection with the employee's travel expense reimbursements

would not be refundable if the assignment ends prematurely.

• Temporary Assignment Extended

If a temporary assignment is realistically expected to last for one

year or less, but at some later date is extended to exceed one year,

then the assignment shall be treated as temporary until the date the

employee's realistic expectations change. Thus, travel expense

reimbursements would not be taxable for the period of the

assignment that was expected to be temporary. Travel expenses

reimbursed thereafter must be included in the employee's income

subject to withholding.

• Indefinite Assignment Interrupted by Trips to Former Residence or

to Headquarters

An indefinite assignment that is interrupted by occasional trips to the

employee's former residence or headquarters shall be subject to the

one-year rule. Such return trips do not change the tax status of an

indefinite assignment.

b. Foreign Travel

Under IRS regulations, foreign travel expenses are subject to a special allocation

rule that is used to disallow certain nonbusiness travel expenses. The disallowed

expenses are treated as taxable income to the employee, and are computed as

follows:

Number of nonbusiness days divided by total number of business and

nonbusiness days and then multiplied by total travel expenses.

See Section VII., Frequently Asked Questions, for the four situations where the

special allocation rule does not apply to nonbusiness foreign travel expenses.

University of California – Policy G-28

Travel Regulations

26 of 53

i. Travel - Assignments of Less Than 30 Days

Foreign travel shall be reimbursed in accordance with the Federal

Maximum Travel Per Diem Allowances for Foreign Areas published by the

Department of State (see Appendix B). (Refer to Section c, Adjustment of

Per Diem Rates, below, for information on prorating per diems). An official

University business trip begins when the traveler leaves his or her

residence or headquarters, whichever occurs last, and ends when the

traveler returns to his or her residence or headquarters, whichever occurs

first. Travelers should only claim actual travel expenses (e.g. subsistence

and lodging) up to the per diem rate.

If actual expenses that are greater than the per diem are claimed due to

special or unusual circumstances, the traveler must document such

circumstances by submitting a written explanation with the travel expense

claim. The amount reimbursed, however, may not exceed 300% of the

applicable federal rate established for the location of travel. The

reimbursement of actual expenses must be supported by receipts, as

specified in Section V.I.2.b., Documentation Requirements.

The following are some examples of special or unusual circumstances that

warrant reimbursement of actual expenses:

• A traveler is required to attend a meeting or conference where

meals and lodging must be obtained at a prearranged place, and

lodging consumes all or most of the applicable maximum per diem

allowance;

• The travel is to an area where the per diem is normally adequate,

but subsistence costs have temporarily increased because of a

special event or function, e.g., a national or international sports

event; or

• Due to the situation described above, affordable lodging is not

available within a reasonable commuting distance of the employee’s

meeting or conference and transportation costs to commute to and

from the less expensive lodging facility consume most or all of the

savings achieved from occupying less expensive lodging.

ii. Long-Term Travel - Assignments of 30 Days or More

The per diem allowance authorized for long-term travel is actual costs up to

100% of the applicable federal per diem rate (see Appendix B). The

traveler is expected to seek long-term accommodations when staying in

one location for 30 or more consecutive days but less than one year. See

Section V.E.2.a.ii., Long-Term Travel – Assignments of 30 Days or More,

above, for information on estimating and computing a daily lodging rate.

iii. Indefinite Travel - Assignments that Exceed One Year

The rules for domestic indefinite travel set forth in Section V.E.2.a.iii.,

Indefinite Travel - Assignments that Exceed One Year, above, also apply to

University of California – Policy G-28

Travel Regulations

27 of 53

the reimbursement of travel expenses incurred in connection with indefinite

foreign assignments of one year or more, with the following exceptions:

• To compensate for additional federal and state income taxes and

employment taxes owed by the employee, the reimbursement rate

for actual subsistence expenses may be increased by up to 150%

of the applicable federal per diem rate authorized for long-term

travel (see Section ii, Long Term Travel, above).

• The amount of the increase, if any, calculated for each employee

must take into account the effect of the annual foreign earned

income exclusion that may be available to the employee.

c. Adjustment of Per Diem Rates

Travelers may not request reimbursement of actual expenses for one portion of

a trip and per diem for the remainder. The method selected must be used for the

entire trip. However, a per diem may be used for M&IE and actual costs used for

lodging. The request for reimbursement of such lodging expenses must be

supported by receipts. See Section V.E.2.b.i., Travel – Assignments of Less

Than 30 Days, above, if the traveler is claiming actual expenses due to special

or unusual circumstances.

i. Adjustment for Multiple Locations

The method provided in Appendix D may be used to determine travel

expenses when a trip is reimbursable under more than one per diem rate.

This method may not be used if an alternative method is contractually

mandated by the funding source.

ii. Adjustment for Partial Days

The reimbursement of subsistence expenses shall be calculated in

multiples of the applicable federal per diem rate based on the total number

of hours between the time of arrival at the foreign or OCONUS location and

the time of departure for the return trip to the traveler's headquarters or

residence (see Section V.E.2.b.i., Travel – Assignments of Less than 30

Days, for the definition of when a travel assignment begins and ends).

For partial days, hours should be rounded to the nearest quarter day as

follows: 3 hours up to 9 hours equals 1/4 day; 9 hours up to 15 hours

equals 1/2 day; 15 hours up to 21 hours equals 3/4 day; and 21 hours up to

24 hours equals 1 day.

An alternative method of prorating partial days may be used provided the

method is reasonable and consistently applied.

iii. Adjustment for Subsistence or Lodging Provided Without Charge

When subsistence or lodging expenses are paid directly by the University,

are reimbursed as entertainment expenses, or are otherwise furnished to

the traveler without charge, the per diem rate authorized for foreign (or for

OCONUS) travel must be reduced correspondingly by the amounts

University of California – Policy G-28

Travel Regulations

28 of 53

specified in Appendix B, Section 301 of the Federal Travel Regulation.

When lodging is provided without charge, only the M&IE portion of the per

diem will be reimbursed. An alternative method may be used to reduce the

M&IE rate provided the method is reasonable and consistently applied.

Situations that may require an adjustment include the following:

• Meals are furnished as part of official University entertainment,

• Meal or lodging expenses are included in the registration fees,

• Group expenses are billed directly to the University, or

• Complimentary accommodations are extended (generally to a

conference leader/coordinator and assistants) by a hotel or motel

complex for block patronage of guest rooms.

Refer to Section 4, Payment of Group Subsistence Expenses, below, for

more information on claiming group expenses.

d. Use of Non-Commercial Facilities

When non-commercial facilities such as cabins, house trailers, vans, field

camping equipment, or other such facilities are used, the traveler shall be

reimbursed a daily amount based on an estimate of actual expenses up to 100%

of the applicable federal per diem rate for the appropriate geographic area (see

Appendix B). (See Section V.E.2.a.ii., Long-Term Travel - Assignments of 30

Days or More, above, for information on computing the daily expense rate).

e. Lodging with a Friend or Relative

When a traveler lodges with a friend or relative while on official business for the

University, a non-cash gift, such as flowers, groceries, or a restaurant meal, may

be provided to the host. The actual cost of such a gift may be reimbursed up to

$75. Under IRS regulations, a receipt must be provided for gifts costing $25 or

more. Only one gift per stay may be provided to a host.

3.

Travel of Less than 24 Hours